House Positions

posted on

Dec 08, 2015 11:07PM

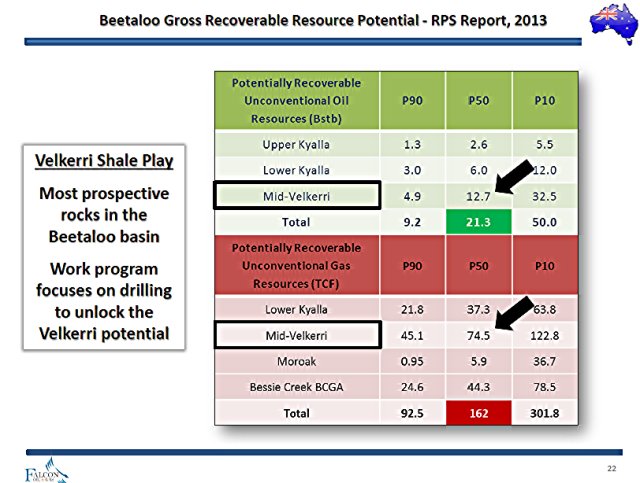

Developing large acreage positions of unconventional and conventional oil and gas resources

|

House Positions for C:FO from 20151208 to 20151208 |

|

House |

Bought |

$Val |

Ave |

Sold |

$Val |

Ave |

Net |

$Net |

|

159,500 |

19,937 |

0.125 |

4,400 |

550 |

0.125 |

155,100 |

-19,387 |

|

|

241,000 |

30,125 |

0.125 |

102,000 |

12,764 |

0.125 |

139,000 |

-17,361 |

|

|

27,000 |

3,375 |

0.125 |

0 |

|

27,000 |

-3,375 |

||

|

15,000 |

1,875 |

0.125 |

0 |

|

15,000 |

-1,875 |

||

|

23,054 |

2,971 |

0.129 |

15,000 |

1,950 |

0.13 |

8,054 |

-1,021 |

|

|

4,600 |

574 |

0.125 |

3,500 |

437 |

0.125 |

1,100 |

-137 |

|

|

700 |

87 |

0.124 |

100 |

12 |

0.12 |

600 |

-75 |

|

|

18,500 |

2,362 |

0.128 |

23,300 |

2,912 |

0.125 |

-4,800 |

550 |

|

|

0 |

|

10,000 |

1,300 |

0.13 |

-10,000 |

1,300 |

||

|

0 |

|

15,000 |

1,875 |

0.125 |

-15,000 |

1,875 |

||

|

0 |

|

316,054 |

39,506 |

0.125 |

-316,054 |

39,506 |

||

|

TOTAL |

489,354 |

61,306 |

0.125 |

489,354 |

61,306 |

0.125 |

0 |

0 |

.

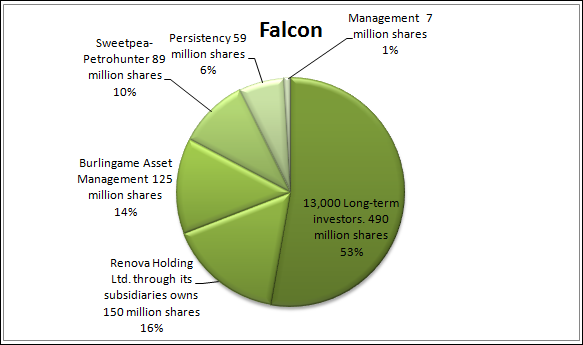

Rule to long-term investing:

When you find a value stock put it in your portfolio and hold; like Burlingame, like Soliter, like Sweetpea, like Persistency.....

When big players are set to acquire a big position in a company, they always employ agents to accumulate the shares on the open market, then months later a transaction will occur between the parties for a healthy profit for the agents. On the other hand the buyer saves a lot of money for not buying it on the open markets.

This is how Burlingame acquired 105,835,269 shares in 2008 and 2009.

In 2011 Burlingame increased their holding to 125 million shares.

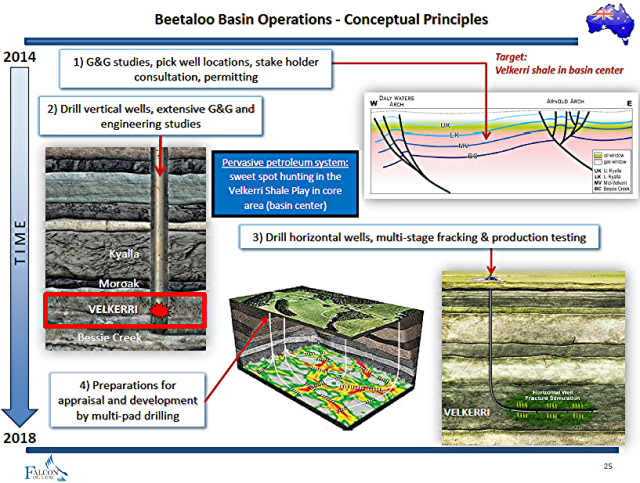

Shale Oil and Gas. America has done it.

Now it's Australia's turn.

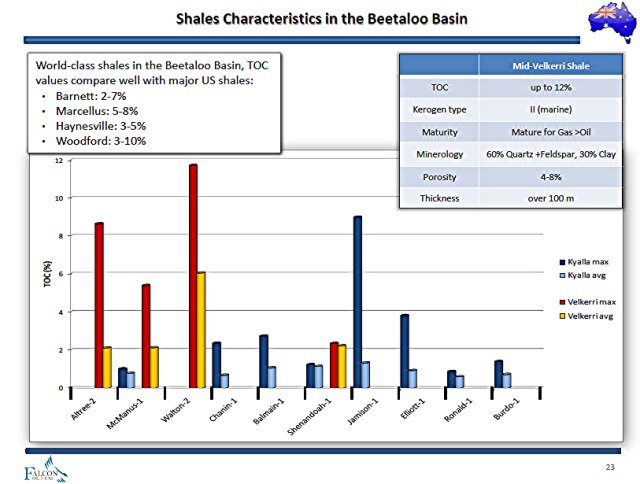

Compares with Barnett, Marcellus, Haynesville and Woodford shales