Argentina's Stock Market Continues to Outperform -

Disconnects from Other Emerging Markets

Emerging markets have been in the financial headlines as investors have been pulling their money out of this general sector. In the last three years, US$6 billion has flowed out of Exchange Traded Funds (ETFs) that lump disparate emerging economies into a single investment basket.

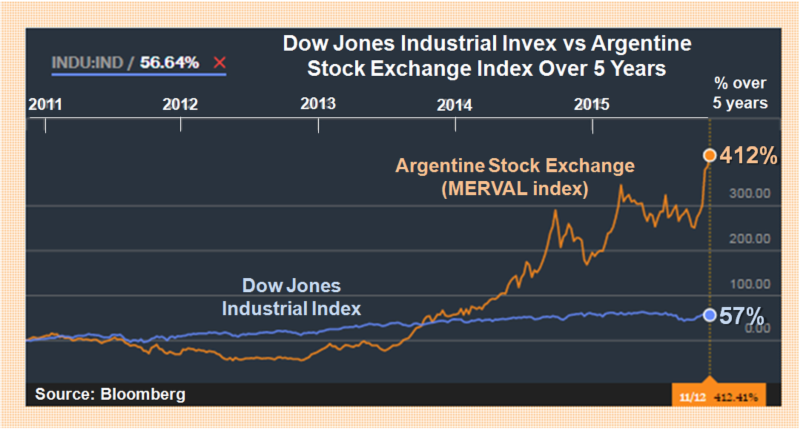

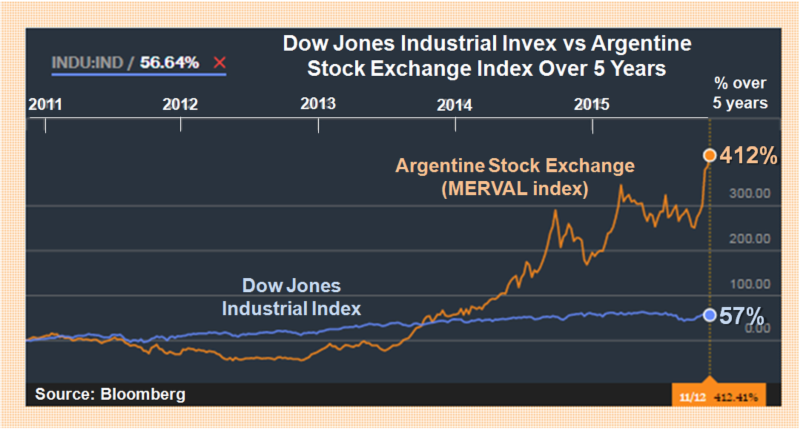

In stark contrast, US$7 billion has flowed into country-specific ETFs within the emerging market group. One of the recent better performing ETFs is an Argentina-specific fund. The Argentine stock market posted the best performance in the world last year - up 60% in US dollar terms - and is up another 55% so far in 2015 as the final round of Argentina's national elections approaches.

The performance of the Argentine exchange is attributed to recognition that the new government that will come into power after the tie-breaking second-round election on November 22, is likely to be pragmatic and business-friendly. A recent survey by the renowned polling company, Poliarquía, has the leader of the opposition, Mr Macri, ahead with a projected 48.7% of the vote against 40.2% for Mr Scioli, the candidate of the ruling party.

It is key to recognize that it doesn't matter which of the two candidates wins. The opposition candidate is more outspoken about the way in which he plans to attract investment and foreign capital. The candidate from the ruling party is less outspoken, but has an impressive track-record as governor of a province in which 40% of Argentina's people live and which generates 50% of Argentina's GDP. He inherited Buenos Aires province in a fiscal mess in 2007 and, through careful economic stewardship, achieved a balanced budget in 2013 and has maintained a surplus since then. The credentials of both candidates are impressive.

Earlier this week the Wall Street Journal published an article entitled "From Default to Darling: Argentina Bets Pay Off for Hedge Funds," which pretty much captures the positive mood. That article lists some of the investment that is pouring into Argentina, as well as some of the returns that have been made recently.

U3O8 Corp. looks forward to advancing the Laguna Salada uranium-vanadium deposit towards production in a more positive economic environment in Argentina: a country that is committed to nuclear as a source of clean, base-load electricity. Argentina brought its 3rd reactor on-stream this year and has signed financing and construction deals for another three reactors.

Sources: The Globe and Mail, Zachs, Bloomberg, La Naciόn and The Wall Street Journal

November 5, 2015 - ETF investors untie emerging markets