Re: Big Picture on Venture-Klaus

in response to

by

posted on

Dec 05, 2014 09:12AM

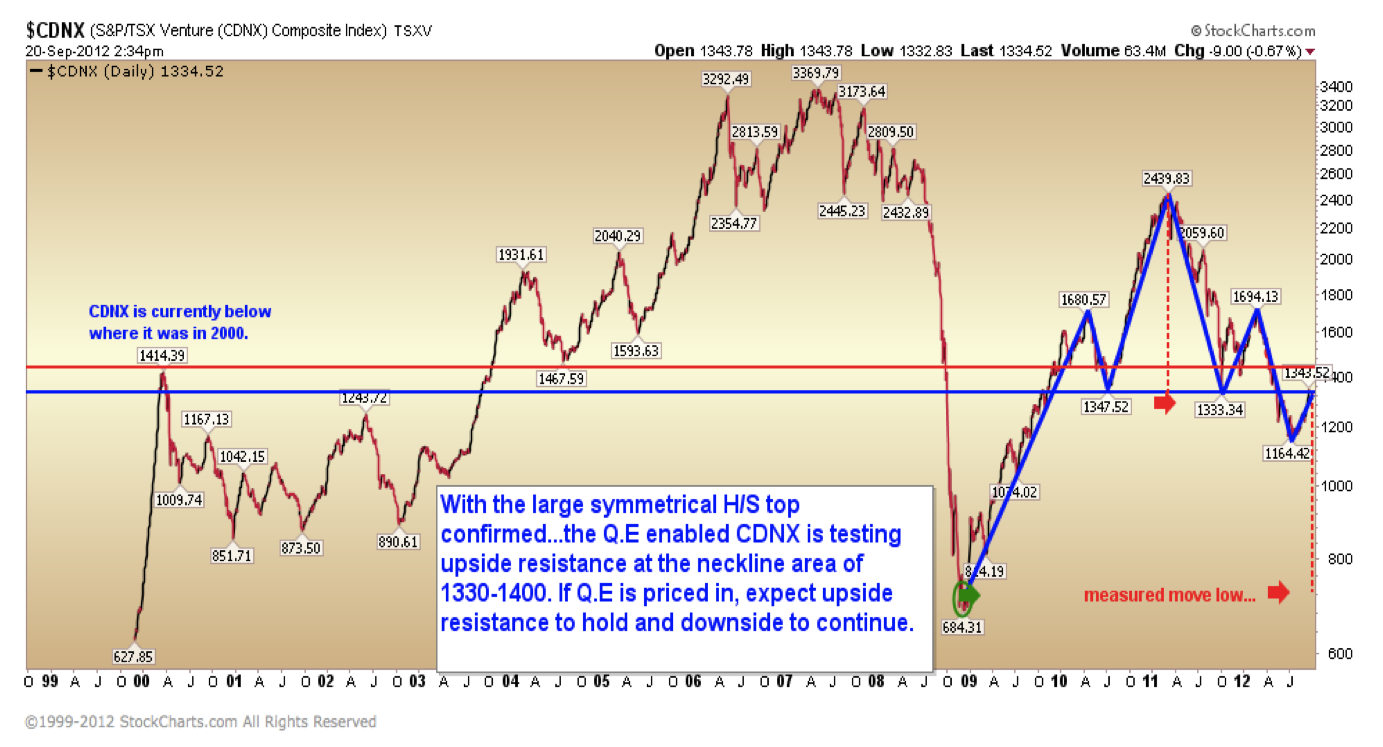

Edit this title from the Fast Facts Section

My technician partner, Cory Venable, gave me the chart below of the Canadian Venture exchange for a presentation I was giving in September 2012. Although metals, minerals, mining and energy companies had rebounded sharply from the 2009 lows, by 2011 they began falling again in a series of dramatic drops and rallies. The consensus view was that the sector was building a base and would soon rebound to new highs on rabid Chinese demand and QE liquidity from the west. As shown in his comments and notations above, contrary to the consensus view, Cory’s work suggested that a break below 1330 was likely to prove fatal to bullish beliefs, and see the Venture retrace all the way back to the 700 area from which the commodity boom had originally launched in 2000. His technical assessment lined up well with our fundamental, macro, behavioral and historical cycle analysis that suggested the deflating credit bubble would suppress consumption and global growth for a decade or more, as excess inventory and asset values worked back down in line with household spending power in the real economy.

As shown in his comments and notations above, contrary to the consensus view, Cory’s work suggested that a break below 1330 was likely to prove fatal to bullish beliefs, and see the Venture retrace all the way back to the 700 area from which the commodity boom had originally launched in 2000. His technical assessment lined up well with our fundamental, macro, behavioral and historical cycle analysis that suggested the deflating credit bubble would suppress consumption and global growth for a decade or more, as excess inventory and asset values worked back down in line with household spending power in the real economy.

Fast forward a little over 2 years later, and here is Cory’s chart of the same index today. There is no question that QE mania slowed the retracement process. But not the end result: today just barely above its 2009 low, all price gains in this index have indeed completely evaporated.

The pivotal questions now are these:

The pivotal questions now are these: