Breakout week - sector review

posted on

Oct 24, 2011 10:18AM

Edit this title from the Fast Facts Section

http://dragonflycap.com/2011/10/24/the-breakout-week-sector-review/

Last week was a breakout week for many of the Select Sector SPDR ETF’s. But just like every breakout effort it means different things to different sectors. For some it means on to new or previous highs. For others death averted. What matter’s most is what they do now that they have broken out. So which are which? Lets take a look.

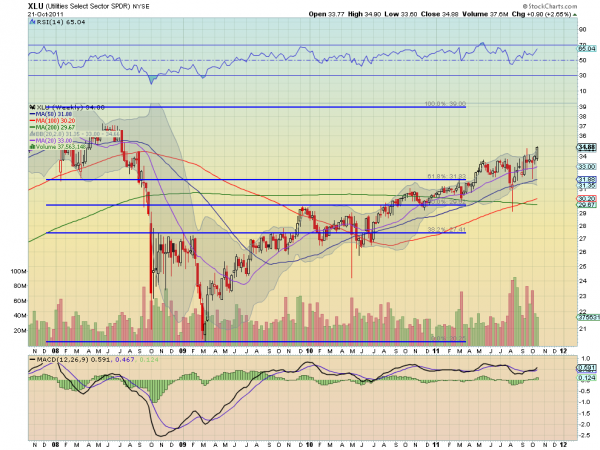

As has been the case for a long time the Utilities Select Sector SPDR, $XLU continues to lead and broke to new 3 year highs last week. And it shows no signs of letting up as it heads back to the all

Utilities Select Sector SPDR, $XLU

time highs at the end of 2007. The chart above shows the Simple Moving Averages (SMA) paralleling the rise in price with a steady rising slope, expect for the the 200 week SMA. The Relative Strength Index (RSI) has remained bullish since mid 2009 and is currently rising, while the Moving Average Convergence Divergence (MACD) indicator has crossed bullishly. Above 35 this seems destined to retest the all time high, given the continued low interest rate environment and weak economy.

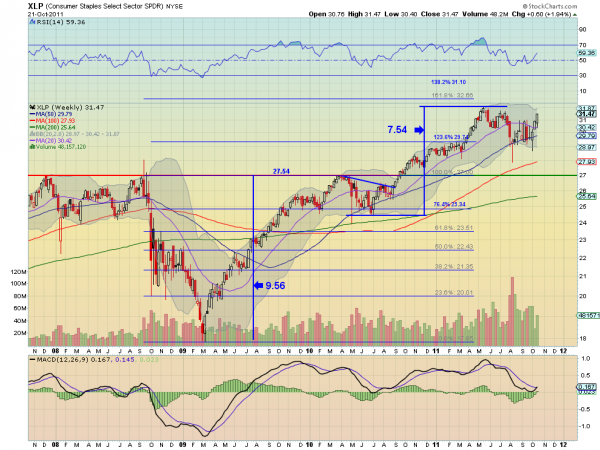

Three other sectors that have been performing well and moving towards new all time highs or more than 10 year highs. These are the Technology Select Sector SPDR, $XLK, Consumer Staples Select Sector SPDR, $XLP, and Consumer Discretionary Select Sector SPDR, $XLY, with the XLK the one looking at the 10 year high. Like the chart below for the XLP, each has a rising RSI back over 50 and heading toward 60, and a MACD that is crossing positive, to support further upside.

Consumer Staples Select Sector SPDR, $XLP

All are above the midpoint of the Bollinger bands and all of the SMA’s as they move higher. look for these to continue to be strong for a continued run higher in the broad markets.

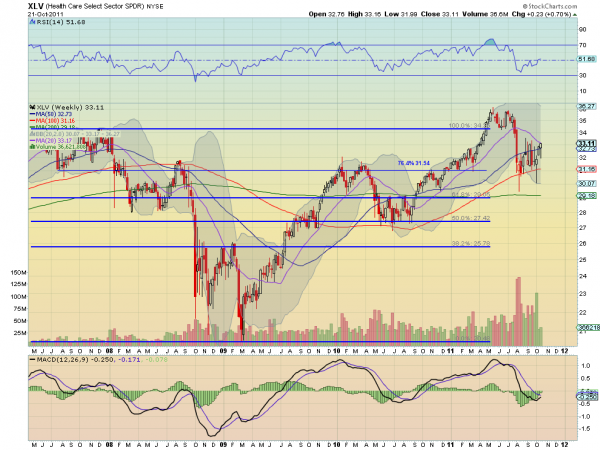

Two other sectors, the Industrials Select Sector SPDR, $XLI and Health Care Select Sector SPDR, $XLV, have held up fairly well in the downturn and are moving higher. But they are just coming out of the bear flags higher. Just getting started. From the XLV chart below notice that the MACD has not crossed positive yet but it looks likely and the RSI is only now reaching the mid line. They are

Health Care Select Sector SPDR, $XLV

still tangled in the SMA’s and under the midpoint of the Bollinger bands. A continued move higher and the broad market will look a lot healthier, especially in the XLI.

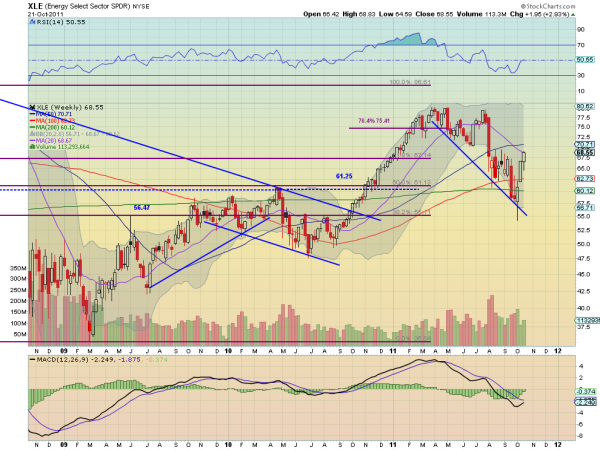

Finally three other have averted death, for now. These are the Materials Select Sector SPDR, $XLB, Energy Select Sector SPDR, $XLE and Financials Select Sector SPDR, $XLF. As in the chart of the XLE below, rising off of the long downtrend support line each has a MACD heading for a cross, but a RSI that is still below the mid line or in the case of XLE turning at it. They are only just

Energy Select Sector SPDR, $XLE

approaching and peaking over the top of the recent resistance levels from August. If these sectors can continue higher over their SMA’s the broad market will likely enter a new bull phase.

The broad market is on the cusp of another leg higher and it shows in these charts. With Utilities leading coming in and some defensive sectors close behind, it will take the laggards turning into leaders to ensure another leg higher. The seeds of that move were planted last week. Stay tuned.

If you like what you see sign up for more ideas and deeper analysis using the Get Premium button above. As always you can see details of individual charts and more on my StockTwits feed and on chartly.

If you like what you see above sign up for deeper analysis and trading strategy by using the Get Premium button above. As always you can see details of individual charts and more on my StockTwits feed and on chartly.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned