Quick Double Bottom In Copper May Mean A Big Rebound

posted on

Sep 30, 2011 11:48AM

Edit this title from the Fast Facts Section

In the last few days copper has put in a new 2011 low ($3.07) Monday followed by a near low ($3.08) Wednesday, Sept. 28. In each case it has left a long candlestick tail. This is a strong indicator of likely upward movement soon in candlestick charting theory. A double bottom is another strong signal of a likely upward movement, although it is weaker for having occurred within a three-day period. It is at the very least a likely signal for a near term upward movement in copper. If you put this in the context of the expansion of the EFSF approval process, it may really indicate a turn upward. The Finnish parliament, which had been thought to be a major stumbling block to the approval process, approved the expansion of the EFSF facility Wednesday, Sept. 28. The German parliament will vote today. Approval is expected. If this happens, it may be enough to change the tune of the market.

On the other hand, the US Initial Claims data and the third estimate of the US Q2 GDP are today. A particularly bad Initial Claims number would have sent the market down further. A failure of approval and/or a marginal approval of the EFSF expansion by the German parliament could send the market down. There is also the possibility of some mutual funds and hedge funds wanting to get rid of their losers before the end of the quarter. This could send copper and other commodities and commodity related equities further down. While this is possible the technical behavior of many commodities argues against this. It actually argues that much of this behavior has already taken place. Gold and Silver both hit likely intraday capitulation bottoms on Monday Sept. 26. Gold hit a low of $1535/oz., and silver hit a low of $26.15. At the time of this writing they are at $1625.90 and $30.81 respectively. Copper looks to have double bottomed (Monday and Wednesday). Many other metals have had similar performance. To me this looks like it should be at least a near-term capitulation. It means that metals are likely to rebound on good news (or even semi good news) coming from the EU.

You can always bet on the metal futures directly. Copper, iron ore, steel, aluminum, gold, silver, etc. are all possible investments. However, if you believe copper is a big economic indicator, it might be a good idea to bet on copper mining stocks. These have been pounded in recent weeks on the fear of an economic apocalypse in the near term. If this apocalypse is not going to happen near term, the selling is far over done. It may have been over done anyway. Fear often drives the markets to extremes. Some of the biggest copper miners are: Rio Tinto plc (RIO), BHP Billiton Limited (BHP), Teck Resources Limited (TCK), Freeport-McMoran Copper & Gold Inc. (FCX), and Southern Copper Corp. (SCCO). Some of these also mine coal, iron ore, gold, silver, etc. However, as I have tried to point out above, these materials are likely to rebound near term too.

Let’s look at how good bargains these stocks may now be. The following table contains some of the fundamental financial data for these stocks. The data are from TDameritrade and Yahoo Finance.

|

Stock |

|||||

|

Price |

$46.76 |

$67.95 |

$29.40 |

$32.30 |

$26.06 |

|

1 yr Analysts’ Target price |

$96.97 |

$85.34 |

$67.73 |

$62.66 |

$39.86 |

|

Predicted % Gain |

107% |

26% |

130% |

94% |

53% |

|

Annual Dividend Rate |

$1.17 (2.50%) |

$2.02 (2.97%) |

$0.6147 (2.08%) |

$1.00 (3.00%) |

$2.19 (8.40%) |

|

PE |

5.73 |

7.96 |

9.41 |

5.50 |

11.11 |

|

FPE |

4.70 |

7.60 |

5.24 |

5.34 |

7.78 |

|

Avg. Analysts’ Opinion |

1.6 |

2.4 |

1.7 |

2.0 |

2.4 |

|

FY2012 EPS Estimate |

$9.94 |

$8.94 |

$5.61 |

$6.05 |

$3.35 |

|

FY2012 EPS Estimate 90 days ago |

$9.59 |

$8.94 |

$5.79 |

$6.26 |

$3.71 |

|

EPS % Growth Estimate for 2011 |

25.80% |

110.80% |

93.50% |

26.90% |

61.20% |

|

EPS % Growth Estimate for 2012 |

11.40% |

-0.70% |

10.70% |

2.70% |

13.60% |

|

5 yr. EPS Growth Estimate per annum |

9.00% |

17.40% |

9.20% |

15.06% |

19.34% |

|

Market Cap |

$90.12B |

$185.47B |

$17.37B |

$30.62B |

$22.03B |

|

Enterprise Value |

$104.80B |

N/A |

$21.97B |

$36.14B |

$24.78B |

|

Beta |

1.68 |

1.52 |

3.88 |

1.89 |

1.58 |

|

Total Cash per share (mrq) |

$4.07 |

$3.79 |

$2.17 |

$4.62 |

$1.99 |

|

Price/Book |

1.52 |

3.33 |

1.13 |

2.28 |

5.93 |

|

Price/Cash Flow |

4.87 |

5.99 |

6.43 |

4.08 |

10.26 |

|

Short Interest as a % of Float |

0.43% |

0.68% |

0.80% |

2.12% |

3.27% |

|

Total Debt/Total Capital (mrq) |

20.78% |

21.60% |

22.03% |

17.16% |

40.62% |

|

Quick Ratio (mrq) |

1.22 |

0.97 |

1.70 |

2.07 |

3.81 |

|

Interest Coverage (mrq) |

-- |

-- |

13.74 |

36.43 |

23.01 |

|

Return on Equity (ttm) |

29.52% |

44.92% |

11.85% |

44.66% |

50.95% |

|

EPS Growth (mrq) |

28.69% |

102.41% |

166.50% |

103.87% |

110.24% |

|

EPS Growth (ttm) |

73.55% |

87.61% |

-13.57% |

51.22% |

45.35% |

|

Revenue Growth (mrq) |

18.38% |

33.13% |

27.21% |

50.47% |

53.55% |

|

Revenue Growth (ttm) |

25.59% |

35.87% |

25.03% |

31.19% |

31.62% |

|

Gross Profit Margin (ttm) |

-- |

43.61% |

45.37% |

53.62% |

59.24% |

|

Operating Profit Margin (ttm) |

37.94% |

44.35% |

32.00% |

50.35% |

52.19% |

|

Net Profit Margin (ttm) |

28.36% |

33.38% |

19.32% |

31.72% |

32.51% |

All of the above are strong stocks. Some have truly outstanding analysts’ predicted one year percentage gains: RIO (107%), TCK (130%), and FCX (94%). Even if earnings are revised downward at some time in the future, these stocks may still appreciate considerably. SCCO has a dividend of 8.40% with a predicted percentage on year stock price gain of 57%. These all look like great bounce plays. To me they all look like great long-term buys at their current valuations. Of course, I do not at this time foresee a Black Swan event near term for Europe. I may be wrong. If I am I may choose to trade any of these I buy shorter term. Otherwise I may keep them long term. I should mention that Peru’s President just signed a “Windfall Mining Profits Tax” into law. Companies such as SCCO and FCX will have to pay more in taxes going forward. Australia also has a new Windfall Mining Tax. This will hurt BHP, RIO, TCK, and FCX profits. Since TCK is more heavily invested in Canada, it may not be hurt as much as the others If there is a new Windfall Mining Tax in Canada, I have not heard of it. My sense is that these new taxes have not been fully plugged into analysts’ earnings estimates. The good news is that the taxes are on “profits”.

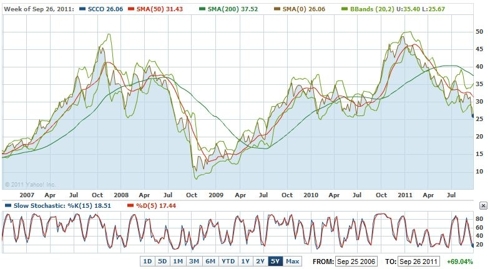

Let’s look at the technical charts for these stocks to get an idea of what may (or is likely to) happen. The five year charts are below - (click to enlarge).

The five-year chart of RIO is below.

The five-year chart of BHP is below.

The five-year chart of TCK is below.

The five-year chart of FCX is below.

The five-year chart of SCCO is below.

All of these stocks are oversold on their slow stochastic sub charts. All are at or below their lower Bollinger band. All are significantly below their 200-day SMA’s. All seem perfectly set up to bounce upward. I have used the five-year charts to show the bottoms in 2008-2009. I should add that since that time, many governments have acted to curb speculation. The futures exchanges have done the same. This means that there will be fewer sellers if there is a future Black Swan event. In addition these companies have increased production since that time. Keep in mind that China and a number of other countries grew their production capacities during the recession and the ensuing year(s). There should be more profits now. These companies should have stronger support at higher price levels.

All of these companies are good investments in the long term. Some of them may bounce more in the short term. TCK has a Beta of 3.88. If the overall market bounces on good news from the EU, TCK may bounce faster than other mining stocks. The analysts’ percentage one-year gain of 130% for TCK is further evidence that it should bounce upward. The high Beta also helps to explain why TCK may have fallen so dramatically. I don’t think you can go too far wrong with any of these stocks. BHP has perhaps the worst short-term statistics, but it has been a consistent grower over many years. If you are looking for a long-term investment, this may still be a better investment than others with better short term fundamental statistics.

Consider the Initial Claims data released Thursday. Perhaps look at the Russian GDP data. If you want to be safer, wait for the German parliament approval. This is thought to be a sure thing, but there could be variations that are less good than a strong approval.

I should mention that a number of top analysts have said that we have already put in the near-term bottom. Doug Kass, who called the March 2009 bottom, again feels that stocks are buys based on very cheap valuations. Art Cashin of UBS thinks we should be in for a big rally upward soon. Many others think stocks are so lowly valued that they can be bought now as long as you have a long-term view. This view is not dependent on whether or not there is a near-term Black Swan event or not.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in TCK, RIO, SCCO over the next 72 hours.

This article is tagged with: Lon