RM.. 6 reasons why Rodinia Lithium should be a triple in the next few months

posted on

Sep 29, 2011 09:31AM

Edit this title from the Fast Facts Section

Today .18c

Last November I discussed Rodinia Lithium and my belief that it is the next prize in the second leg of the lithium boom. Insider trade reports supplied by TD Ameritrade, indicate that, with one small exception, all insider transactions for 2011 are "buys"! There are "NO" sell trades.

This is a clear indication that the people who actually know what is occuring in the company, on a day to day basis, and those overseeing the company's development, are very poositive about their prospects, that they have only bought more of the stock, and not sold "any" of their holdings. This information alone, tells us something of value is growing at Rodinia.

1. Insiders are buying this stock.

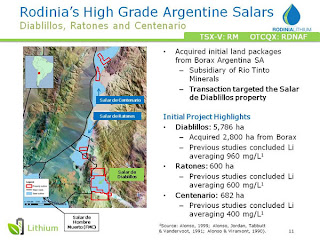

2. Rodinia owns three of the top 25 lithium properties in the world.

3. Shan Shan Corp., one of the largest lithium battery suppliers in China, purchased their entire bought deal in Nov 2010, above the asking price, to ensure they are flush with cash to advance their properties.

4. Rodinia's top three properties are all brine properties, with low development costs, in two of the best mining districts in the world, Clayton Valley Nevada and Salta Argentina. They are also listed in the top 25 lithium properties in the world today.

5. Byron Capital Markets Dr. Jon Hykaway, rates it a strong buy with a target of $2.25

(considered one of the foremost lithium investment experts today)

6. On April 12, 2011 Ubika Research has issued a valuation report with a Price of $1.12 for Rodinia Lithium. (We think that is a very low assessment)

Rodinia was trading today at .18 cents. RM.v or in the U.S. as RDNAF.PK

Rodinia was trading today at .18 cents. RM.v or in the U.S. as RDNAF.PK

It's market cap today is listed at $11.79M with 65.5M shares outstanding.

With $10 Million in cash on hand for development, this values the company at only $1.79 million.

That is a ridiculously low valuation for Rodinia's lithium properties!

Further more, it does'nt even address the large potash concentrations which will be a secondary product for this small company.

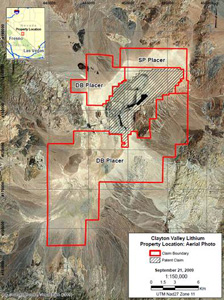

Besides the Argentinian properties, Rodinia also has its lithium brine project in Clayton Valley, Nevada which constitutes the only lithium brine asset in the continental United States.

Besides the Argentinian properties, Rodinia also has its lithium brine project in Clayton Valley, Nevada which constitutes the only lithium brine asset in the continental United States.

For these reasons, I have been buying more Rodinia stock this month. I believe this stock will triple by Christmas, however, I am looking for a 10 bagger and I expect to get it sometime next year.

Maybe you should consider adding Rodinia Lithium to your speculative value portfolio.

Wishing you great success with your Retirefund.

HP

Rodinia - Clayton Valley Nevada

More Articles:

The resource of the 21st century

Rodinia looks like the next prize

Rodinia CEO interview

http://seekingalpha.com/instablog/524943-retirefund/221013-6-reasons-why-rodinia-lithium-should-be-a-triple-in-the-next-few-months