China: Actions Speak Louder Than Words

posted on

Jan 24, 2011 08:04AM

Edit this title from the Fast Facts Section

http://seekingalpha.com/article/248073-china-actions-speak-louder-than-words?source=dashboard_macro-view

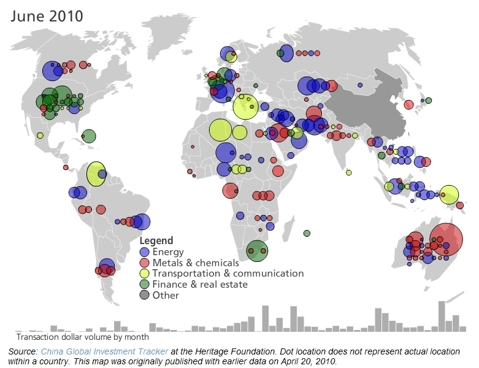

It's understandable that investors are cautious. Mining and resource stocks have continued to back off and the overall TSX and TSX Venture exchanges have been dropping. But investors shouldn't jump the gun just yet. The Chinese are smart. While they claim to tame growth, their ultimate goal is to continue growing. The Chinese have been saying for months that they will slow their progress, yet the numbers tell a different story. There's a reason Chinese Q4 GDP once again shattered expectations. So despite what Chinese officials say regarding the data, we should look towards their actions rather than their words. And their actions are speaking very loud. Chinese companies were behind more takeover deals in Canada than ever before last year, spending more than $5 billion. This included the largest ever oil sands deal in Canada. That's a 392% increase over the 2007 peak. There's now hardly a well-known oil sands project in Canada that the Chinese don't have a piece of. But it's not just Canadian energy the Chinese want. The list of investments into other sectors around the world have been growing at an exponential rate. Over the past 5 years, the foreign investments from China into other countries have been staggering. In the past few years, investments into the Energy and Metals sectors have been the largest target of investments by Chinese firms. Click to enlarge If those investments are any indication of China's ambition for growth, then clearly they're not about to stop. While many experts are calling the commodities sector a bubble based mainly on Chinese demand, we beg to differ. The world is becoming a different place. A larger, wealthier class of people in the emerging world are demanding more goods as they raise their standard of living. Investments in the emerging world are stronger than ever and a quick glance will tell you that the world is continuing to grow. While forecasts point to slow and continued growth in N. America, the economies in the emerging markets are growing at stable and healthy rates. China and India, among others, are forecasted to grow between 8-10%, which are not characteristics of an overheating economy - as many suggest is the case for China. Increased auto sales in China is clearly evident of higher income and growth. Car sales have jumped over 30% in the last year alone and 46% between 2008-2009. That's a 91% increase in the last two years. But again, China is not the only one. International car sales outlook for 2010 is estimated to be just over 100 million, according to Scotia Capital's global auto report. In 2011, the world is expected to sell over 106.4 million units. Despite a slower US economy, you can see how the emerging markets have fuelled oil prices. Oil production is expected to drop while demand continues to increase worldwide. This demand means that prices will remain high, leading to greater opportunities in junior oil and gas stocks. But that's not all. Many of the emerging markets are beginning to learn about credit. China, India, Brazil, and Russia have consumer debt levels below 20 percent. Compare that with Canadian and American debt levels of around 140%. As credit expands to the citizens of these countries, the consumption of microwaves, TVs, refrigerators, furniture and other luxuries will grow, leading to a further demand for metals and higher metal prices. It's not just the consumption of luxury goods that will fuel the resource boom. Expansion means that these emerging market countries will require new power grids, sewer systems, and transportation upgrades such as rail systems and buses. Just take a look at China's upcoming 5-year planhere, and you can see the growth that China is expecting. Those are just some of the reasons why base metals, such as copper, lead, tin, and zinc have doubled in price over the past few years. Coal prices should also remain high. And this isn't expected to drop anytime soon. The commodities market should remain strong over the next few years, allowing us to benefit from investments within the sector. The metals and energy markets may trade sideways over the next few months, along with the stock market, but we see this as more of a consolidation rather than a downturn in these sectors. Right now the markets are overreacting to any slight pullbacks in both commodity prices and mining / resource stocks. But do these pullbacks warrant the selloff seen in many of the resource-based stocks? We don't think so. Whether gold is at $1400 or $1200 and silver at $30 or $25, the value of many junior explorers and producers are still intact. That doesn't mean the pullbacks have stopped or the selling has subsided. The overreactions are clearly a sign of cautious investors protecting themselves from another 2008 loss. So take your time and invest wisely based on value, and not momentum. Invest with knowledge, not emotions. If you're going to invest in a sideways market, take advantage of the pull backs by averaging down and sell on the way up. If you're going to invest in juniors, finding companies with a good capital structure is critical in this market. Remember, you don't lose or make money until you sell. Investing is risky, especially in juniors. Please do your own due diligence and conduct your own research.

Does that mean we should run? Does that mean it's time to liquidate?

Before we get started, we have to fix something. A few weeks ago we talked about the insurmountable debt the US has taken on and what a trillion dollars really looks like (see Beyond Comprehension.) It turns out the link we provided had a slight error. Clickhereto view the correct link.

There's no doubt that investors in mining stocks have sold off on worries of a slowing Chinese economy. Even as March copper contracts in New York rose, Friday became the second day of losses in the mining sector after Q4 economic growth data in China defied expectations of a slowdown. This led to raised concerns that officials will need to slow things down to ease inflationary pressures.

|