Buying Gold and Silver in the Dips

posted on

Jan 21, 2011 12:29AM

Edit this title from the Fast Facts Section

7 comments | by: Robert Kientz January 20, 2011 | about: GLD / SLV

Precious Metal bulls will tell you to buy the dips. This means, wait for the price to temporarily deflate, and then purchase your position. It is a way to maximize dollars for gold and silver purchased while maintaining a steady buying program in that metal. The same concept could be used for any fund or stock, as well.

This morning I woke to find gold and silver had tumbled. This doesn't surprise me anymore because gold and silver have become hotter markets, and there will be more speculation in them. As I wrote in Mr. Market Speaks: Flight to Safety, the market is slowing moving away from long term debt, looking for safety of principal and inflation protection. Gold and silver markets have benefited from this movement.

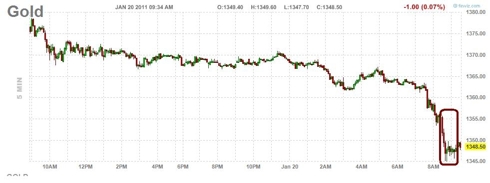

Gold has steadily been moving relatively sideways the last two days, as seen in the following Kitco chart. But also notice the sharp drop off on Jan 20th at approximately 8am.

(Click to enlarge)

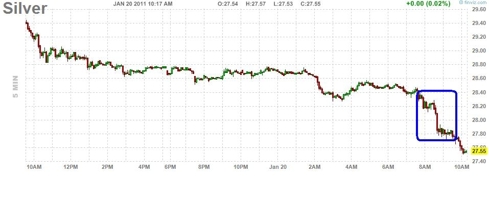

Silver looked exactly the same. The sharp downward move happened about the same time.

(Click to enlarge)

So I took a look at a 5 minute gold chart and found a 15 minute sharp drop, which I circled in red.

(Click to enlarge)

And a silver 5 minute chart, circled in blue.

(Click to enlarge)

I have written before about how sharp, quick movements in liquid markets don't signal normal price action. Even on bad news, liquid markets take time to react and respond because they are traded by people. And people take time to make decisions on the overall balance of the news in a given market in a given time frame.

So I decided to take a look at what the news was in the precious metals market. CNBC didn't have much.

(Click to enlarge)

On gold, Bloomberg Businessweek had a piece on everyone getting out of gold. Definitely bearish. The Street agreed with that assessment, commenting that interest rate hikes in Brazil and buying of U.S. dollars weakened gold demand domestically. But the article also notes that China continues to buy gold in Brazil. The Wall Street Journal reports gold weakness on improving economic conditions. Bloomberg had a piece about silver profit taking potentially lowering silver 20%. Definitely bearish and timely. I also found an article from FMX Connect on silver, discussing reasons for silver contango yesterday.

The two main reasons FMX outlines for this movement in silver would either be an interest rate move (none) or metals delivery issues. If metals delivery issues, then this is bullish for silver (and potentially gold) as a complementary inflation-protection investment.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.