Power Up Your Portfolio With Uranium-dml

posted on

Sep 27, 2010 07:35AM

Edit this title from the Fast Facts Section

http://seekingalpha.com/article/227017-power-up-your-portfolio-with-uranium?source=hp_wc

by Mike McDermott EXECUTIVE SUMMARY: • Annual demand for uranium will rise with each new reactor, challenging existing supplies and production levels. • Low-cost uranium deposits are already largely in production, leaving higher-cost deposits as the only option for increasing supply. • Two uranium securities offer investors the opportunity to participate in the significant expected increase in the price and activity level of uranium: ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ The world is demanding more energy, at lower costs, with a smaller environmental footprint. The need is great, and with an increasing portion of the population moving from agrarian communities to developed cities, the global consumption of electricity is rising sharply. In the past, emerging markets like China and India have been able to meet this rising demand by building coal-fired electricity plants, with the obvious byproducts being pollution and poor health. But emerging markets are increasingly turning to alternative sources of energy – generating power through cleaner processes and using renewable sources. Of course, the term “nuclear” brings up images of Chernobyl and Three-Mile-Island, but over the past few decades the technology of nuclear power generation has become much safer and the threat of a nuclear accident is now very small. Even staunch environmentalists often concede that the risks associated with reactors (and the disposal of nuclear waste) is less of a danger than the harmful gases typically emitted from traditional energy sources. The bottom line is that, for the next several decades, nuclear energy production is likely to increase as developed and emerging markets alike seek to meet rising energy demands in a responsible and efficient manner. Uranium is the universal fuel for nuclear energy – and it is a limited resource facing significant scarcity. Put very simply, the long-term demand for uranium is significantly above the current or proposed production levels. If you pull out your trusty Economics 101 textbook, you will find that when a resource is scarce and demand is strong, the end result is a significant increase in price. China and India are by far the most important catalysts in the nuclear energy growth story. The World Nuclear Association (WNA) recently reported that China currently has 11 reactors in operations, with an additional 24 reactors under construction. So, in the next few years, China is projected to see a 218% increase in the number of active reactors. The trade association estimates that China will have built 200 reactors by 2030, and also notes that there are a total of 59 new reactors currently under construction around the world. The warhead issue is an interesting part of the supply equation, and has had a significant effect on the historical price of uranium. At the turn of the century, uranium was selling as low as $10 per pound.Decommissioned weapons were abundant, and the glut of uranium available to power producers kept prices at a level where it made little sense for miners to invest capital to drive production. Times of course changed, and by 2007 the price of uranium had spiked to $136 per pound, leading producers to once again focus on increasing mine capacity. The global financial crisis derailed expansion plans and helped to suppress uranium prices, but with China stockpiling uranium at nearly double the pace of its actual usage, the outlook is very bullish for the scarce resource in the medium to longer term. Today’s uranium miners are able to produce the resource at an average cost of roughly $31 per pound. But this metric only tells part of the story. New mines that are coming online are generating new supply at a cost between $40 and $50 per pound, indicating that additional production is coming from deposits that are harder and more expensive to mine. Higher production costs for marginal increases to supply are likely to continue to drive spot and forward prices higher. There is significant concern that the current prices for uranium will not be sufficient to stimulate additional investment in production. (As of this writing, the spot price is roughly $48 per pound with long-term contracts north of $60). If these concerns are warranted, we could easily see another spike in the price of uranium as China, India and a host of other countries building nuclear reactors enter a bidding war for this valuable resource. Of course, investing in uranium isn’t as easy as buying a grain futures contract or a bar of gold bullion. The market is highly regulated, and uranium typically changes hands based on long-term contracts between the producers and the utilities operating individual mines. However, there are a few opportunities available to us as traders and investors, which will allow us to participate in what appears to be the beginning of a new (and potentially spectacular) bull market for uranium. The price action for each of these vehicles looks attractive as of this writing, and skilled traders should be able to find key inflection points to enter positions with proper risk control. So let’s take a look at our top uranium opportunities… • A promising pipeline of new projects in the US, Canada, Zambia and Mongolia. • Attractive balance sheet with no debt and $81 million in working capital. • Future acquisitions coupled with projects coming online makes DNN an aggressive growth story. Denison Mines has an attractive portfolio of both active producing minesas well as development projects with significant potential. Significant investments to acquire the rights to deposits and develop mines for production are beginning to pay off with the company generating positive cash flow in 2010. This year the company expects to produce 1.6 million pounds of uranium from its three producing mines in the US. At a cost of just $35.52 per pound Denison enjoys a healthy profit margin with today’s uranium prices, and has the potential to enjoy much larger gains once the price of uranium ramps higher. One of Denison’s core strengths is the ability to manage expenses and keep costs to a minimum. In Q2 2010, the company managed to reduce operating costs in its US mines to less than 50% of last year’s levels. In addition to low operating costs, Denison is able to fund a good bit of its uranium production by selling Vanadium – a byproduct resource which is used to make specialty steel and titanium alloys. Management has also done a good job of protecting the capital base asDNN currently has no debt and $81 million in working capital. That capital is being used to develop additional projects in Zambia and Mongolia, which are expected to gradually come online in the next 2 to 5 years. Dennison understands the importance of aligning itself with the best in the business, and has several joint ventures or outside contracts with titans like Cameco Corp. (CCJ), and BHP Billiton (BHP). Management has noted they will continue to consider acquisitions to build out their pipeline of future production – although DNN itself could easily become a takeover candidate. One issue traders need to wrestle with is the liquidity of the stock. DNN trades an average of 550,000 shares daily, and at a price of $1.56 per share, a few large trades could significantly move the market price.The low level of liquidity is an issue for entering a position (and in the event one might need to make a speedy exit). But with a long-term production goal of 10 million pounds of annual production, and a significant increase in the long-term price of uranium in the cards, DNN could see its market cap – and liquidity - increase tremendously over the next year (click to enlarge). • Diversified portfolio of reserves estimated at 480 million pounds. • Healthy balance sheet with more than $1.3 billion in cash and short-term investments. • Attractive share price considering NAV and long-term production levels. It’s a shame that this world-class uranium producer is most well known for a colossal failure. The company’s Cigar Lake project has flooded twice, causing significant damage to Cameco’s reputation and delaying the timetable for eventual production. But the Cigar Lake project is a single dark mark on an otherwise very attractive operation. Cameco is the number one producer of uranium, and currently commands roughly 16% of global uranium market share. Its joint ownership of the McArther River mine in Canada is the company’s largest asset, and Cameco estimates its share of the mine’s reserves is more than 230 million pounds. The company’s joint ventures with other mining operations collectively account for an estimated 480 million pounds of reserves, and CCJ is still on the hunt for additional deposits. Cameco also has an interesting business model in that it has takensignificant financial interests in a number of smaller exploration companies which are actively seeking new uranium deposits. Once these deposits are found and tested, CCJ is expected to purchase the assets and invest the necessary capital to develop the reserves into productive mines. An increase in the contract price for uranium would be a huge benefit to CCJ because of the effect it would have on the net asset value and future profitability of the company. The stock is currently trading very close to its listed net asset value — and with less than 400 million shares outstanding, a $1.00 increase in the price of uranium equates tomore than a corresponding $1.00 increase to the value of CCJ’s assets. So the company is attractively leveraged to the uptrending price of uranium, and has potential to develop even more exposure in the coming years. I expect two significant events to affect investor sentiment over the next 12 to 24 months: First, any success in moving Cigar Lake towards production would be a positive catalyst for the stock price. Additional production from this mine would be a major boost to profitability (and would boost the morale for long-term investors).Second, an acquisition could also spark investor interest if CCJ were able to materially increase its level of reserves. Typically, an acquisition announcement causes the buyer’s stock price to at least temporarily decline (as arbitrageurs play the spread between the companies in question). But CCJ would likely make a cash acquisition, and investors may perceive an acquisition as a positive sign that the company is pursuing growth. After all, with CCJ’s strong position in the market and $1.3 billion dollar cash cushion, management can afford to be aggressive. A 40% increase in the price of uranium (which would still leave the resource well below its high of a few years back) would equate to a 75% increase in the price of CCJ. That ratio is assuming the stock trades very close to NAV. However, if uranium begins to move significantly, investors will likely pay a premium to NAV – which makes a good argument for CCJ above $50. (click to enlarge) The next few years should feature significant changes in both production levels and, more importantly, robust sources of long-term demand for this scarce resource. We are determining the most attractive price points that allow for significant upside with acceptable risk, and suggest you keep these two vehicles on your radar screen. • In the coming years, emerging market nations will build hundreds of nuclear reactors to meet rising energy demands.

• In the coming years, emerging market nations will build hundreds of nuclear reactors to meet rising energy demands. “Grid parity” or renewable energy at a comparable price to traditional measures is still not possible for technologies such as wind and solar, but nuclear energy costs are very close to matching coal and natural gas with much less fallout in the way of carbon emissions.

“Grid parity” or renewable energy at a comparable price to traditional measures is still not possible for technologies such as wind and solar, but nuclear energy costs are very close to matching coal and natural gas with much less fallout in the way of carbon emissions.The Case for Uranium

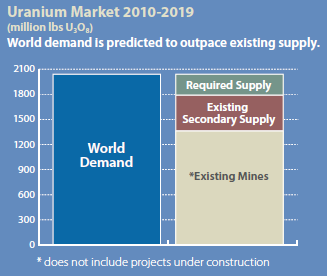

All of these new reactors will require fuel – and this fuel is becoming harder and harder to procure.Despite the rising demand for uranium, production growth has been stagnant at best. According to RBC, uranium production increased by 12% last year, but is only expected to increase 4.8% in 2010 and 3.4% in 2011.And this production includes recycled supplies from Russian warheads…So what happens when those warheads are depleted?

All of these new reactors will require fuel – and this fuel is becoming harder and harder to procure.Despite the rising demand for uranium, production growth has been stagnant at best. According to RBC, uranium production increased by 12% last year, but is only expected to increase 4.8% in 2010 and 3.4% in 2011.And this production includes recycled supplies from Russian warheads…So what happens when those warheads are depleted?Production Challenges

Denison Mines Corp. (DNN)

• Profitable production from 3 operating uranium mines in North America.

• Profitable production from 3 operating uranium mines in North America.Cameco Corp. (CCJ)

• The number one uranium producer with 16% of worldwide production.

• The number one uranium producer with 16% of worldwide production.