Be Cautious on Commodities

posted on

Jul 22, 2010 08:26AM

Edit this title from the Fast Facts Section

http://seekingalpha.com/article/215773-be-cautious-on-commodities?source=dashboard_macro-view

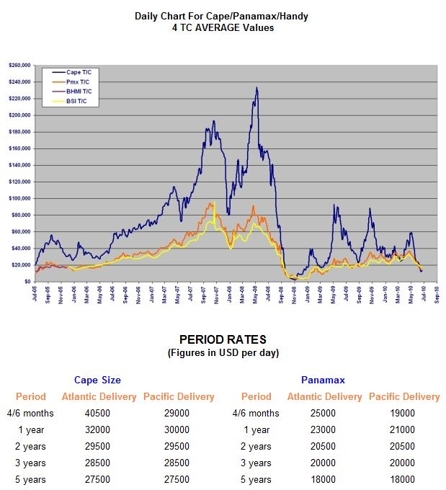

The Baltic Index has fallen dramatically. This is a good barometer of the strength of Chinese commodities buying. Commodity prices are coming off their lows, but they are still weak. Some pundits argue that the Chinese will stop their economic tightening as the Chinese economy has slowed significantly (GDP down to 10.3% growth from 11.9%). Many pundits conclude that commodities prices will go up dramatically. Why won’t the Chinese just stop tightening entirely if they are getting enough economic slowing? The reason is that the "Materials tax" proceeds are slated to go to municipal governments. Many municipal governments have taken on expansion related debts that they quite simply cannot afford to pay off. This tax revenue might prevent a large number of loan defaults and/or municipal bankruptcies. The National People’s Congress identified this as a priority. This tax will help municipalities. It will help businesses, who will get paid. It will help banks. It will help slow an overheated Chinese Economy. The Chinese will proceed with the tax. Why does China need to slow? One big reason is the cost of materials. For instance, China is the world’s biggest steel producer. China produces approx. 50% of the world’s steel. If China over produces steel (as they have started to do after a Chinese stimulus program kept industrial growth high while the world need for Chinese products declined), the over production will bring down the world price of steel. This may in some ways help them take away market share. However, it is angering the US and Europe. It is making the US and Europe protectionist. It is hurting the margins on Chinese steel. Many Chinese steelmakers are losing money. The incremental business China may gain at this point may not be worth the internal pain or the external political costs that the process of gaining this incremental business will engender. China has recently passed the US as the biggest energy consumer in the world. The oil trade deficit has been a big drag on the US economy. Energy costs are going up worldwide. The US military has estimated that worldwide oil demand will exceed supply within 2 years. This means prices of oil/energy will go up dramatically in the not too distant future. It means importing energy (and raw materials) will be a bigger and bigger drag on both the US and the Chinese economies. China has recently become the world's largest auto market. A big portion of Chinese oil use could be said to be discretionary. China has to slow its use of imported energy and raw materials as they become more expensive in the next 5-10 years (as world demand increases). Otherwise the Chinese economy will simply implode. Their margins will get squeezed to nothing. Instead of getting richer, they will soon find they are getting poorer. They have to manage the world’s resources and their own ability to access them at reasonable prices. Many other countries besides China are growing quickly, even beyond the other BRIC countries. China has been buying resources worldwide, but they cannot acquire resources quickly enough to keep up with their current growth rate. They have to slow their growth rate, or their economy will kill itself via supply and demand rules that will escalate raw materials costs beyond China’s ability to profit from manufacturing using them. China is not the world’s resources bank. It is one of the world’s biggest manufacturers. It needs resources to manufacture. If the price of those resources (due to their relative scarcity) grows faster than the prices of the goods being manufactured from them, China will kill itself. It cannot afford to overproduce hugely for the longer term. How does this translate into a trading recommendation? Shorter term it means that commodity prices may stay low for longer than some are envisioning. Longer term it still means higher commodity prices. However, good Chinese materials management and Chinese growth management may mean that commodity prices will not go up quite as quickly as many are predicting.

There are problems with both of those points (commodities rising and no tightening). First China may stop or reduce new tightening measures. However, they have already decided on a 5% materials tax, and the Chinese government seldom changes its mind on a course of action. This tax has only been dictated for one province so far and only for oil and gas. It is supposed to be put into place in all provinces, likely within a year. I apologize for not having the exact schedule. Perhaps this will happen by Christmas. The materials tax is supposed to be expanded to include most major materials such as coal, iron ore, etc. When all of this happens, it will significantly affect GDP growth. It will act to depress commodities prices. I note the government says the tax rate may vary on the additional commodities. The government clearly wants to limit oil and gas use more than that of other commodities.

Additionally the European economy is likely to double dip. There is a good chance the US economy will double dip. If these things happen, commodity prices may plummet, rather than skyrocket. Buy and hold is likely not the best strategy for the short term. Extreme caution in commodities investment is warranted.

Good luck trading.

Disclosure: No positions at this time.