Kinross Gold Corporation Hits the Wall Commodities / Gold & Silver Stocks Jul 20

posted on

Jul 20, 2010 10:26AM

Edit this title from the Fast Facts Section

Commodities / Gold & Silver Stocks Jul 20, 2010 - 08:32 AM

By: Bob_Kirtley

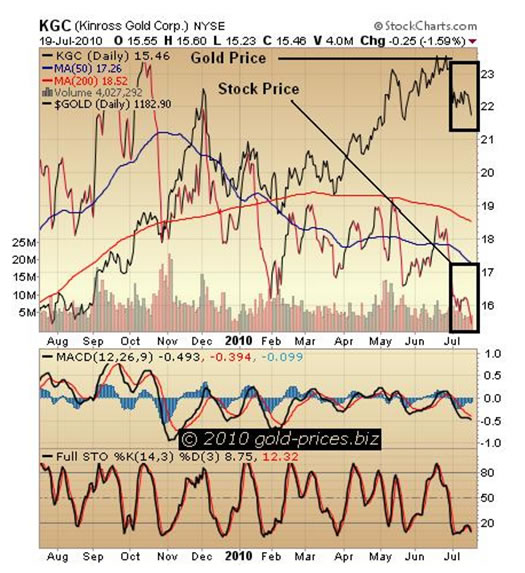

The stock price of Kinross Gold Corporation (KGC) has been hammered recently with a loss of around 20% to close today at $15.46, on the back of gold prices softening during this holiday period to trade at $1184.20 as we write.

We have plotted gold prices on the above chart so that we can see just how Kinross Gold has performed relative to them. As we can see this stock was heading south while gold was heading north and as gold prices peaked and fell the stock price of Kinross got hammered.

This is a disappointing performance by Kinross, however, they are not alone as many of the other quality stocks have also failed, or at least been sluggish in their reaction to golds advance. Kinross Gold will release its financial statements and operating results for the second quarter of 2010 on Wednesday, August 4, 2010, after market close. These results may add some cheer, however, the last set of results fell a tad short of analysts expectations and so the stock fell accordingly.

On the positive side if the stock drops a little further then it could well present us with a wonderful pre-fall bargain, when, from Labour Day onwards we expect precious metals prices to zoom. This aberration in KGCs stock price could also give us an options trading opportunity, once we have established that this downward trend is over. We will continue to monitor the situation and as usual we will post as soon as we see a trade with a good possibility of generating a profit.

Kinross Gold Corporation trades on the TSX under the symbol of K, and on the NYSE under the symbol of KGC. Kinross has a market capitalization of $10.86 billion, with average turnover of around five million shares, a P/E of 31.66 and closed today at $15.46.

In response to our readers requests we recently launched an options trading service which has recorded sixteen consecutive winning trades, a performance that puts our core holdings in the shade. We had intended to use it to give our portfolio a small boost, however, it does raise questions about the strategy of holding mining stocks on the basis that they will perform as they did in the last gold bull market. This is not 1980 and things are most certainly different and the overall outcome could also be different, a question we will tackle shortly.