Precious Metals: A Lesson for Princes and Paupers

posted on

May 11, 2010 07:15AM

Edit this title from the Fast Facts Section

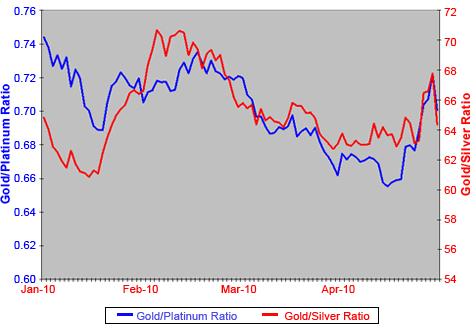

conclusion: There's a lesson for the poor and the rich here. When looking for a precious metal investment, keep your eye on its industrial demand. It matters. http://seekingalpha.com/article/204313-precious-metals-a-lesson-for-princes-and-paupers by Brad Zigler As the price of gold vacillated this year, princes and paupers found themselves oddly joined at the hip. I'm talking about traders and would-be investors in silver and platinum. Platinum started out the year trading at a $383-per-ounce premium to gold, but as the year progressed and signs pointed to a resurgence of economic activity, the premium expanded. Platinum group metals are used in automotive catalytic converters, so brightening prospects for auto sales boosted commercial and speculative interest in white metals. By the last week in April, platinum's per-ounce premium to gold fattened to $601. Put another way, the ratio of gold's price to platinum's dipped from 0.74 to 0.66 in the first four months of 2010. For investors in physicals, that put platinum even further out of reach than before. It helped to be a prince if you wanted the stuff; it clearly didn't for paupers. Gold's relationship with silver—the "poor man's gold"—seemed be marching to a different drummer. At the top of the year, the gold/silver ratio stood at 65-to-1 but then dipped to the 60-to-1 level—its low point for the year—within just three weeks. So, gold got cheap in silver terms (that is, silver got relatively expensive) early in the year, while platinum's price took another three months to reach its apex. But if you plot the metals' price ratios vs. gold on the same graph, the arcs are actually quite similar. Gold/Platinum Ratio Vs. Gold/Silver Ratio What you're seeing is the manifestation of investors' expectations for economic recovery reflected in white metal prices. Platinum and silver, in addition to being precious metals, are also industrial components. Gold, with fewer manufacturing applications, is primarily an investment. As economic recovery seemed the order of the day, white metal prices were bolstered. The underpinnings of such optimism, however, were kicked loose in the past week, causing the spike you see on the right side of the graph (the drop at the right-most edge reflects this morning's lower fixes, a reaction to the European Union's rescue package passed over the weekend). There's a lesson for the poor and the rich here. When looking for a precious metal investment, keep your eye on its industrial demand. It matters.

About the author: Hard Assets Investor

About the author: Hard Assets Investor