http://seekingalpha.com/article/191323-riding-the-golden-bubble

Investors Big And Small Piling Into Gold

Perhaps that's why we've seen such incredible upswing in investment demand for the yellow metal year over year, particularly in ETFs. According to theWorld Gold Council, ETF demand in 2009 hit 594.7 tonnes—85 percent higher than 2008 levels. Granted, most of that was driven by outsized buying in the first quarter of '09, as investors, smarting from the 2008 financial crisis, fled perilous markets into supposed safe haven assets like gold. Still, ETF buying has remained brisk, with demand in Q4 2009 hitting 31.6 tonnes.

Most of that demand has gravitated toward the SPDR Gold Trust (NYSE Arca: GLD), the world's biggest bullion-backed ETF and the second-largest ETF overall. Investors big and small piled into GLD last year, which saw $13.8 billion in new net investment dollars in 2009. The fund now sits at over $35.4 billion in assets under management.

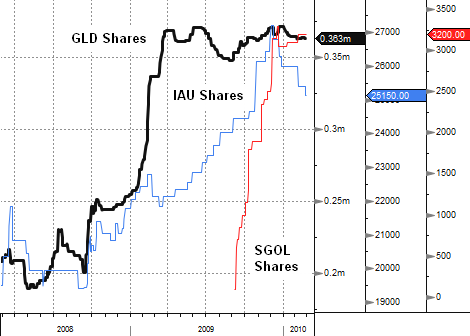

What's interesting is that the other two U.S. bullion-backed gold ETFs—the iShares COMEX Gold Trust (NYSE Arca: IAU) and the ETF Securities Physical Swiss Gold Shares (NYSE Arca: SGOL)—haven't seen nearly the same boost in demand as GLD.

Shares Outstanding For U.S. Bullion-Backed Gold ETFs

Source: Bloomberg data. Figures quoted in thousands (000).

And the rock that is GLD remains.