Saturday, January 12, 2008

History of U.S. Bank Failures

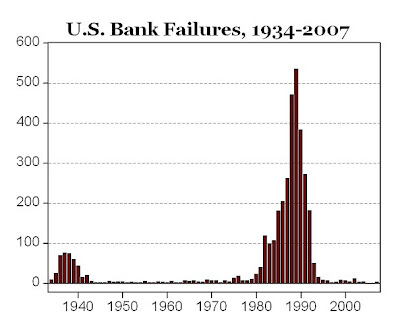

The chart above shows annual bank failures from 1934-2007 using data from the FDIC. Several facts:1. There have only been two years since 1934 when NO U.S. banks failed: 2005 and 2006.2. Only 3 U.S. banks failed in 2007. 3. Besides the 2005-2007 period, there has never been another three-year period since 1934 when only 3 U.S. banks failed.4. Even at the peak of the S&L banking crisis when more than 1,000 banks failed in 1988 and 1989, at a rate of more than 2 every business day for two consecutive years, the economy survived without going into a recession. Bottom Line: The U.S. banking system is probably stronger and more stable today than at any time in U.S. history. A subprime crisis by itself will probably not be enough to pull the U.S. economy into a recession in 2008.

The chart above shows annual bank failures from 1934-2007 using data from the FDIC. Several facts:1. There have only been two years since 1934 when NO U.S. banks failed: 2005 and 2006.2. Only 3 U.S. banks failed in 2007. 3. Besides the 2005-2007 period, there has never been another three-year period since 1934 when only 3 U.S. banks failed.4. Even at the peak of the S&L banking crisis when more than 1,000 banks failed in 1988 and 1989, at a rate of more than 2 every business day for two consecutive years, the economy survived without going into a recession. Bottom Line: The U.S. banking system is probably stronger and more stable today than at any time in U.S. history. A subprime crisis by itself will probably not be enough to pull the U.S. economy into a recession in 2008. Confusion reigns. In the oppinion of others, the US economy has been in a multi-year ression with worse to come.

Inflation/deflation??

Macro/micro??

Up/down??

We are no doubt in "uncharted" waters.

Continued "paper" wars should favour gold, so, "stay the course!"

RUF