Royal Helium Rockets to the Forefront of the Helium Industry

posted on

Oct 17, 2023 05:00PM

From Rockets to MRIs - A Multi-Use Gas in Short Supply

By AGORACOM Staff

Introduction

In the midst of an unprecedented era of space exploration, where nations and private companies are reaching for the stars, one commodity is skyrocketing in demand: helium. Royal Helium, a Canadian company with a commitment to revolutionizing the helium market, has been making waves with its recent accomplishments. In a recent interview with the company's President and CEO, Andrew Davidson, we dove into the fascinating world of helium production and its profound significance for the aerospace and technology sectors.

Record-Breaking Space Race

The space race has been nothing short of a whirlwind over the past few years. India's successful moon landing, SpaceX's ambitious asteroid mission for NASA, and numerous other space endeavors have brought this niche industry into the spotlight. The growing excitement surrounding rocket launches has become a primary driver of the helium market's expansion.

The Helium Supply Challenge

Helium is not only crucial for the success of space missions, but it also plays a critical role in various high-tech applications. However, the increasing demand for helium has posed a significant challenge for the market. Helium prices have risen dramatically, drawing attention from companies worldwide.

Royal Helium's Game-Changing Move

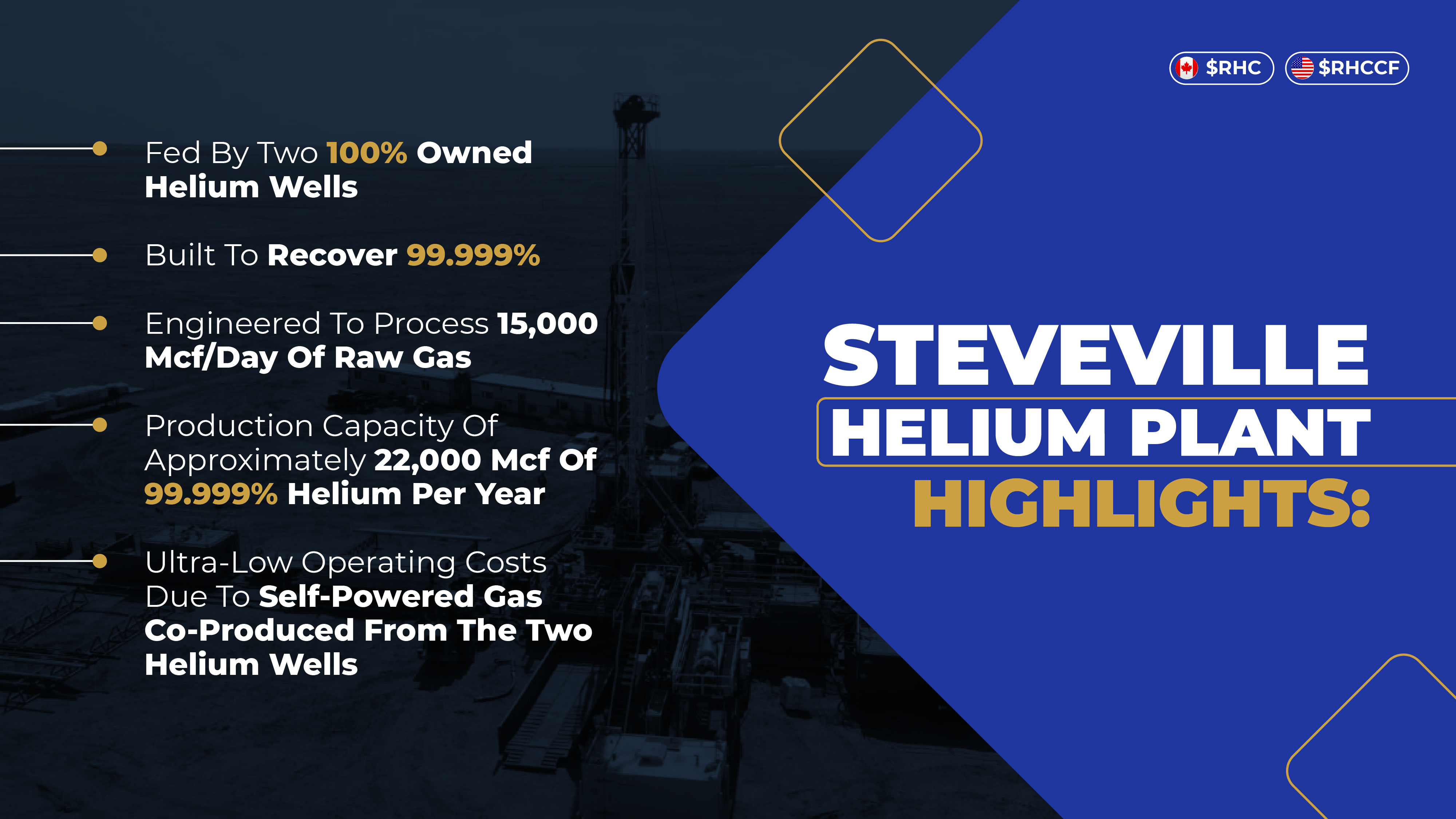

Royal Helium has been quietly achieving remarkable milestones in the background. The company recently completed the commissioning of its Steveville Helium Purification Facility, a groundbreaking achievement in the helium industry. This facility is the largest of its kind in Canada, designed to produce the highest quality helium in the country.

The Importance of Steveville Helium Plant

The significance of this achievement cannot be overstated. It positions Royal Helium as the first publicly listed helium producer in Canada, with a production capacity that is already 100% sold out to aerospace customers. With profit margins hovering around 80%, Royal Helium is well-positioned to dominate the helium market.

The Road Ahead for Royal Helium

Royal Helium doesn't plan to rest on its laurels. The company is set to replicate its success by establishing similar helium wells and purification plants at other locations. This approach aligns with the growing demand for helium, not only from the aerospace sector but also from industries such as healthcare and semiconductor manufacturing.

The Market Demand and Geopolitical Factors

Helium demand has surged due to various factors, including the reemergence of space exploration, onshoring of semiconductor manufacturing, and the growth of green energy projects that use helium as a coolant. Combined with geopolitical tensions affecting helium supply from major sources, the market is at an inflection point.

Securing a Solid Base Price

Royal Helium's contribution to the helium market is substantial. The company expects two offtake partner agreements at an average price of CAD $730 /mcf, marking a significant shift in the market's baseline price. While parabolic price increases are unsustainable, Royal Helium is poised to offer a stable and competitive pricing structure to its customers.

Third-Party Validation and Strategic Growth

Major consumers have already reached out to Royal Helium, seeking to secure their supply chain by partnering with the company. This interest underscores the pressing need for a reliable helium source as production lags behind demand.

The Mystery of Off-Take Partners

One fascinating aspect of Royal Helium's story is the secrecy surrounding its off-take partners in the aerospace and space launch industries. Royal Helium is unable to disclose their identities, sparking a wave of speculation and curiosity among investors.

A Bright and Expansive Future

With Royal Helium approaching its first delivery and an unrelenting commitment to growth, the company's journey is far from over. As the helium market continues to evolve and expand, Royal Helium remains at the forefront, ready to meet the growing demand from a wide range of industries.

Conclusion

In a world captivated by the possibilities of space exploration, helium has emerged as a critical player, enabling the success of rocket launches and other high-tech applications. Royal Helium's groundbreaking achievements have solidified its position as a key player in this industry. The completion of the Steveville Helium Purification Facility sets the stage for a bright future in which Royal Helium will continue to innovate and provide reliable helium supplies. Investors and industry enthusiasts should keep a close eye on this company as it shapes the future of helium production and distribution. Royal Helium is poised to rise to new heights in this rapidly evolving market.

YOUR NEXT STEPS

Visit $RHC HUB On AGORACOM: https://agoracom.com/ir/RoyalHelium

Visit $RHC 5 Minute Research Profile On AGORACOM: https://agoracom.com/ir/RoyalHelium/profile

Visit $RHC Official Verified Discussion Forum On AGORACOM: https://agoracom.com/ir/RoyalHelium/forums/discussion

Watch $RHC Videos On AGORACOM YouTube Channel: https://www.youtube.com/watch?v=QvOY1vfcY28&list=PLfL457LW0vdKytYjwL-YOrGdsx-rqONoy

DISCLAIMER AND DISCLOSURE

This record is published on behalf of the featured company or companies mentioned (Collectively “Clients”), which are paid clients of Agora Internet Relations Corp or AGORACOM Investor Relations Corp. (Collectively “AGORACOM”)

AGORACOM.com is a platform. AGORACOM is an online marketing agency that is compensated by public companies to provide online marketing, branding and awareness through Advertising in the form of content on AGORACOM.com, its related websites (smallcapepicenter.com; smallcappodcast.com; smallcapagora.com) and all of their social media sites (Collectively “AGORACOM Network”) . As such please assume any of the companies mentioned above have paid for the creation, publication and dissemination of this article / post.

You understand that AGORACOM receives either monetary or securities compensation for our services, including creating, publishing and distributing content on behalf of Clients, which includes but is not limited to articles, press releases, videos, interview transcripts, industry bulletins, reports, GIFs, JPEGs, (Collectively “Records”) and other records by or on behalf of clients. Although AGORACOM compensation is not tied to the sale or appreciation of any securities, we stand to benefit from any volume or stock appreciation of our Clients. In exchange for publishing services rendered by AGORACOM on behalf of Clients, AGORACOM receives annual cash and/or securities compensation of typically up to $125,000.

Facts relied upon by AGORACOM are generally provided by clients or gathered by AGORACOM from other public sources including press releases, SEDAR and/or EDGAR filings, website, powerpoint presentations. These facts may be in error and if so, Records created by AGORACOM may be materially different. In our video interviews or video content, opinions are those of our guests or interviewees and do not necessarily reflect the opinion of AGORACOM.

From time to time, reference may be made in our marketing materials to prior Records we have published. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously published information and data may not be current and should not be relied upon.

NO INVESTMENT ADVICE

This record, and any record we publish by or on behalf of our clients, should not be construed as an offer or solicitation to buy or sell products or securities.

You understand and agree that no content in this record or published by AGORACOM constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable or advisable for any specific person and that no such content is tailored to any specific person’s needs. We will never advise you personally concerning the nature, potential, advisability, value or suitability of any particular security, portfolio of securities, transaction, investment strategy, or other matter.

Neither the writer of this record nor AGORACOM is an investment advisor. Both are neither licensed to provide nor are making any buy or sell recommendations. For more information about this or any other company, please review their public documents to conduct your own due diligence.

If you have any questions, please direct them to info@agoracom.com

For our full website disclaimer, please visit https://agoracom.com/terms-and-conditions