Smart people - where is KXL? where are the juniors going?

in response to

by

posted on

Sep 06, 2008 03:23PM

Creating shareholder wealth by advancing gold projects through the exploration and mine development cycle.

Since discovering Hercules, KXL has tracked the gold junior exploration companies very, very closely - and of course it has tracked them downwards through 2008.

So - where do we go from here?

The depression in the stock price since December 2007 hasn't been a KXL story - it's been the story of the whole market, and moreso the gold juniors. For example:

Frank Barbera's blog - with a good "FSO" stock price index for the junior gold explorers.

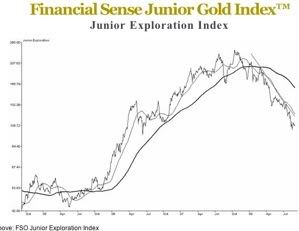

Barbera's site does a nice job of saying where the gold juniors and explorers have been, and where they are now. Here a snapshot of his latest "FSO" index for the junior explorers (for the full size chart, visit his site above):

So - according to his index, his basket of junior gold explorers is now at about "105", versus a high of "225" in October 2007 and a low of "45" in September 2004.

His vertical scale here is log-scale, so keep that in mind.

I wondered to myself - okay, we're very roughly 1/2-way down from the top, looking at the last 4 years. What happens if you look back further?

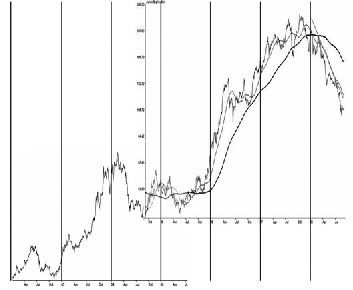

You can dig up older blog posts for the FSO indexes, and I pulled this one up here.

That older gold explorer index FSO chart goes all the way back to January, 2002. With a bit of photoshop stretching and squeezing, I stitched the two charts together, with the overlap showing in the center:

From this we can see that the gold exploration juniors have come up a very, very long way. In January 2002 (far left hand side of the chart), the index was very approximately at "20." The older chart is not log scale, so take that with a big grain of salt. Vertical bars were drawn in at Jan. 1 of each year, and the composite chart covers January 2002 up to September 2008 - i.e. nearly 7 years.

For comparison, here is the price of gold itself over the same period:

So in the last 7 years, the price of gold has gone up roughly 4 times to the peak, and the explorers have gone up roughly 8 times. That does make sense, to an extent - with a higher price of gold, marginal mines suddenly make a lot more financial sense.

So, O Wise Ones - where do we go from here?

We are in the midst of a series of huge financial shocks, with more to come. Do people run to gold, pushing it back over 900? Or do the Morgan Stanleys and central banks of the world print a bunch more gold-tinted paper and push it down to 600?

Do KXL and the junior gold explorers follow the price of gold up or down, or follow the stock market, with cash in general washing in or out?

With a broad brush, it seems that the long term story (7 years) is gold explorers becoming much more valuable with every rise in the price of gold. However, in the shorter term (2008), money being sucked out of the stock market has meant money sucked out of gold stocks too.

It seems we have three time scales competing for effect - 3 months (up: peak KXL assay season), 1-2 years (down: stock market deflation) and 5-10 years (up: gold, commodity and mining demand).

KXL has a fantastic story and is just at the cusp of releasing some exciting results - 600 meters deep drilling, Lucky Strike/Golden Mile intersection, strike lengthening to SGX and Alto and confirmation of historic high grade prospects.

At the same time, banks everywhere are as sick as they've ever been.

If you multiply Barbera's FSO index for the explorers by 1.5, you have KXL's stock price, approximately. With it at FSO:100/KXL:$1.50 now, will it dip to 80/$1.20, or bob back to 140/$2.10?

Which one will whack the other over the head in the next 3 months? What do you think?

Thanks for reading this far / cedar