BHP gets it too-oink oink

posted on

Sep 17, 2021 08:42AM

NI 43-101 Update (September 2012): 11.1 Mt @ 1.68% Ni, 0.87% Cu, 0.89 gpt Pt and 3.09 gpt Pd and 0.18 gpt Au (Proven & Probable Reserves) / 8.9 Mt @ 1.10% Ni, 1.14% Cu, 1.16 gpt Pt and 3.49 gpt Pd and 0.30 gpt Au (Inferred Resource)

From Aug but pretty sure not posted. BHP fully gets the magnitude of the potential. Funny how all these authors just asssumed the deal was done. The reason why BHP acquired Noront, and why BHP's CDO talks about a "world-class growth option" BHP carries a lot of clout and I guess everyone thinks that we would jump on the offer from the largest mining company. They underestimated the fact that Noront holders know full well what is in the ground.

Oh yeah this is my fav ring of fire picture...bring the piggies to the trough.

=====================================================

Noront is a special company with special assets. This acquisition may become one of the key moments in BHP's history over the coming years and decades.

https://seekingalpha.com/article/4447026-bhp-group-positioning-for-the-decades-to-come

Hiroshi Watanabe/DigitalVision via Getty Images

Hiroshi Watanabe/DigitalVision via Getty Images

BHP (BHP) announced a C$325 million ($259 million) acquisition of Noront Resources (OTCPK:NOSOF). Although at a first glance, a $259 million acquisition looks like a spit in the ocean for the $183 billion mining giant, Noront is a special company with special assets. This acquisition may become one of the key moments in BHP's history over the coming years and decades.

BHP will pay C$0.55 ($0.44) per Noront share, which represents a 69% premium to the pre-announcement closing price. This is a nice premium and it elevated Noront's share price to the highest level since March 2015. Therefore, it is hardly surprising that the deal won the support of Noront's management and Board of Directors.

BHP will pay C$0.55 ($0.44) per Noront share, which represents a 69% premium to the pre-announcement closing price. This is a nice premium and it elevated Noront's share price to the highest level since March 2015. Therefore, it is hardly surprising that the deal won the support of Noront's management and Board of Directors.

Also BHP seems to be optimistic, as Johan van Jaarsveld, BHP's Chief Development Officer, stated:

Also BHP seems to be optimistic, as Johan van Jaarsveld, BHP's Chief Development Officer, stated:

For BHP, the acquisition of Noront presents a world-class growth option, in a key future-facing commodity. The highly prospective Eagle’s Nest nickel project provides an excellent platform from which to develop further opportunities in Ontario’s Ring of Fire.

We are excited to bring our mining expertise and capabilities to develop these long-term opportunities. We look forward to working in constructive partnerships with First Nations peoples, government and communities to realize the untapped potential of these important resources.

The reason why BHP acquired Noront, and why BHP's CDO talks about a "world-class growth option" (and for a company of BHP's size world-class really means world-class), is the Canadian Ring of Fire. It is a region rich in chromite, nickel, copper, and PGM mineralization, situated in The James Bay Lowlands area of Northern Ontario. It is not a single project. The Ring of Fire consists of numerous projects of different sizes in different development stages, owned by different companies. However, Noront controls the major part of the area (map below). According to some sources, Noront controls around 85% of base metal holdings in the Ring of Fire. Noront's latest corporate presentation states that Noront owns 22 of 26 significant mineral discoveries, 7 of 9 NI43-101 compliant resource estimates, and 2 of 2 feasibility-stage projects.

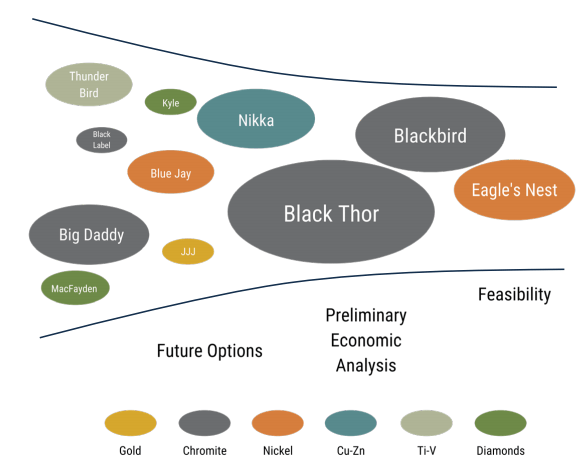

An overview of Noront's development projects can be found below. The most advanced one is the Eagle's Nest deposit that contains mainly nickel, but also copper, platinum, and palladium. Eagle's Nest is Noront's most advanced project, with a completed feasibility study. The Eagle's Nest development should be followed by the Blackbird chromite deposit development according to Noront's plans, however, BHP may have different priorities, as there is also the Black Thor deposit that is much bigger than Blackbird and that has a completed feasibility study. However, there are numerous other deposits in earlier development stages, such as the copper-zinc Nikka deposit, Kyle and MacFadyen diamond deposits, or Thunder Bird titanium-vanadium deposit. And this is only the beginning, as a major portion of the huge land package is underexplored. Noront states that it has identified over 70 nickel-copper-PGM exploration targets, and most of them have never been tested.

Source: Noront Resources

Source: Noront Resources

As mentioned above, the most advanced is the Eagle's Nest project. It contains reserves of 412.3 million lb nickel, 213.5 million lb copper, 319,000 toz platinum, 1.1 million lb palladium, and 64,000 toz gold. According to the 2012 feasibility study, a mine with an annual throughput of 1 Mtpa should be able to produce 33.7 million lb nickel, 18.9 million lb copper, 89,500 toz palladium, 23,000 toz platinum, and 4,800 toz gold per year on average, over 10-year mine life. The cash cost was estimated at $1.54/lb nickel, and the pre-production CAPEX was estimated at $600 million. The recent corporate presentation indicates that the mine construction could start in early 2024, with the first production before the end of 2026.

Less than 1 km from Eagle's Nest lies the Blackbird deposit. This is also the reason why Noront has a plan to develop it shortly after Eagle's Nest, with construction start-up in early 2026 and first production before the end of 2028. The idea is that both mines could share some infrastructure which should help to reduce development costs. Blackbird has measured and indicated resources of 20.46 million tonnes of ore containing 35.76% of chromium oxide, with a chromium-iron ratio of nearly 2. The inferred resources contain another 23.48 million tonnes of ore of similar quality. Noront's plan is to transport chromite by truck and train to a ferrochrome production facility that should be built at Sault Ste Marie. The ferrochrome produced at the facility should be sold on the U.S. market.

Only several kilometers away are situated another three chromite deposits (Big Daddy, Black Thor, Black Label). They should be developed after Blackbird. The ore should be processed at the Sault Ste Marie facility after it undergoes an expansion. The additional ferrochrome production should supply the European and Asian markets.

The Black Thor deposit is a real giant. It contains measured and indicated resources of 137.7 million tonnes of ore containing 31.5% of chromium oxide and inferred resources of 26.8 million tonnes of ore containing 29.3% of chromium oxide. A feasibility study for Black Thor was prepared by its previous operator, Cliffs Natural Resources (today Cleveland-Cliffs (CLF)), back in 2013. It envisioned an open-pit mine with a 30-year mine life. The problem is that the initial CAPEX was estimated at $4.4 billion. Close to Black Thor is situated the Black Label deposit. It contains measured and indicated resources of 5.4 million tonnes of ore containing 25.3% of chromium oxide and inferred resources consist of 0.9 million tonnes of ore containing 22.8% of chromium oxide.

And there is also Big Daddy, 70%-owned by Noront and 30%-owned by Canada Chrome Mining Corporation. Its measured and indicated resources include 29.1 million tonnes of ore containing 31.7% of chromium oxide, and its inferred resources include 3.4 million tonnes of ore containing 28.1% of chromium oxide.

Worth mentioning is also the Nikka copper-zinc-silver project. The VMS deposit contains indicated resources of 54.7 million lb copper or 69.5 million lb of copper equivalent. The inferred resources contain further 185.2 million lb copper or 238.1 million lb of copper equivalent.

To sum it up, BHP is going to acquire a large land package with sizable resources and huge exploration potential. The currently known deposits would be sufficient for several decades of mining operations in the Ring of Fire area. But it is almost sure that this is just the beginning and much more reserves and resources will be identified over time.

However, not everything is rosy. Ring of Fire is in a remote area and substantial infrastructure needs to be built. Fortunately, the Ring of Fire development has strong support from the Ontario government that committed C$1 billion to build the necessary road infrastructure. The government support should help also during various permitting processes. The problem is that BHP will have to deal with 8 first nation communities living in the area. And not all of them are happy about the potential future mining activities in the area.

Only this April, the Attawapiskat, Fort Albany, and Neskantaga First Nation declared a moratorium on Ring of Fire development. The moratorium was declared because the First Nations believe that the Impact Assessment Agency of Canada has breached several laws during the current permitting process. What is interesting, Noront didn't announce the news regarding the moratorium to its shareholders, and only last week, the Osgoode Hall Law School’s Environmental Justice & Sustainability Clinic announced the results of its research:

In our research, we found deficiencies in Noront’s disclosures in relation to material facts and material changes in the extent of Indigenous opposition to its ongoing plans and activities in the Ring of Fire.

It appears that Noront failed to inform investors about the significant extent of Indigenous dissatisfaction in the region.

However, this shouldn't endanger the deal, as BHP surely knew about the moratorium before it made its offer to acquire Noront.

The acquisition of Noront Resources and its large Canadian Ring of Fire properties may turn out to become one of the key moments in BHP's history. By acquiring the properties, BHP will acquire sizeable reserves and resources of chromite, nickel, platinum group metals, and other minerals. Moreover, the exploration potential is so huge that there is only little doubt that much more resources will be discovered in the future. BHP has the financial sources and the expertise to develop and operate the prospective mining complex that may become a very important part of its business for the upcoming decades. Although I believe that the acquisition is good news for BHP and its shareholders, it is important to note that it will take time before the fruits of the acquisition are ready to be reaped. The development of the mining complex will take many years and cost a lot of money. Moreover, BHP will have to deal also with the local opposition.