For industrial metals exploration, it's game on

posted on

Jun 30, 2021 11:18AM

NI 43-101 Update (September 2012): 11.1 Mt @ 1.68% Ni, 0.87% Cu, 0.89 gpt Pt and 3.09 gpt Pd and 0.18 gpt Au (Proven & Probable Reserves) / 8.9 Mt @ 1.10% Ni, 1.14% Cu, 1.16 gpt Pt and 3.49 gpt Pd and 0.30 gpt Au (Inferred Resource)

A good article, long so will focus on nickel....Noront not even mentioned as a new discovery...hello majors where are you?

According to BloombergNEF, demand for Class 1 nickel is expected to out-run supply within five years, fueled by rising consumption by lithium-ion electric vehicle battery suppliers.

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically, technically and environmentally feasible? The pickings are slim.

Decades of under-investment equals few new large-scale greenfield nickel sulfide discoveries. Only one nickel sulfide deposit has been discovered in the past decade and a half, Nova-Bollinger in Western Australia.

The result of such limited nickel exploration is a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will therefore be extremely attractive to potential acquirers.

=======================================================================

https://www.investorideas.com/news/2021/mining/06301RickMills-Metals-Exploration.asp

Nickel

Nickel is present in over 3,000 different alloys, used in over 300,000 products for consumer, industrial, military, transportation, marine and architectural applications.

Nickel's biggest use, about 65%, is in alloying – particularly with chromium and other metals to produce stainless and heat-resisting steels.

Another 20% is used in other steels, non-ferrous alloys (mixed with metals other than steel) and super alloys (metal mixtures designed to withstand extremely high temperatures and/or pressures, or have high conductivity) often for highly specialized industrial, aerospace and military applications.

About 9% is used in plating to slow down corrosion and 6% is for other uses, including printing coins. Rechargeable nickel-hydride batteries are used in cell phones, video cameras, and other electronic devices. Nickel-cadmium batteries are used to power cordless tools and appliances.

In many of these applications there is no substitute for nickel without reducing performance or increasing cost.

Most recently, nickel sulfate powder made from nickel sulfide ore, is a crucial ingredient in cathode formulation for lithium-ion batteries needed to propel electric vehicles.

Nickel is popular with EV battery-makers because it provides the energy density that gives the battery its power and range. Increasing the amount of nickel in a battery cathode ups its power/ range but, add too much of it and the battery becomes unstable, ie. vulnerable to overheating and a shortening of its lifespan.

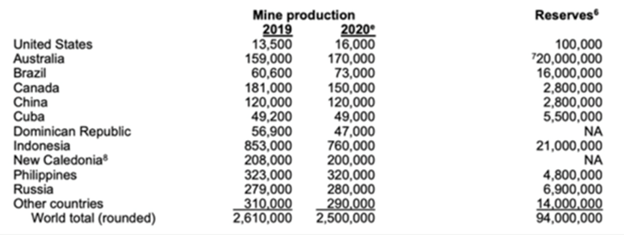

According to CRU, current global primary nickel demand was approximately 2.2 million tonnes per annum for 2018 and is expected to grow to 2.8 million tonnes by 2023. Mined nickel production in 2020 was only 2.5 million tonnes, meaning if the market doesn't see an annual supply increase of at least 300,000 tonnes in the next two years, it will slip into deficit. (the market not only has to supply enough nickel to meet stainless steel demand, but an expected 7-fold increase in demand from EV batteries)

Glencore CEO Ivan Glasenberg recently said nickel supplies need to grow by an additional 250,000 tonnes a year, and he projected annual nickel demand will rise from 2.5 million tonnes currently to 9.2Mt, over the next few decades.

2020 global mined nickel production. Source: USGS

Historically, most nickel was produced from sulfide ores, including the giant (>10 million tonnes) Sudbury deposits in Ontario, Norilsk in Russia and the Bushveld Complex in South Africa, known for its platinum group elements (PGEs). However, existing sulfide mines are becoming depleted, and are not being replaced, which has changed the geographical weighting of nickel production.

Nickel miners are having to go to the lower-quality, but more expensive to process, as well as more polluting nickel laterites such as found in the Philippines, Indonesia and New Caledonia.

Map of nickel sulfides and laterites

Producing nickel-rich battery cathodes requires high-purity nickel, in the form of nickel sulfate, derived from ‘Class 1' nickel sulfide deposits. This nickel can be processed at relatively low cost, and with minimal waste, using a simple flotation technique.

China says it has found a way to make "green" nickel chemical for EV batteries from nickel laterite deposits in Indonesia that could help to alleviate the coming supply deficit in the metal that is essential to electric vehicle batteries.

Don't be fooled. The process is extremely polluting, and "ocean tailings ponds" are anything but green. Thankfully car companies aren't buying it.

Future nickel supply for battery-making is therefore unlikely to come from Indonesia or anywhere else where nickel laterites are mined.

According to BloombergNEF, demand for Class 1 nickel is expected to out-run supply within five years, fueled by rising consumption by lithium-ion electric vehicle battery suppliers.

Where will mining companies look for new nickel sulfide deposits, from which the extraction of high-grade nickel needed for battery chemistries is economically, technically and environmentally feasible? The pickings are slim.

Decades of under-investment equals few new large-scale greenfield nickel sulfide discoveries. Only one nickel sulfide deposit has been discovered in the past decade and a half, Nova-Bollinger in Western Australia.

The result of such limited nickel exploration is a very low pipeline of new projects, especially lower-cost sulfides in geopolitically safe mining jurisdictions. Any junior resource company with a sulfide nickel project will therefore be extremely attractive to potential acquirers.