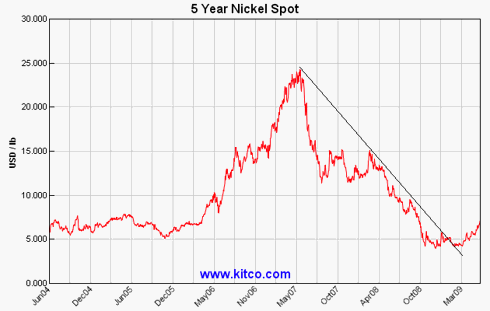

If you had been following nickel, you would have gotten quite a heads up as the economic train wreck that was coming in 2008. Nickel was one of the first of the commodities to get killed. It started to fall in April 2007, a year before copper. At the time, nickel had soared to almost $25.

Before the carnage was over, it had plummeted to below $5. The largest producers of nickel didn't know what was happening. The CEO of Vale (VALE), for instance, in October 2007, offered:

And so nickel prices are also bouncing back, reflecting the healthy fundamentals that we put there. So, the growth is there. The world growth is there. Asia is growing and again demand would -- it's a matter of time that demand will reflect this situation is different in the nickel market.

He was wrong in his forecast. Nickel would ultimately tumble eighty per cent. Vale's other businesses such as iron and coal would follow suit. In hindsight, nickel was an important clue to the coming collapse in the global economy and commodity markets of 2008.

Now it looks like nickel is starting to make a come back, something that would validate the move we have seen in copper and oil. Technically, nickel is seeing a break out above its long term down trend.

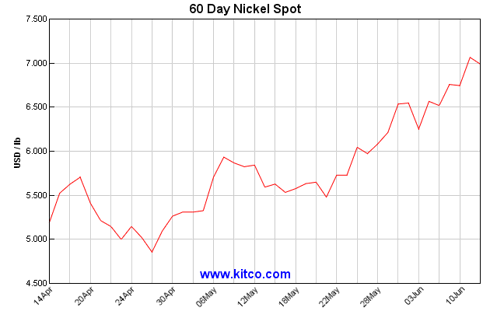

Over the last sixty days, nickel has been showing strength.

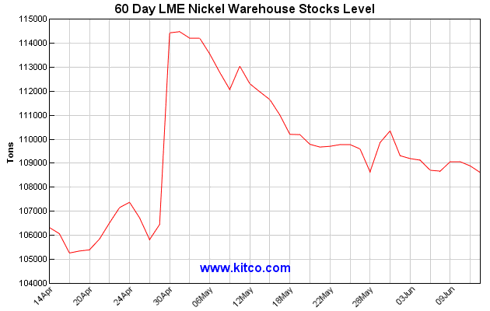

Stores are starting to decrease.

A stronger nickel market portends a strengthening global economy. Nickel clues us in, for example, on how iron is doing, a metal crucial to the world economy and much harder to track because it lacks a significant futures market. NIckel is a key ingredient in many steel alloys.

Right now, nickel is telling us good things about iron and steel.

Nickle should continue to be a good tell for the global markets. Now it is saying positive things about the world economy, and one stock in particular.

In 2006, Vale paid $17 billion for Inco, a preeminent of nickel producer (just in time for the commodity debacle). Although its timing was badly off, Vale should now benefit from the resurgence in nickel.