AUM disappearing?

posted on

Jun 11, 2013 09:32AM

Golden Minerals is a junior silver producer with a strong growth profile, listed on both the NYSE Amex and TSX.

From Golden Minerals latest Press Release:

++++++++

Outlook

As previously communicated, the Company currently expects to produce between 900,000 and one million ounces of payable silver equivalent in 2013. The Company continues to expect completion of the San Mateo ramp in the third quarter 2013, and that production in the third and fourth quarters of 2013 will exceed first quarter production as broken material inventories are replenished in the mine and additional development work opens new stopes for production. Due to the depletion of broken ore resulting from the explosives permit suspension that ended April 10, 2013, the Company expects second quarter production and metals sold to be lower than the first quarter. Given the recent decline in prices for gold and silver the Company is now assuming prices for silver of $25 per ounce and for gold of $1,500 per ounce for the remainder of 2013. Taking into account lower forecast prices and the disruption in production caused by the temporary suspension of the explosives permit, the Company anticipates ending 2013 with a cash and cash equivalents balance of approximately $18.0 million.

+++++++

The article below and the AUM Outlook above are they inter-related?? Is Golden Minerals (with funds and money in the Bank just a bit over the disappearing threshold mentioned below) headed to oblivion, too? Is it just a matter of time before AUM expenses eat up the Golden bank account? Time will tell.Note the price of silver and gold quoted in the media release above and what today's actual spot prices are ($1369 /oz gold and $21.55 / oz silver). I have said this before and will probably say it again. “You old guys (senior management) get off the pot, go golfing or something, but please leave AUM now. Assumptions seem to be flawed. Let someone younger, new and vibrant run this company. Why, because Management are not doing what they should be for us the shareholders, i.e. making all of us money! (….except for yourselves in your overpaid remunerations.)

GO, go now....retire, leave, depart, disappear...... because we are watching.

+++++++++++

The Consequences of Destroying the TSX Venture: A Look into the Impact of the TSX Venture Exchange on the Economy

Dear Readers,

The latest TMX Group data shows there are 1,310 mining companies listed on the TSX Venture, making up 58 percent of the entire exchange of 2,256 companies.

Reports are springing up everywhere that many of these companies, as many as 700 of them, have less than $200,000 in the bank and trade at less than 20 cents a share.

As I mentioned a couple of weeks ago, a junior on the TSX Venture spends on average around $200,000/year in legal and other fees just to comply with regulations; that doesn't include office space, employees, general working capital, and the costs to maintain their assets.

When you factor in other costs, a junior on the TSX Venture will generally need a minimum of at least $1 million per year to operate, provided they cut back on any major drill programs or advancements to their projects.

That means a minimum of $700 million needs to be raised to keep the 700 companies on the TSX Venture alive for just one more year. That's a lot of money.

When you consider the overall impact of the destruction of the TSX Venture, the numbers become staggering.

Of the 700 juniors that might go under, let's say 20% of them share offices and have three employees each making $30,000/year (I am being very lean here).

Let's say the average commercial office space is $3000/month (on the very low side). That's a total of $1.89 million in lost office space revenue every month, and $22.68 million per year. Of course, the actual financial impact of losing 700 companies on the TSX Venture will be a lot more than this because we haven't even begun to factor in companies that service these resource companies; put that into the equation and the numbers become staggering.

What companies will take over these empty spaces?

Perhaps the smart money is already catching on?

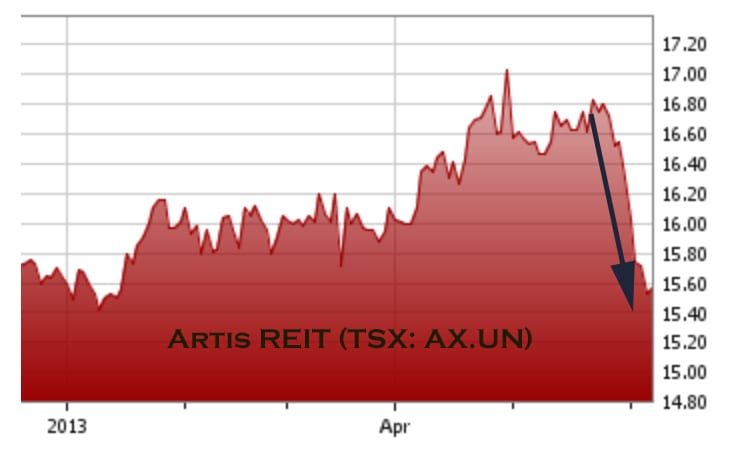

Take a look at these charts of Real Estate Investment Trusts (REITS) in Canada:

Despite Earnings Per Share growth and strong analyst sentiment, both companies are down significantly over the last month or so. While both are in oversold territory and may experience a slight rebound, perhaps the decline suggests things are looking weak?

Are the charts trying to tell us something?

What do you think? Leave a Comment by Clicking Here

Loss of Jobs

Based on our very simple example above, a bare minimum of 2100 employees will lose their jobs if the 700 TSX Venture juniors go under; that's at least $60 million in lost revenues every year.

But this does not even come close to factoring the loss of jobs for the services sectors that service these juniors, or the brokers and small institutions that might go under as a result.

According to the Australian:

"OVER past three months the value of mining service companies has fallen by more than 35 per cent, or a massive $17 billion, in arguably the biggest single sectoral destruction of value since the dotcom crash early last decade."

The full fiscal impact of losing these juniors will be staggering.

While it is unknown just how many jobs will be directly affected if the TSX Venture continues to fall, let's look at the mining sector as a whole and use some comparisons to get a broader scope of the industry.

The World's Public Mining Hubs: The TSX and the TSX Venture

The Toronto Stock Exchange (TSX) and the TSX Venture Exchange are home to 58 per cent of the world's public mining companies.

In 2011, the TSX and the TSX Venture Exchange listed over 1,600 mining companies - more than half of the world's listed companies - with a market capitalization of $427 billion in 2011.

As at April 30, 2013, the quoted market value of both the TSX and the TSX Venture was less than $292 billion; the TSX Venture representing a dismal $13 billion of that total.

Source: TMX Group

In 2012, 70% of the equity capital raised globally for mining companies was raised on TSX and the TSX Venture in 2012.

If the TSX Venture downfall trend continues, a lot stands to be lost.

Mining Jobs in Canada

In 2010, Canada's mining sector contributed $36 billion to the national GDP and employed 308,000 workers in mineral extraction, smelting, fabrication and manufacturing.

That means one out of every 50 Canadian workers was directly employed in mining.

While Statistics Canada does not break down employment data in mining-related supporting activities (e.g. exploration, contract drilling, and transportation), the Mining Association of Canada reports that 3,223 companies supply goods and services to mining companies such as accounting, environmental consulting, legal and technical advice, and finance.

They also note that the Canadian mining industry also supports many jobs in shipping, rail and transportation. What they didn't say was that mining accounts for more than half of Canada's rail-freight revenues and tonnage. That means big companies such as CN Rail, CP Rail, the Port of Montreal, and the Port of Vancouver depend on a strong mining economy.

The Direct and Indirect Effects of Mining on the Economy

A 2011 analysis of the economic impacts of mining in British Columbia found that 21,112 people were employed directly in mining (2% of BC's labor force), with an additional 16,590 jobs indirectly created.

Let's look at Canada's biggest mining province, Ontario:

Via the Ontario Mining Association:

"Because almost 90% of the input costs of mining operations in Ontario are sourced from within Canada, with most of those being local, and 60% of its output is exported, the mining sector is a natural multiplier of jobs. The economists who produced the recent study Mining: Dynamic and Dependable for Ontario's Future explored, with the use of StatsCan data, some of the upstream linkages of the various inputs for mineral production in this province.

They employed this input-output model to see what impact a $1 billion increase in the value of Ontario's mineral production, based on OMA members, would have on the economy and employment. In 2011, the value of total mineral production in Ontario was $10.7 billion.

This analysis shows that such an increase would boost Ontario's GDP by $858 million and Canada's GDP by $900 million. It also shows that there would be an increase in direct mine employment of 2,421 jobs. Because of the overwhelmingly domestic source of mine inputs, this leads to 1,997 direct jobs in Ontario in sectors such as wholesale trade, professional and scientific, administration, finance, construction, utilities and government. That makes for a total of 4,418 jobs.

When the induced impact of $1 billion increase in mineral sector revenues is included, the boost to the provincial GDP surpasses $1 billion for Ontario and $1.1 billion for Canada. In addition, we see 1,942 new jobs created in sectors such as retail, health care, accommodation and food services, non-profit institutions, arts and entertainment, information industries and construction. The induced jobs are derived from where and how the direct and indirect employees spend their pay cheques.

This impact is significant because as this economic study shows the average weekly wage paid in the mining industry in Ontario is 60% higher than the province's average industrial wage. Salaries paid in the mining support sector (indirect jobs) can be higher because of specialization.

The numbers show that from $1 billion in new mineral revenue there can be generated a total of 6,360 jobs - 2,421 direct, 1,997 indirect and 1,942 induced - in Ontario. All of Canada, but predominantly Quebec and Alberta, benefit from increased mineral output in Ontario. The 2,421 direct jobs in Ontario lead to a higher total of 2,354 indirect jobs and 2,329 induced jobs across the country. The 2,421 positions in Ontario grow to 7,104 jobs in the country. This is a job multiplier of about three. Jobs equal opportunities for people of all skills and abilities."

These numbers coincide very well with a 2010 study done by the U.S. National Mining Association showing that mining directly created 627,650 jobs and indirectly and induced* created 1,353,405 jobs.

*induced effects measure the U.S. economic impact of spending of payrolls resulting from direct and indirect activity

The spillover effect of the mining industry is even more apparent when you look elsewhere in the world. All industries create spillover effects, known as multipliers, but the mining sector generally creates a higher multiplier effect than other sectors.

For example, case studies found that for every job directly created by the Yanacocha mine in Peru, 14 jobs were indirectly created. In South Africa, while 150,000 people are directly employed in gold mining, a comparable number are employed indirectly. Each person employed in the industry may, on average, support eight dependents, which shows an extremely high multiplier effect.

The Importance of the TSX Venture

The destruction of the TSX Venture will not only affect Canada, but the rest of the world. Consider this:

In the last year (YTD April 30, 2013), the TSX Venture was responsible for raising $525,629,946 in 456 financings, while the TSX raised $989,266,371 in 60. However, the TSX Venture only has a market value of $13 billion, whereas the TSX $291 billion.

When you consider that 70% of all capital equity raised for mining was completed on the TSX and the TSX Venture in 2012, with the TSX Venture representing more than a third of that number, a further decline in the TSX Venture will be disastrous for the world mining economy.

With more regulatory changes underway, companies on TSX Venture will likely have an even harder time raising capital. If this continues, we stand to lose a lot as Canadians.

Article above quoted from:

Ivan Lo

The Equedia Letter