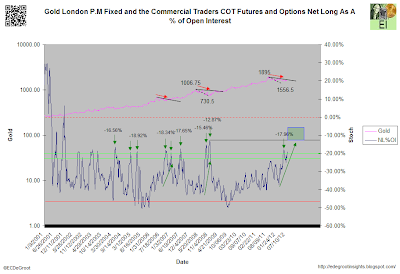

- Net long as a percentage of open interest has risen to -19.06% (chart 1). The invisible hand has been aggressively covering its shorts position in 2012. The last time it did that was 2008 before the huge rally of 2009-2011.

Chart 1: London P.M Fixed and the Commercial Traders COT Futures and Options Net Long As A % of Open Interest

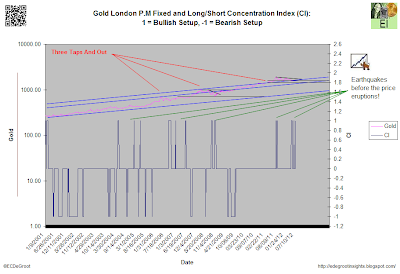

- The gold market continues to vent gas and record earthquakes before the price eruption of 2012-2013 (chart 2).

Chart 2: Gold London P.M Fixed and Long/Short Concentration Index (CI) 1 = Bullish Setup, -1 = Bearish Setup

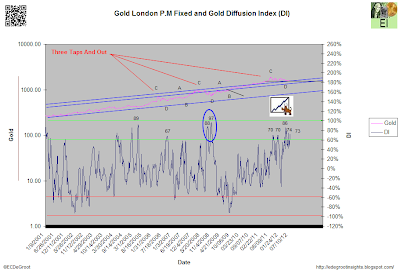

- The size of the growing magma dome or energy that will propel the next advance is quantified by the breadth diffusion index readings above 60 since 2011 (chart 3). This price eruption will be shocking when a technical buy signals creates the first panic.

Chart 3: Gold London P.M Fixed and Gold Diffusion Index (DI)

The pressure and energy building for the next advance is only matched by the number of investors giving up on gold. This is why speculation is the most unique game on the planet. Humans want to be lead in the game of speculation. They act largely without understanding within the perceived comfort and safety of the herd.

Yet, true success requires independent thought and action. Profitable trades elude most traders because the sheer size of the herd robs them of the independence required for a clear view of the trend. Gold is setting up for a historic upside explosion, but few can see the subtle changes in trend beginning to emerge.

http://agoracom.com/ir/GoldenMinerals/forums/discussion/topics/new