The analysis below by Eric de Groot intrigues me. On the one hand Silver seems to have shaken out all weak hands, given a DI of 95, on the other hand the Gold DI seems to not have reached a total shake out of gold longs, though we are very close or maybe we are already there, but just at a much lower level than in Gold

Anyone who understands a bit more on these concepts?

Sunday, October 9, 2011

Loose Cannon On the Gold & Silver Ship Will Be Tethered Soon

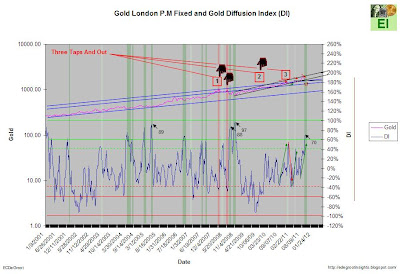

The well-orchestrated paper attack on gold, silver, and quality gold share, similar to a loose cannon on deck during a hurricane, is wrecking havoc on the deck hands (investors). Falling prices engenders fear. Fear, in turn, facilitates even more selling, and margin calls grease its wheels. The cycle repeats until there’s no paper fuel left.

A diffusion index (DI), already well above 60%, suggests growing statistical concentration and huge reduction in paper fuel. This implies that the loose cannon despite growing fears that everything will be lost will be tethered down soon. A DI reading in the 80’s or 90’s, similar to 2005 and 2008, should mark the point of maximum panic – deck damage. Once the final rope has been secured, it will become obvious that a large number of deck hands have been lost from the gold and silver ship. Welcome to the gold and silver game.

Gold London P.M Fixed and Gold Diffusion Index (DI)

Silver London P.M Fixed and the Silver Diffusion Index (DI)