This week in 'The Room'

posted on

Apr 07, 2008 07:49PM

Golden Minerals is a junior silver producer with a strong growth profile, listed on both the NYSE Amex and TSX.

Deno

Casey Files:

This week in 'The Room'

David Galland

International Speculator

written Apr 4, 2008

posted Apr 8, 2008

Welcome to "The Room" The subscribers-only home page of Casey Research.

Dear Readers,

This week finds me writing from Room 2218 of the infamous Jekyll Island Club. The hotel's adjective comes from a secret meeting held here in 1910 involving some of America's most powerful men. Here's an official history of that seminal event...

Soon after the 1907 panic, Congress formed the National Monetary Commission to review banking policies in the United States. The committee, chaired by Senator Nelson W. Aldrich of Rhode Island, toured Europe and collected data on the various banking methods being incorporated. Using this information as a base, in November of 1910 Senator Aldrich invited several bankers and economic scholars to attend a conference on Jekyll Island. While meeting under the ruse of a duck-shooting excursion, the financial experts were in reality hunting for a way to restructure America's banking system and eliminate the possibility of future economic panics.

The 1910 "duck hunt" on Jekyll Island included Senator Nelson Aldrich, his personal secretary Arthur Shelton, former Harvard University professor of economics Dr. A. Piatt Andrew, J.P. Morgan & Co. partner Henry P. Davison, National City Bank president Frank A. Vanderlip and Kuhn, Loeb, and Co. partner Paul M. Warburg. From the start the group proceeded covertly. They began by shunning the use of their last names and met quietly at Aldrich's private railway car in New Jersey. In 1916, B. C. Forbes discussed the Jekyll conference in his book Men Who Are Making America and illuminates, "To this day these financiers are Frank and Harry and Paul [and Piatt] to one another and the late Senator remained 'Nelson' to them until his death. Later [following the Jekyll conference], Benjamin Strong, Jr., was called into frequent consultation and he joined the 'First-Name Club' as 'Ben.'"

And so it was that the Fed, that blight upon the U.S. dollar and instrument of unlimited government power, was born. Some of you, learning in last week's missive that Doug and I were heading to this place, wrote strong words condemning the place as if it had a life of its own. Like, perhaps, the set piece of one of those classic horror films.

But writing from the perspective of an instant expert (as I have only been here three days now), the hotel is grandiose and very pleasant in a Southern manor sort of way. The food is excellent, the amenities are plentiful and the weather far more agreeable than that gripping my hometown in the Northeast. I would, however, caution you to avoid the place in summer; in addition to high heat, the bugs are reputed to be both fierce and relentless. Even now, in early spring, the truth of that reputation is confirmed by the occasional no-see-um enjoying a snack at my personal expense.

Apparently, the old club had fallen into disrepair after World War II, when the money men that founded the place, including J.P. Morgan himself, stopped coming here in favor of the more refined holiday resorts of Europe. Such disrepair, in fact, that it was closed for four decades before eventually limping back into existence as a 4H camp and, some have said, even a flop house. Thanks to a substantial infusion of cash from the state of Georgia, or, more correctly, the taxpayers of Georgia, the club and its grounds have been restored to their former state of glory and are now very much up to code.

But why are Doug and I here? As much as I wish it was pure holidaying, or even plotting to replace the Fed system and returning to one that is actually based on something more tangible than political whim, we are here at the invitation from a friendly competitor, Porter Stansberry, to attend his annual editors conference.

It has been an interesting experience because Stansberry tends to focus on investment areas we tend to avoid. That said, there is a solid contrarian streak that flows through the organization, such as the one that has some editors talking about homebuilders being a good buy just now.

Homebuilders? Surely you jest, I thought to myself as I listened to the presentation. But then, Steve Sjuggerud, editor of the highly popular and widely read Daily Wealth, discussed how, in a typical housing collapse, the shares in the homebuilders will go down by as much as 75% to 90%, a level that would make it seem hard to get hurt. But the more important thing is that when they rebound from those depressed levels, they can go up by as much as 300% to 500%.

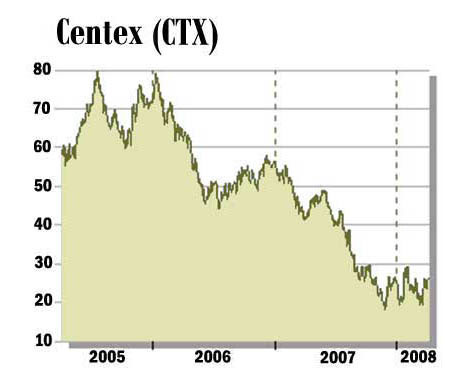

Consulting the ever-reliable stock research tool on the CaseyResearch.com website, I find that Steve has a point. Centex (CTX), which is shown in the chart below and will be mentioned later, is off by about 68%.

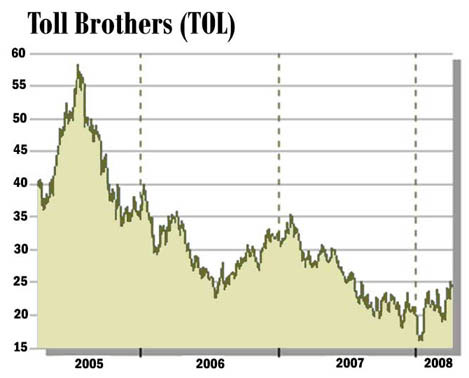

And the following chart is from another of the nation's largest builders, Toll Brothers (TOL), which is off from about $57 to $24... a loss of about 58%.

While I personally am of the belief that the real estate that underlies these companies has a long way to go before touching bottom... a topic we'll return to momentarily, it is hard to argue with Steve's basic premise that, at some point, the home builders sell at such a steep discount that there is pretty much only one way they can move: up.

It is a classic contrarian play and one to watch for. When the blood-letting has these stocks down by 80% or more, which I think we'll see, you can assume that pretty much anyone who is going to sell will have sold, which, for the speculative minded, is the time to buy. Then sit back and wait for the next upswing. It may take quite awhile for the payoff, but provided the companies have the financial ability to avoid bankruptcy - a matter for further and serious investigation - in time the upswing will come and provide a big payday.

The Trillion-Dollar Sure Thing

After falling as low as $887 earlier in the week, gold has come quickly back to $907 as I write in the wee hours of Friday morning. Why the fall? Sometimes it is hard to divine the minds of humankind, so I'm not really sure. Misplaced optimism? Profit taking?

Even so, gold showed its spine, returning quickly to the $900 level, a level which, as we have recently discussed in this missive, may be the new base for the yellow metal... a level below which people intuit that gold is "cheap." Which it is.

Why? Because it is the U.S. dollar that most people use when assessing the value of gold. And the U.S. dollar is being increasingly put at risk by the growing list of bailouts that are hastily engineered by the government and all its various apparatchiks. During a phone call the other day, our own Bud Conrad started tallying up all the money that the government has applied or committed to the unfolding crisis so far. The sum is now closing in on one trillion dollars.

Does that number concern you? Does it surprise you? Does it make you, mouth agape, stumble toward the nearest barkeep, your hand waving in a frantic attempt to capture his attention so that he might provide a restorative?

I suspect not.

Thanks to our being inoculated with a steady dose of large numbers, a number as huge as a trillion probably only softly touches your individual consciousness. The way, perhaps, that an acquaintance in this gentle clime might helpfully brush a fallen magnolia blossom from the shoulder of your white linen suit.

The impact should, however, register more like a solid slap across your ruddy jowls delivered by a southern belle after an imprudent remark encouraged by one too many mint juleps.

But a trillion-dollar bailout, just like a three-trillion-dollar war - or more correctly, in addition to a three-trillion-dollar war -- carries with it consequences. As an old and wise friend of mine now in his twilight repose in Portugal likes to ungrammatically say, "There ain't no such thing as a free lunch." And he's right, mostly.

A basic tenet of economics has it correctly that if you flood the market with a large supply of anything, the value of each successive unit must fall. Money is no different, and monetary inflation will, as sure as day precedes night, result in price inflation. And you don't need me to tell you that the cost of pretty much everything at this point is going up.

While the sort of price inflation that eventually stirs the masses to action is still ahead of us, there is little question at this point that it is inevitable. Therefore, betting that interest rates will rise as lenders demand compensation for the anticipated erosion in the value of their money between the time it is lent and the time it is returned to them, is as close to a sure thing - even a free lunch -- as you can imagine.

In the past I have mentioned those fairly rare occasions where Doug Casey, our illustrious chairman and resident guru here at Casey Research, gets a certain look in his eye and speaks with a certain tone in his voice that indicates that he is issuing forth, oracle-like, a forecast that invariably comes true. His view on the inevitability of interest rates rising strongly over the next few years is delivered with that same force of conviction. In fact, he is on the record, as recently as yesterday morning, saying it is the single most powerful trend he sees just now.

Personally, I have placed my bets on that particular outcome and you might want to consider doing so as well.

One of the best ways to do so is with properly organized EuroDollar puts. If you are a subscriber of the International Speculator and want to re-read our write-up on that investment strategy, simply access the March 2008 issue from the archives.

If you are not yet a subscriber to the International Speculator, sign up today with our 3-month, 100% satisfaction money-back guarantee. Click here to learn more and sign up now.

(There is a reason that this publication is now in its 28th year, but me telling you and seeing for yourself - without risk - are two different things.)

China on the Brink?

At our recent Scottsdale Crisis & Opportunity Summit, I had an exchange with one of our many interesting subscribers. In the interest of his privacy, and because of where he calls home, I will call him only CG. He is an international entrepreneur whose latest venture has led him to take up residence in China for some time now.

In Scottsdale he told me that he had translated some recent observations I had made in this weekly column on the topic of China for his Chinese wife. His wife, as he relayed it, said something to the effect of, "He is exactly right. How does he know this?"

While it is always flattering to have one's opinion thought worthy by those in the know, what I found most interesting, and why I share this story here, is that my comments were about the potential for civil unrest in China. Not to be repetitious, but I think the topic important enough to repeat the paragraphs which CG's wife found so revealing... here they are:

After all, while many of the world's economic observers fawn over China's remarkable progress, the facts are simple. (a) The U.S. already has the infrastructure in place that China is now trying to build; (b) China is run by a cadre of corrupt communist comrades, not exactly a model ripe for emulation by a thinking person; (c) they have over a billion mouths to feed. Which is to say, any setbacks that cause the aspirations of its large public to be disappointed could result in social unrest and worse. (The rocketing cost of rice, up almost 100% over the last year, may be a catalyst for such unrest.)

Adding to the discomfort about the potential consequences of social unrest, one only needs to glance casually into the cupboard to find tightly packed examples of the culture's apparent disdain for steadily beating hearts.

Reaching into said cupboard, we pick up Barbara Tuchman's excellent Stillwell and the American Experience in China to read her accounts of General "Vinegar Joe" Stillwell's arrival in that country in the support of Chiang Kai-Shek, as despicable a two-legged creature ever to have wandered onto the human stage. In between other duties, Joe had to restrain himself, and his men, from opening fire on officers of Mr. Kai-Shek's nationalist army that would routinely punish the loss of even so much as a single lice-ridden blanket by a foot soldier with summary execution.

But as degraded as Chiang and his fellows were, they were nothing compared to the big guy himself. Based on readings on the topic, confirmed with an airplane seat consultation with an academic who had made the study of such things his life's work, Chairman Mao was reliably responsible for the unnatural deaths of over 50,000,000 of his fellow countrymen.

To disabuse you of the notion that China has reached a level of permanent stability, I would like to share with you a YouTube video that our own Louis James brought to my attention. While I have only watched part 1 of the 8 parts available (I plan on ordering the full documentary), it's enough to give you a better sense of the place than you'll get from the mainstream media.

The documentary is called The Tank Man and it is quite moving. View it here.

One of the consequences of a sense of unsettledness in that populous nation will almost certainly be a move to stash away more gold, something they can do more easily these days, thanks to a liberalization of gold ownership that began in 2005.