Re: Charts & Comments - Bylaw/Rollback

in response to

by

posted on

Sep 15, 2014 03:59PM

Saskatchewan's SECRET Gold Mining Development.

Bylaw/Rollback

Why is this occurring now, when there is no obvious advantage to shareholders, except that a lot of shares appear on the offer? If you wanted to buy into the company, you would need min. 10X that amount of shares now. But the shares are still very cheap. You need to measure as a percentage of the float before acquiring, or wait until the rollback is settled. In effect, it appears to have placed a buyers moratorium on the stock.

A 30X rollback for this company is not a feasible outcome, especially since it requires a shareholder vote and a huge potential for short selling the shares further. But a 10X rollback may actually be desired. To be a shareholder of record, you need to buy in by Wed., Sept. 17.

Rollbacks of this magnitude could potentially wipe out smaller shareholders. Too big of a rollback would also make it very easy for larger players to buy out the company.

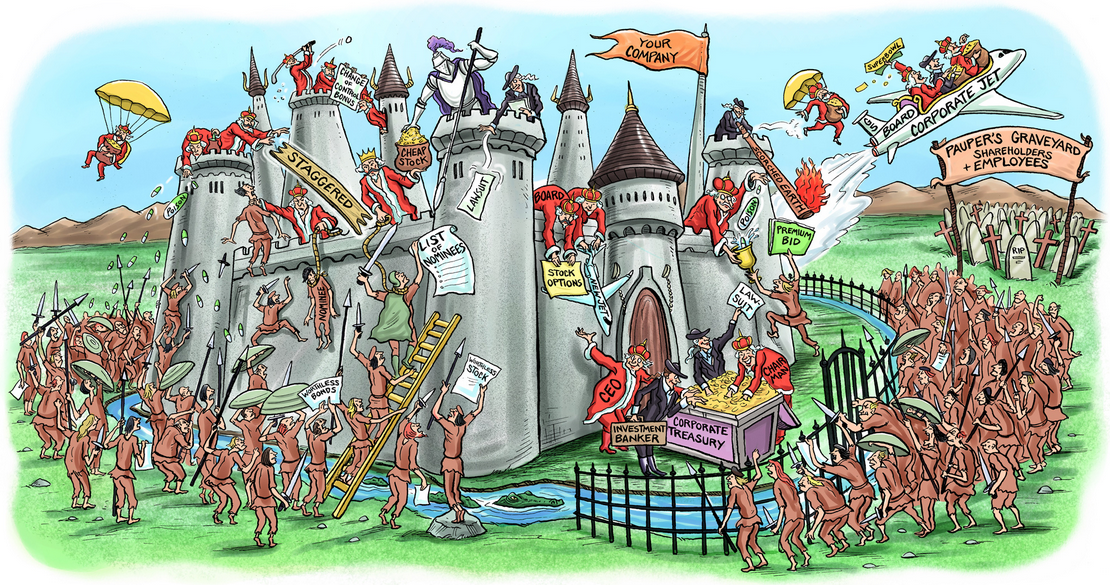

It's basically swapping one form of shark repellent for another.

The by-law makes it imperative that a hostile bidder would be required to take an overwhelming majority position, engage in a proxy battle, possibly challenge security laws in order to make any headway.

This kind of action is called a corporate takeover defense:

http://www.investopedia.com/articles/stocks/08/corporate-takeover-defense.asp

Here's what happened the same day the bylaw/rollback was announced:

Securities Regulators Adopt Poison Pill Reform

What's completely missing, and has been for quite some time, is a formula for determining fair value in the stock.

A low share value over an extended period of time is no different than a 'flip-in,' where existing and prospective shareholders can purchase shares at a discount.

Alternative Takeover Defenses In The Corporate Takeover Market

And if you really want to get into it:

http://link.springer.com/article/10.1007%2FBF02920606

Conclusion: Logically you would keep the same number of shares with no rollback, but provide a method of determining value. The Q1 report is due this month and would be an opportunity to do so, if capital raised in Q4 2014 shows up as accounts receivable.

http://ftalphaville.ft.com/files/2013/10/CastleIcahn.png

-F6