Re: Charts & Comments - Now And Futures

in response to

by

posted on

Nov 29, 2013 09:09AM

Saskatchewan's SECRET Gold Mining Development.

via Now And Futures - Predict Recession

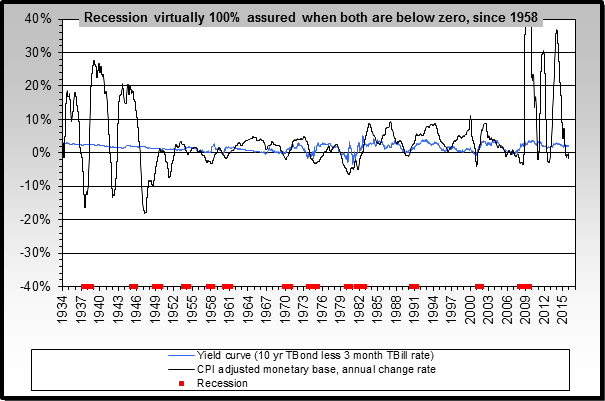

In looking at data concerning recession, there has been no period since yr. 2000 that gold mines and gold were presumed to outperform while markets collapsed into an anticipated depression. In fact, gold and gold mines have traded along with equities.

So what happened? Recessionary conditions that supported gold mines and gold prices during bear markets simply have not happened. And this is according to data going back many years.

The prediction that gold mines would outperform is categorically wrong, because certain recessionary conditions that were presumed to occur are basically not in the cards. But one thing that remained in place is negative real interest rates, which support gold prices.

The 2008 financial crisis finished off the resource sector, which has not really climbed out of the reversal. We did see a rebound, but are back in the rut.

The major recession predicted to occur, following Nasdaq and Lehman's bankruptcy, or the conditions describing it have not materialized.

But it can be argued that in a necessary pre-condition to a major wholesale recession, you have chronically high oil prices, a meteroic stock market, depressed gold mining shares and a gold price correction, high margin debt, high rate of change in CPI adjusted monetary base.

The resource sector blew out in 2008 with the oil price correction, and dragged gold prices with it. This time, however a condition of negative nominal rates should occur on a market correction.

Recessions have been brief, and housing bubble collapses were replaced with re-invigorated stock bubbles.

source: http://www.nowandfutures.com/forecast.html#recession

-F6