Re: Charts & Comments - Now And Futures

in response to

by

posted on

Nov 05, 2013 10:29AM

Saskatchewan's SECRET Gold Mining Development.

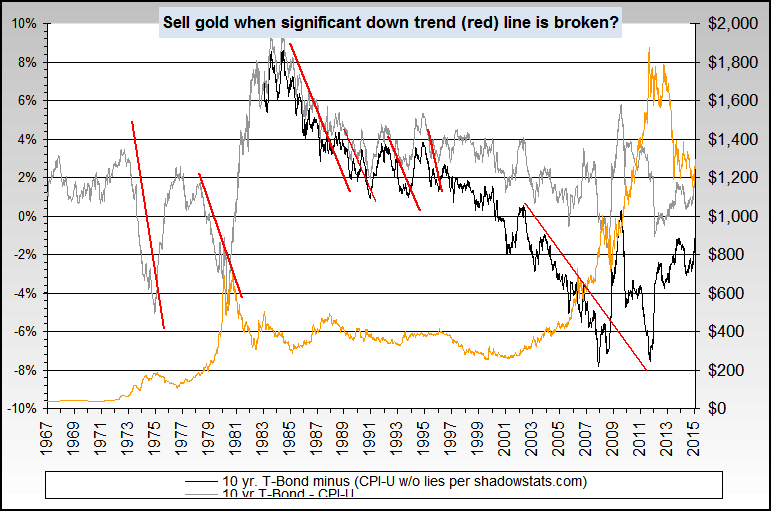

via NowAndFuturues.com - Negative Real Interest Rates

At the very least, gold prices should be well supported here, simply because we are still seeing negative real interest rates.

After the last major correction in gold prices, there was also a follow-upon bond market price correction, leading to interim higher interest rates. The bond market was finished, apparently, and hyperinflation was around the corner.

Despite these interim higher rates, gold prices rose. Gold prices should be advancing very smartly along with the interim correction in bond market prices, despite temporarily advancing interest rates.

Negative real interest rates at the 10-year bond should not be confused with negative nominal rates at the short end of the yield curve. We saw a very brief period of negative nominal rates in short term bill yields, and bill yields remain subdued, well below gold lease rates. This adds up to higher gold prices. Should bond rates continue their decline once again, then gold prices should react by climbing higher.

The chart depicting a comparison between negative real interest rates, meaning rates below inflation on the 10-year bond adjusted for shadowstats, has correctly pointed out selling points, with the exception that rates began declining in the 1990's while gold prices declined precipitously.

Bond rates could advance against inflation, and reach zero, but gold prices could easily see an advance under these conditions. Should bond prices re-adjust and continue to see yields decline, especially since the 10-year had been trading at -3% in the repo markets, then gold prices stand to benefit.

source: http://www.nowandfutures.com/forecast.html#predict_gold

-F6