via Now And Futures

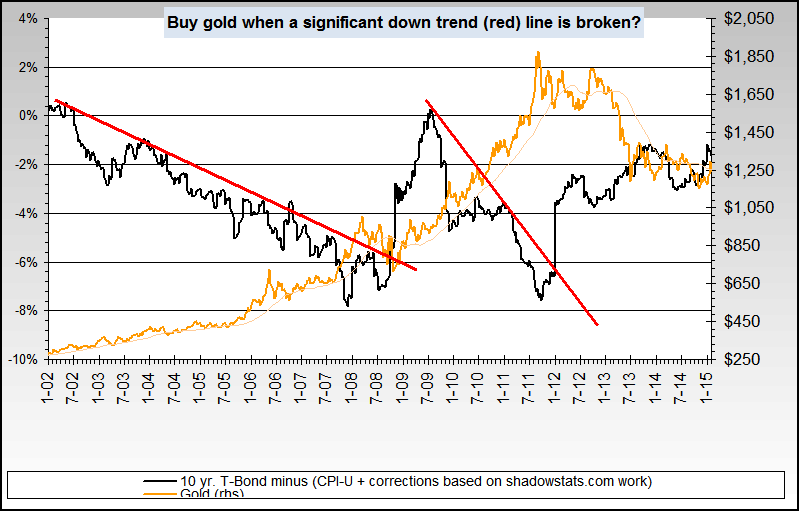

As expected, gold prices rose as interest rates rose very similar to the period immediately following the '2' downwave to 681.

We are now at '0' in terms of negative real interest rates. So if the big indeces sell off, which is expected, then bond prices will rally again, and the interim correction in bond prices will be over. Note that a rise in gold prices here is the absolute reverse of expectation, considering bond rates.

The one major difference is that short term yields are so near zero, that in any stock market sell-off, yields can go negative on three-month treasury bills, as far as up to the 2-yr. treasury.

This will be the support for gold prices after a bout of negative real interest rates, which is a major difference from the 1970's bull market.

source: http://www.nowandfutures.com/forecast.html#predict_gold

-F6