$Gold Monthly - Elliot Wave Count

"Wave 4: Wave four is typically clearly corrective. Prices may meander sideways for an extended period, and wave four typically retraces less than 38.2% of wave three (see Fibonacci relationships below). Volume is well below than that of wave three. This is a good place to buy a pull back if you understand the potential ahead for wave 5. Still, fourth waves are often frustrating because of their lack of progress in the larger trend."

http://en.wikipedia.org/wiki/Elliott_wave_principle

It would appear that the Federal Reserve is conforming with Elliot Wave Theory this month. The only technical aspect that the chart has conformed with at length is Elliot Wave Theory, which has mostly been rejected by traders as hocus pocus.

The first wave up and the correction took 8 years in total. The second wave up, wave 3 plus the correction took 4 years to complete. The corrective wave nearly took up to one third of that time. As they say - in commodities, the fifth wave is the largest.

http://scharts.co/VSzZl0

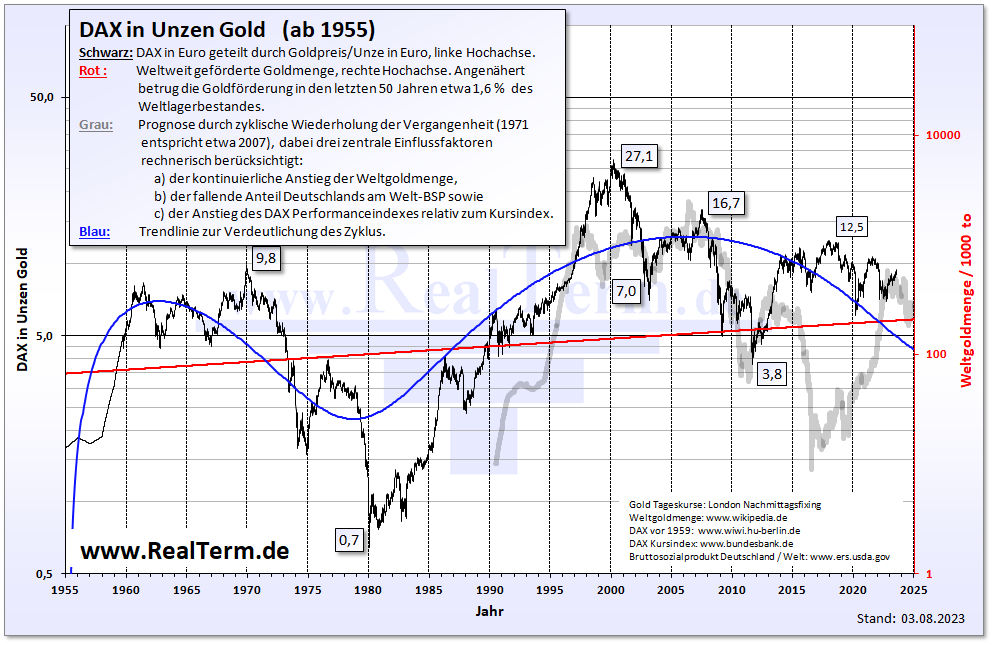

The sole price forcast model that survived is Dax In Gold, with a 3000€ price in 2015 - 2016.

-F6