Charts & Comments

posted on

Jan 04, 2013 09:34AM

Saskatchewan's SECRET Gold Mining Development.

via Nowandfutures.com - Negative Real Interest Rates

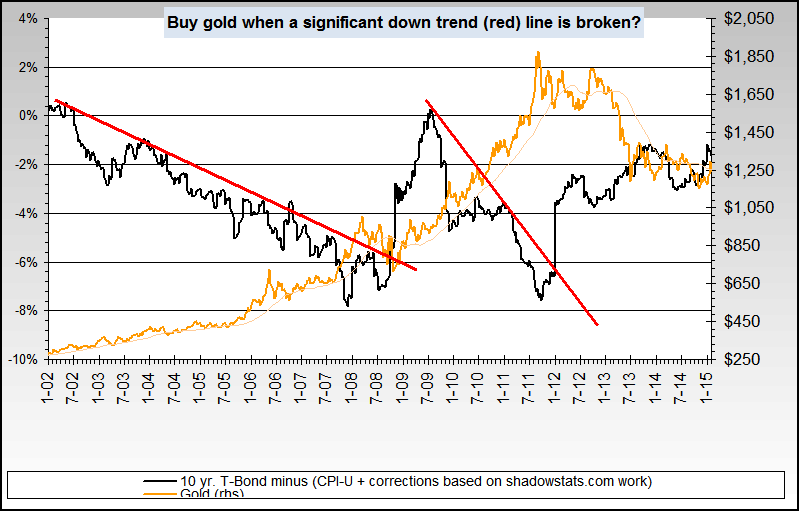

Any time that gold sells off precipitously as it has in the last 24 hours, and that the total amount of gold represented by the sell off since December aught to be well in excess of yearly mine supply, there is one chart I would consult.

The initial reaction to interest rate rises, thus a $US dollar rise, would be to sell off on bullion. But according to the following chart, gold prices are well supported by negative real interest rates for the forseeable future.

The chart implies that interest rates can rise by 400 basis points, meaning that bond yields will still be below inflation @7% on the 10-year treasury bond, and higher on the long dated treasury. A 7% interest rate on the 10-year treasury bond means that U.S. government bonds will have been downgraded to junk.

After the last major correction in gold prices in 2008, interest rates actually rose substantially while gold prices resumed their bull market, even though interest rates temporarily achieved zero against inflation.

So gold prices aught to remain sluggish during this period, but remain neutral until interest rates once again revert to their downward trend against inflation.

In the meanwhile, in the last year, we have had bankruptcies of major futures brokerages, such as MF Global, and PFG Best, and should be seeing the onset of another bankruptcy in the financial space. The brokerage or bank going bankrupt would have been laden with gold contracts, but also has been selling their assets in U.S. treasuries hand over fist. (http://www.imdb.com/title/tt1615147/?ref_=fn_al_tt_1)

We are still in the throes of a major correction and consolidation in gold prices, and still have yet to see a committed renewal of bond buying by central banks in the new year. Jawboning about QE4 has only led to a bond market price rout, rather than a massive move into bonds. Better that they allow purchasing power to decline, rather than go bankrupt.

An announcement on bond purchases should be made in haste once long dated treasuries are pricing in a correction to 120, if not before.

I would say that gold prices are set to rise in all currencies here. There is a major demand/supply deficit that simply can't be filled, since the equivalent of more than one years' mine supply would have been sold into the market in the short space of a month.

source: http://www.nowandfutures.com/forecast.html#predict_gold

TLT Weekly

Despite the bond market sell-off, sell-side brokers are defending their positions in shorting GBN.V shares. That means in the hopes that bond market buying by central banks resume, they are fixing the share price at an extreme. Capricious pricing continues.

Personally, I'm a little mystified. Where is the case for investment in the stock? I'm not essentially against the Waterton deal, since monies are being used to start up full operations after several months of drastic curtailment, but the company has to have some sort of plan after all of this.

imo, this company has to come up with a double-barrelled plan of growth + dividends in order to make the investment case. You can table the highest grade gold ever found, but if the share price does not move, you're completely hooped. Waterton precludes dividends when they're actually warrated under the circumstances.

Waterton could have pulled the carpet out from under GBN.V as we have seen elsewhere in the junior mining space, but this hasn't occurred. They are clearly intending a much larger financing, which is clearly anticipated with stockpiling and a new resource calculation.

I bought more shares at these prices in case somebody makes a hostile offer, in an attempt to stem my losses. The sharks have been hard at work on the feeding frenzy, the vultures have as of yet been out of sight waiting for their turn.

We are in the last month of Q3, fiscal 2013, and still no new developments.

The stock is should be pricing in the bond market of last september, given the price of TLT, not scraping the lows.

supersize: http://www.flickr.com/photos/11747277@N07/8345209697/sizes/l/in/photostream/

-F6