Re: WTF? - Negative Real Interest Rates

in response to

by

posted on

Mar 25, 2012 09:10PM

Saskatchewan's SECRET Gold Mining Development.

Negative Real Interest Rates

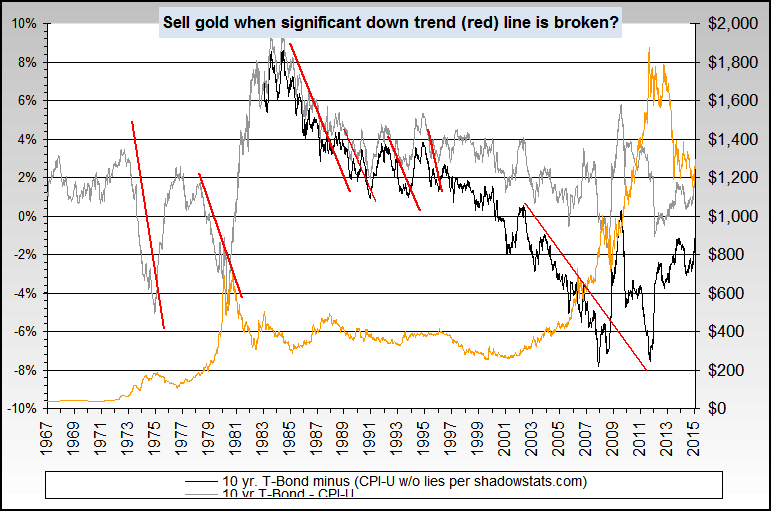

In the eventuality that interest rates might rise against inflation, this might be a subject of concern to gold investors. The interest rates that are important and reflect directly on the gold leasing activity in markets are actually short term rates, not long term rates.

The 10-yr bond rate is depicted in the chart below, but in reality its the very short term rates which are the important driver. Those who are predicting that the "gold price will crash" point directly to the rise in long term rates, and really the doubt has been cast in people's minds.

A bond market price rout can have the effect of unravelling Operation Twist, since monies coming out of the long dated treasuries will automatically spill over into short dated treasuries as they have.

Any downward pressure on short term rates here will have the effect of upending the roughly two year cycle in gold leasing. We have had a very brief reprieve in gold price advances because short term rates rose sharply. Long term rates remained at their low level throughout this episode, except for last week, though gold prices stablized over the 34-week EMA. So there's no basis to the theory that long term rates are presently affecting gold.

There are no long term gold leases, they only go up to 2yrs. And notably we had negative nominal rates in both the Swiss and German treasuries up to 2yrs. We also saw negative nominal treasury bill rates at the ECB very briefly. This was a contributing factor to gold price rises. Lately, short term rates have come off somewhat, so we are seeing gold prices supported.

Negative nominal rates can become policy rates for overnight lending and treasury bills, but negative rates can extend out to 2yr bills.

source: http://www.nowandfutures.com/forecast.html#predict_gold

-F6