Preparing For The Worst/Hoping For The Best

posted on

Mar 11, 2012 10:34AM

Saskatchewan's SECRET Gold Mining Development.

Preparing For The Worst/Hoping For The Best

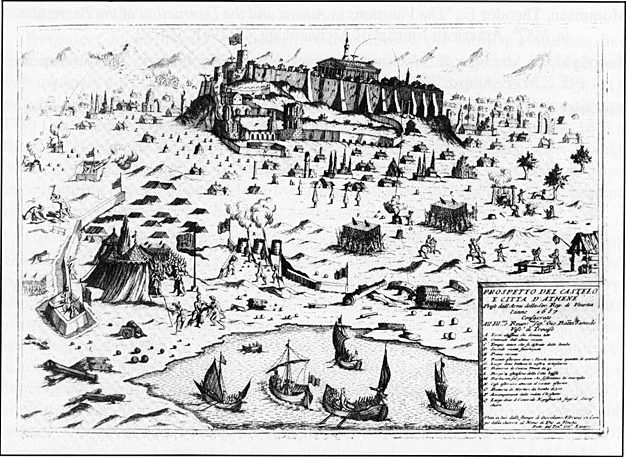

The Venetians (read: bankers) have once again laid seige to their own temple (read: derivatives) built on mathematical principles, where the Turks (read: politicians) have stored their munitions. (read: credit default swaps.)

The subtle irony is that all it will take is one banker to take a pot shot at the greek debt deal and thereby destroy the whole derivatives structure. Just as illegal hypothecation led to the bankruptcy of MF Global betting on the resolution of Eurozone troubles, assume there simply must be the same type of brewing scandal somewhere in the banking sector.

A situation like this has made for tough sledding in forecasting the outcome.

The bright side is that all of those mathematicians and scientists involved in the financial markets will have to go back to work and give up their financial dilletantism. The downside is that a long-standing temple in the sky will have been destroyed.

http://en.wikipedia.org/wiki/Acropolis_of_Athens

$USB Weekly

The weekly bond chart is showing a serious deterioration of the technical indicators in the bond price. Since GBN.V is strongly inversely correlated to this market, a decline in the bond price will result in an advance of the stock.

GBN.V has moved at 4X the inverse of the move in the TLT at times, so you can assume that any sincere move in the bond market will result in GBN.V moving as much or more. Two major gaps in the weekly chart need filling.

supersize: http://www.flickr.com/photos/11747277@N07/6972462745/sizes/l/in/photostream/

GBN.V Weekly

In the last week, we saw traders positioning for what appeared to be a layup to a bond price decline, thus the GBN.V stock would move. The breakout on the weekly chart is very apparent, and we have gone from an extremely bearish slump to a bullish posture.

Remember that on no news whatsoever, the share price advanced constantly to 75¢/share. This was because the backdrop was the bond market selling off. People who had been selling miners and buying bonds were divesting their bond bets and buying back the miners. The same is likely to occur now.

Bond markets reacted accordingly with the jobs report by selling off, but in the futures market, the reaction was much more sluggish. Since GBN.V is strongly inversely correlated to the long term bond markets, the price advanced some, but sold off once again.

The technicals on the chart are unmistakeable. We have the RSI rising above 50. The Parabolic SAR is definitively cut. The 89-week EMA was tested. Eventually the moving averages will cross over.

supersize: http://www.flickr.com/photos/11747277@N07/6826410642/sizes/l/in/photostream/

-F6