Lamelee Iron Ore Ltd. advancing toward the next iron mine at the southern end of

posted on

Jul 25, 2014 09:22PM

Resource projects cover more than 1,713 km2 in three provinces at various stages, including the following: hematite magnetite iron formations, titaniferous magnetite & hematite, nickel/copper/PGM, chromite, Volcanogenic Massive and gold.

News Release - July 25, 2014 5:40 PM ET

http://sectornewswire.com/release072514.htm

Lamelee Iron Ore Ltd. advancing toward the next iron mine at the southern end of the Labrador Trough close to the Fermont Iron Ore camp

NEW YORK, NY, July 25, 2014 /Sector Newswire/ - Lamelee Iron Ore Ltd. (TSX-V: LIR) (Frankfurt: G11) is identified in a newly issued market bulletin report by Market Equities Research Group. LIR.V is a Canadian mining company that possesses the Lamêlée Iron Ore Project which sits in the heart of Quebec’s and Labrador- Newfoundland’s Fermont-Wabush-Labrador City Iron Ore Camp where iron concentrate production is currently at 35 million tonnes per annum. LIR.V has an experienced team with solid track record; the team tasked with advancing Lamelee are the same individuals that started up the Consolidated Thompson's iron ore operation at Bloom Lake, they advance that project to buy-out, and in the process they brought the stock of Consolidated Thompson up to where they sold it for $17.25 per share in 2011 ($4.9 billion) -- the plan is to replicate that success.

The full market bulletin report may be found at http://www.marketequitiesresearch.com/reportq3lir-2014.htm online.

Figure 1. (above) Location map (upper left inset), Lac Lamelee Ridge, containing the deposit at Lamalee, Exploration camp at Lamalee (lower right inset) -- The Project sits 10 km west/southwest of Champion’s Consolidated Fire Lake North project.

|

The Objective The Plan |

Shares Outstanding |

77,221,971 |

The Lamelee South deposit is interesting from an economic point of view as it has a lot of iron formation squeezed into a relatively small area, a study indicates 100% of the Inferred Resources are in the pit shell (the area where the mining is expected to take place).

|

Resource The Lamêlée Iron Ore deposit contains, as of today, Inferred Mineral Resources 520 million tonnes grading 39.5% Fe2O3 (or 27.6% FeT) - work to be completed in 2014 should increase the size and the quality of the iron resources towards 750 million tonnes at the same grade.

The following table outlines incremental tonnages and Iron grades at various cut-off grades:

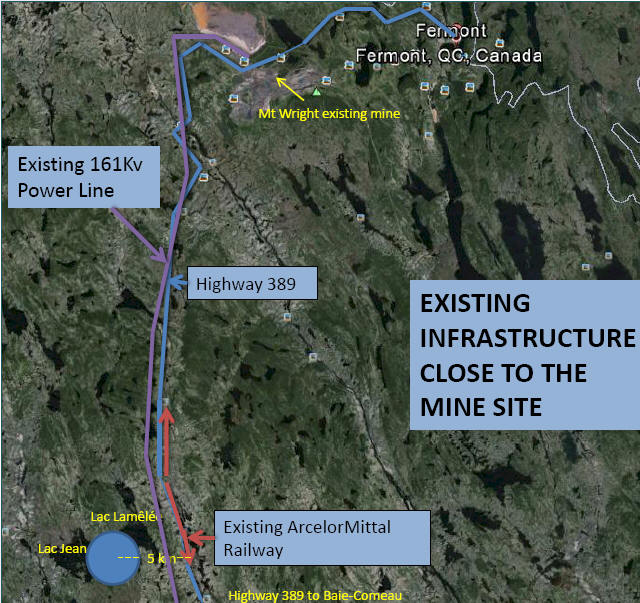

Expectations of a highly economic mining operation Lamêlée Iron Ore expects a viable project producing 5-8 million tonnes of concentrate. Using existing rail and new port infrastructure, between $750 million to $1 billion in capital costs and total operating costs between $60 and $70 per tonne at a sustainable iron ore price of $120-$130 CFR per tonne. |

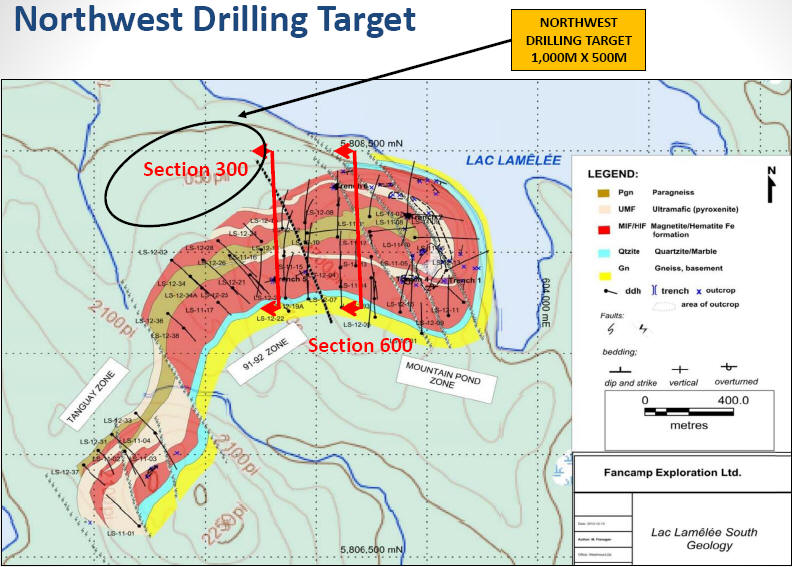

LIR.V plans to conduct metallurgical test work and produce a Preliminary Economic Assessment (PEA) Study (using economic parameters with a +- 30%) for delivery in Q4-2014. Financing requirements: •$3M to complete STEP I including additional drilling and to initiate environmental assessment. Lamêlée Iron Iron Ore will be managed and operated by members of the team that brought the Bloom Lake iron deposit to production within 4 years of the feasibility study. The company was acquired for $4.9B at $17.25 per share. Click here for CVs of Board of Directors. Permitting (environmental, socio-political, First Nations) will not be an issue, since the processing technology follows current industry standards (ie., water is used as the main driver of concentration and there are no deleterious elements in the iron ore); there is only one First Nations group present in the Fermont area which has dealt favorably with the Bloom Lake operation; and Quebec’s and Labrador- Newfoundland’s Fermont-Wabush-Labrador City Iron Ore Camp has a history of iron mining since the 1960’s. Deposit insight Work performed: • Resource Modeling (57 DDH’s / 18,220m) Course hematite and magnetite -- the course grain lends to the expectation to having a cost efficient process. Preliminary specs show very good material with low impurity. Infrastructure advantages Port-Cartier layout - note proposed laydown area for LIR.V's material Transshipment potential via Port-Cartier

Plans

•$7M to initiate and complete STEP II in 2015.

Experienced team

No issues

• 3-D mineralization

• Iron grade estimate

• Samples for future metallurgical test work

• Higher grade BIF’s -43% Fe2O3, hematite and magnetite ore

• Geophysics program / Gravimetryand Mag Survey

Market Equities Research Group has identified the following related research links on Lamelee Iron Ore Ltd.:

- Lamelee Iron Ore Ltd. Corporate Website: http://www.lameleeiron.com

- SEDAR Filings for Lamelee Iron Ore Ltd.: http://sedar.com/DisplayProfile.do?lang=EN&issuerType=03&issuerNo=00032549

This release may contain forward-looking statements regarding future events that involve risk and uncertainties. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual events or results. Articles, excerpts, commentary and reviews herein are for information purposes and are not solicitations to buy or sell any of the securities mentioned. Readers are referred to the terms of use, disclaimer and disclosure located at the above referenced URL(s).

SOURCE: Sector Newswire editorial

Additional Disclaimer and Disclosure I Contact I Terms and Conditions I Copyright I Privacy Policy