House Positions

posted on

Oct 14, 2022 06:33PM

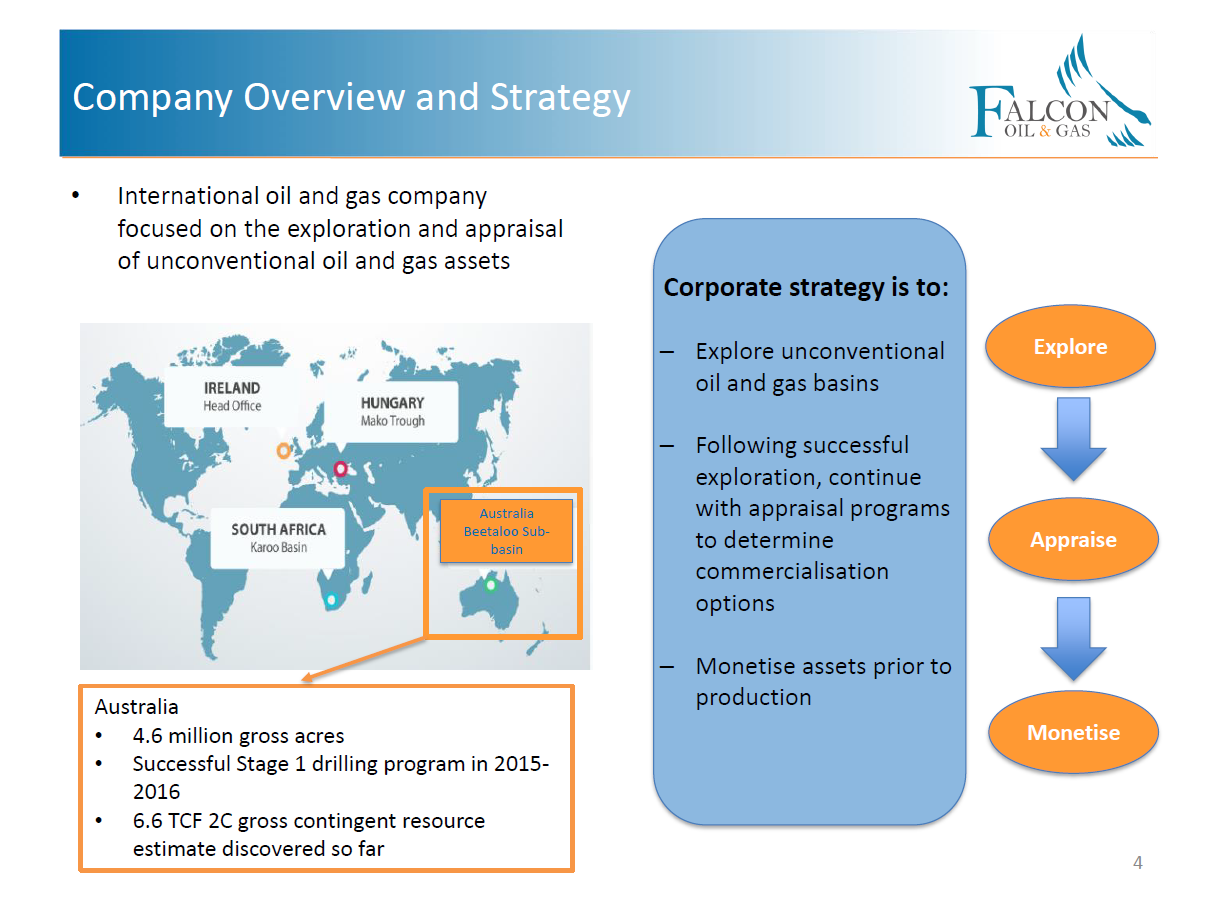

Developing large acreage positions of unconventional and conventional oil and gas resources

2022-10-11 02:00 ET - News Release

Falcon Oil & Gas Ltd.

("Falcon" or "Company")

Binding Letter of Intent Executed with New Joint Venture Partner

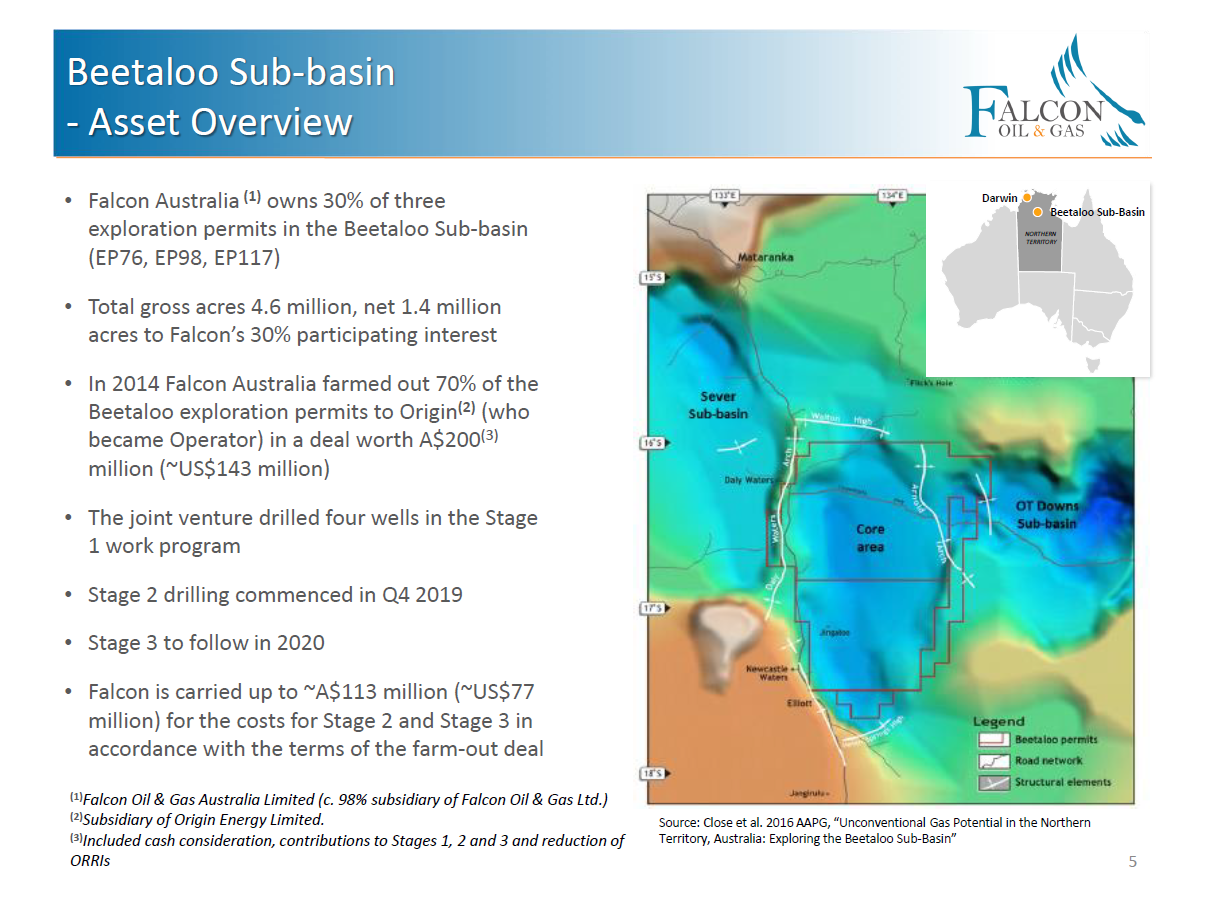

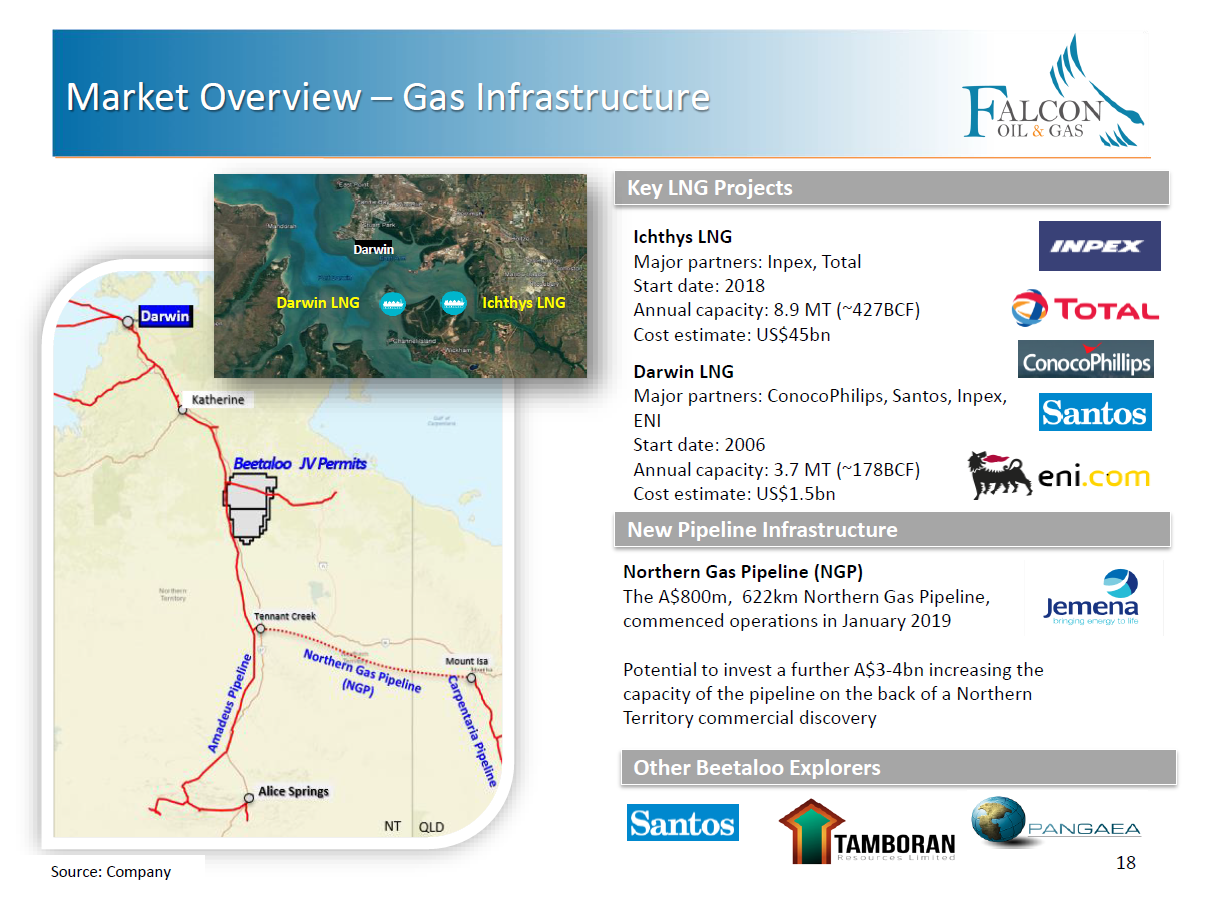

11 October 2022 - Falcon Oil & Gas Ltd. (TSXV: FO, AIM: FOG) is pleased to announce that its c.98% owned subsidiary, Falcon Oil & Gas Australia Limited ("Falcon Australia"), has entered into a binding Letter of Intent ("LOI") with Tamboran (B1) Pty Limited ("Tamboran"), a joint venture between Sheffield Holdings LP and Tamboran Resources Limited, pursuant to which the parties have agreed to amend the terms of the Joint Operating Agreement ("JOA") and the Farm-In Agreement ("FIA"), each dated 2 May 2014 (as amended), entered into with Origin Energy B2 Pty Ltd ("Origin") in respect of Falcon Australia's interest in the Beetaloo Sub-Basin exploration permits.

The Board believes that the proposed amendments to the FIA and JOA will significantly improve Falcon's future capital preservation and optionality. The key terms of the LOI provide for:

The parties will now proceed to negotiate and agree fully termed amendments to the JOA and the FIA reflecting the terms of the LOI.

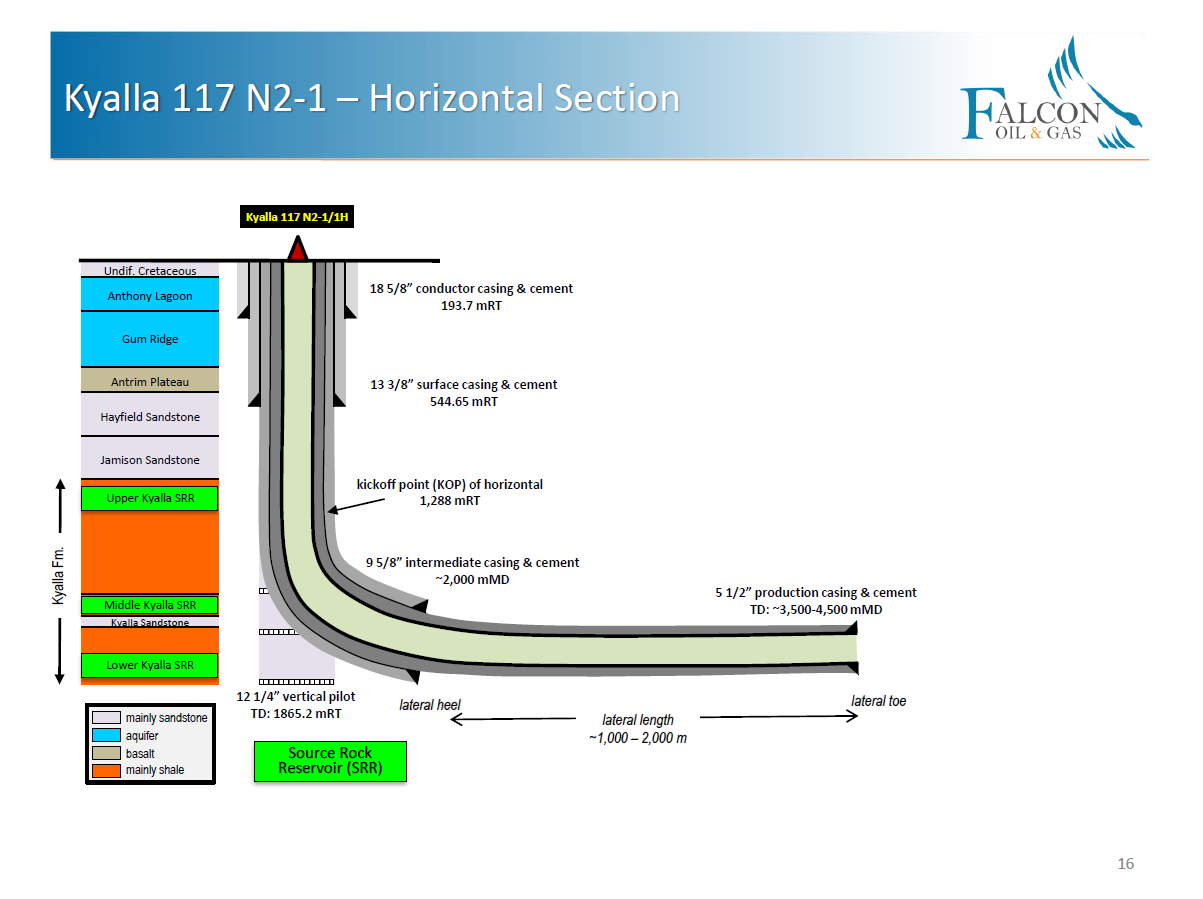

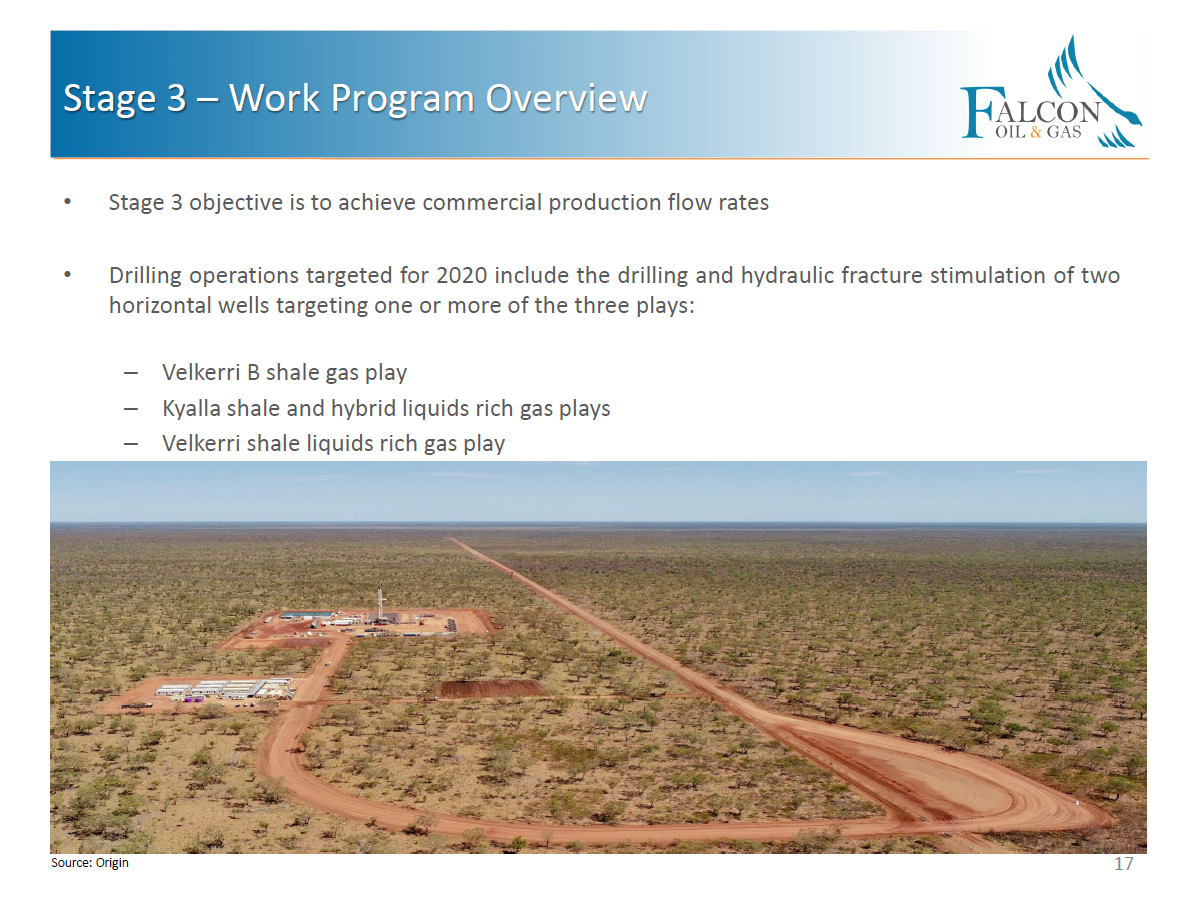

Drilling of the first of the two Stage 3 wells will commence shortly with Falcon Australia still benefiting financially from the remainder of the carry under the existing FIA and JOA with Origin.

Philip O'Quigley, Falcon's CEO,commented:

"Falcon Australia welcomes its new JV partners,Sheffield Holdings and Tamboran Resources. While our immediate focus is on the two Stage 3 Amungee wells, we are really excited about the future pace of development of the Beetaloo. The proposed amendments to the FIA and JOA puts Falcon in a very strongposition going forward creating optionality for our shareholders in terms of the level of participation in any future appraisal and development drilling. Each future well drilled in the Beetaloo basin play further de-risks the play and, as a result of the proposed changes contemplated by the LOI, Falcon can tailor its participation tobest preserve its capital while at the same time maximising its optionality."

Investor Meet Q&A

Falcon will provide a live Investor Q&A with Philip O'Quigley via the Investor Meet Company platform today, 11 October 2022 at 10:00am BST.

The presentation is open to all existing and potential shareholders, and questions can be submitted at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add to meet Falcon Oil & Gas Ltd. via:

https://www.investormeetcompany.com/falcon-oil-gas-ltd/register-investor

Investors who already follow Falcon Oil & Gas Ltd. on the Investor Meet Company platform will automatically be invited.

A recording of the presentation will be made available on the Investor Meet Company platform and the Company's website later today.

This contains inside information.

Ends.

CONTACT DETAILS:

| Falcon Oil & Gas Ltd. | +353 1 676 8702 |

| Philip O'Quigley, CEO | +353 87 814 7042 |

| Anne Flynn, CFO | +353 1 676 9162 |

| Cenkos Securities plc (NOMAD & Broker) | |

| Neil McDonald / Derrick Lee | +44 131 220 9771 |

About Falcon Oil & Gas Ltd.

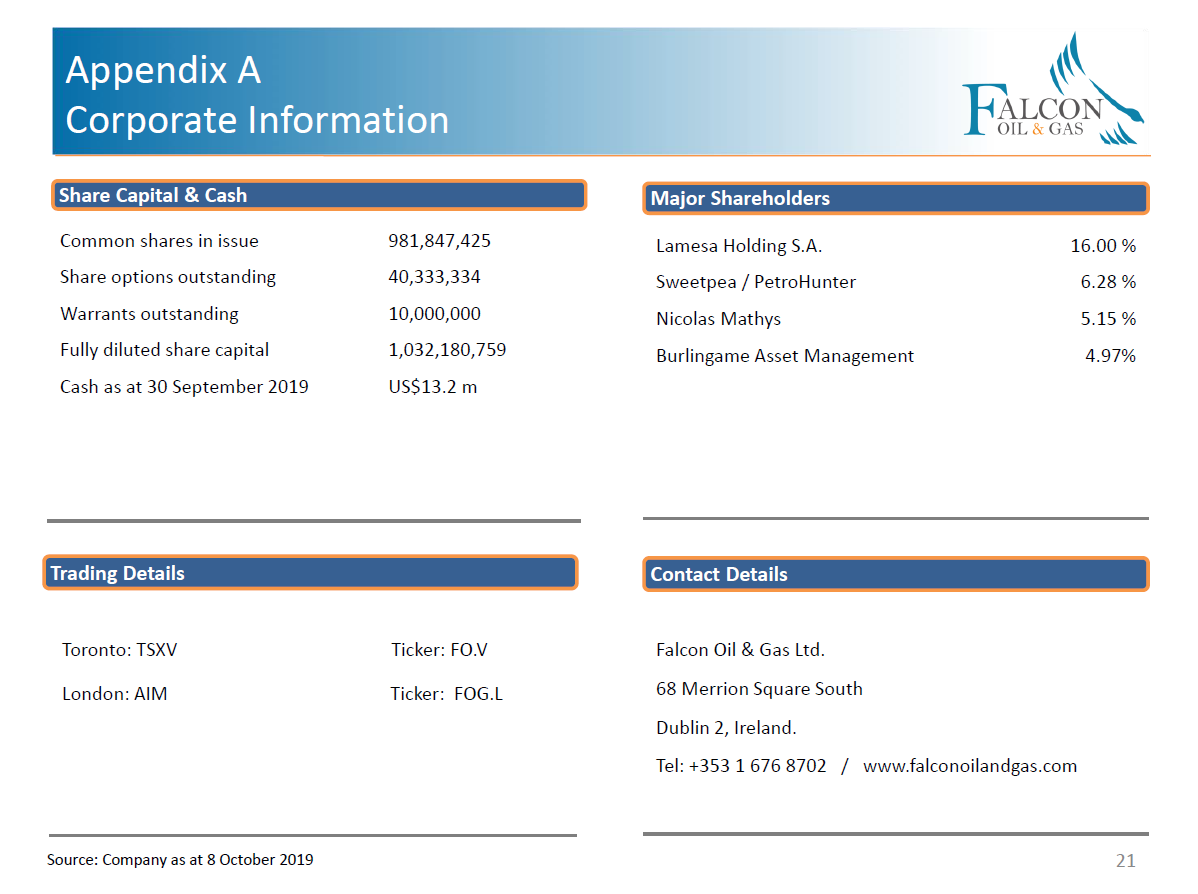

Falcon Oil & Gas Ltd is an international oil & gas company engaged in the exploration and development of unconventional oil and gas assets, with the current portfolio focused in Australia, South Africa and Hungary. Falcon Oil & Gas Ltd is incorporated in British Columbia, Canada and headquartered in Dublin, Ireland with a technical team based in Budapest, Hungary.

Falcon Oil & Gas Australia Limited is a c. 98% subsidiary of Falcon Oil & Gas Ltd.

For further information on Falcon Oil & Gas Ltd. please visit www.falconoilandgas.com

About Tamboran (B1) Pty Limited

Tamboran (B1) Pty Limited is a 50:50 joint venture between Tamboran Resources Limited and Sheffield Holdings, LP.

Tamboran Resources Limited, founded in 2009, is a public natural gas company listed on the ASX (TBN) and OTC markets (TBNNY). It has a vision of supporting the net zero CO2 energy transition in Australia and Asia-Pacific through developing low CO2 unconventional gas resources in the Northern Territory of Australia. It is headquartered in Sydney, Australia with a global management team leveraging a significant depth of experience in the successful commercialisation of unconventional gas throughout North America. The team brings a wealth of knowledge, including modern shale reservoir assessment, as well as cutting-edge drilling and completion design technology.

Bryan Sheffield of Sheffield Holdings LP is a highly successful investor and has made significant returns in the US unconventional energy sector in the past. He was Founder of Parsley Energy Inc. ("PE"), an independent unconventional oil and gas producer in the Permian Basin, Texas and previously served as its Chairman and CEO. PE was acquired for over US$7 billion by Pioneer Natural Resources Company ("Pioneer"), itself a leading independent oil and gas company and with the PE acquisition became a Permian pure play company. Pioneer has a current market capitalisation of c. US$60 billion.

Take away: Do not sell under $10.00

|

House Positions for C:FO from 2022-10-14 to 2022-10-14 |

|

House |

Bought |

$Val |

Ave |

Sold |

$Val |

Ave |

Net |

$Net |

|

59,000 |

6,194 |

0.105 |

12,200 |

1,281 |

0.105 |

46,800 |

-4,913 |

|

|

200 |

21 |

0.105 |

0 |

200 |

-21 |

|||

|

0 |

47,000 |

4,934 |

0.105 |

-47,000 |

4,934 |

|||

|

TOTAL |

59,200 |

6,215 |

0.105 |

59,200 |

6,215 |

0.105 |

0 |

0 |

2022-03-31 02:00 ET - News Release

Falcon Oil & Gas Ltd.

("Falcon" or the "Company")

US$10 million Private Placement with US Strategic Investor

And

US$6 million Acquisition of Overriding Royalty Interest

NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES

31 March 2022 - Falcon Oil & Gas Ltd. (TSXV: FO, AIM: FOG) is pleased to announce that it has received a subscription from Sheffield Holdings LP ("Sheffield") for a US$10 million private placement through the issue of 62,500,000 Common Shares ("the Placing Shares") at a price of CAD$0.20 per share ("the Placing"). Following the placement Sheffield will hold a total of 90,443,607 Common Shares of Falcon, representing 8.66% of Falcon's issued and outstanding Common Shares.

Falcon Oil & Gas Australia Limited ("Falcon Australia") has also agreed to grant Sheffield a 2% overriding royalty interest ("ORRI") over Falcon Australia's 22.5% working interest in the Beetaloo Sub-Basin exploration permits in return for a cash payment of US$6 million. The 2% ORRI is being granted to Sheffield calculated on equal economic terms as the existing 3% ORRI with the TOG Group. The cash proceeds of US$6 million will be used to exercise Falcon Australia's call option to reduce the existing ORRI with the TOG group from 3% to 1%, which is expected to take place before 30 April 2022. The assets subject to the ORRI are not currently revenue generating and there are no profits or losses attributable to them. These changes to the ORRI's, will be submitted to the Northern Territory Government, Australia for registration.

Details of the Placing

The completion of the Placing is subject to approval of the TSX Venture Exchange. A further update on Admission will be provided in due course. The Placing Shares will not trade on the TSX Venture Exchange Market until the date that is four months and a day after the day of issuance. The Company's total issued share capital following Admission will be 1,044,347,425 Common Shares. The information contained within this Announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014. Upon the publication of this Announcement this inside information is now considered to be within the public domain.

The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United State or to, of for the account or benefit of, U.S. persons absent registrations or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in which such offer, solicitation or sale would be unlawful.

Use of Funds

The Placing will add US$10 million to the Company's cash balance of US$8.4 million as at 28 February 2022, which leaves Falcon in a strong financial position well ahead of future decisions on the Beetaloo project.

Philip O'Quigley (CEO of Falcon) commented:

"Falcon is very pleased that Bryan Sheffield of Sheffield Holdings LP has increased his strategic stake in the Company at this time. Bryan is a highly successful investor and has made significant returns in the US unconventional energy sector in the past. He was Founder of Parsley Energy Inc. ("PE"), an independent unconventional oil and gas producer in the Permian Basin, Texas and previously served as its Chairman and CEO.

PE was acquired for over US$7 billion by Pioneer Natural Resources Company ("Pioneer"), itself a leading independent oil and gas company and with the PE acquisition became a Permian pure play company. Pioneer has a current market capitalisation of c. US$60 billion."

Bryan Sheffield of Sheffield Holdings LP commented:

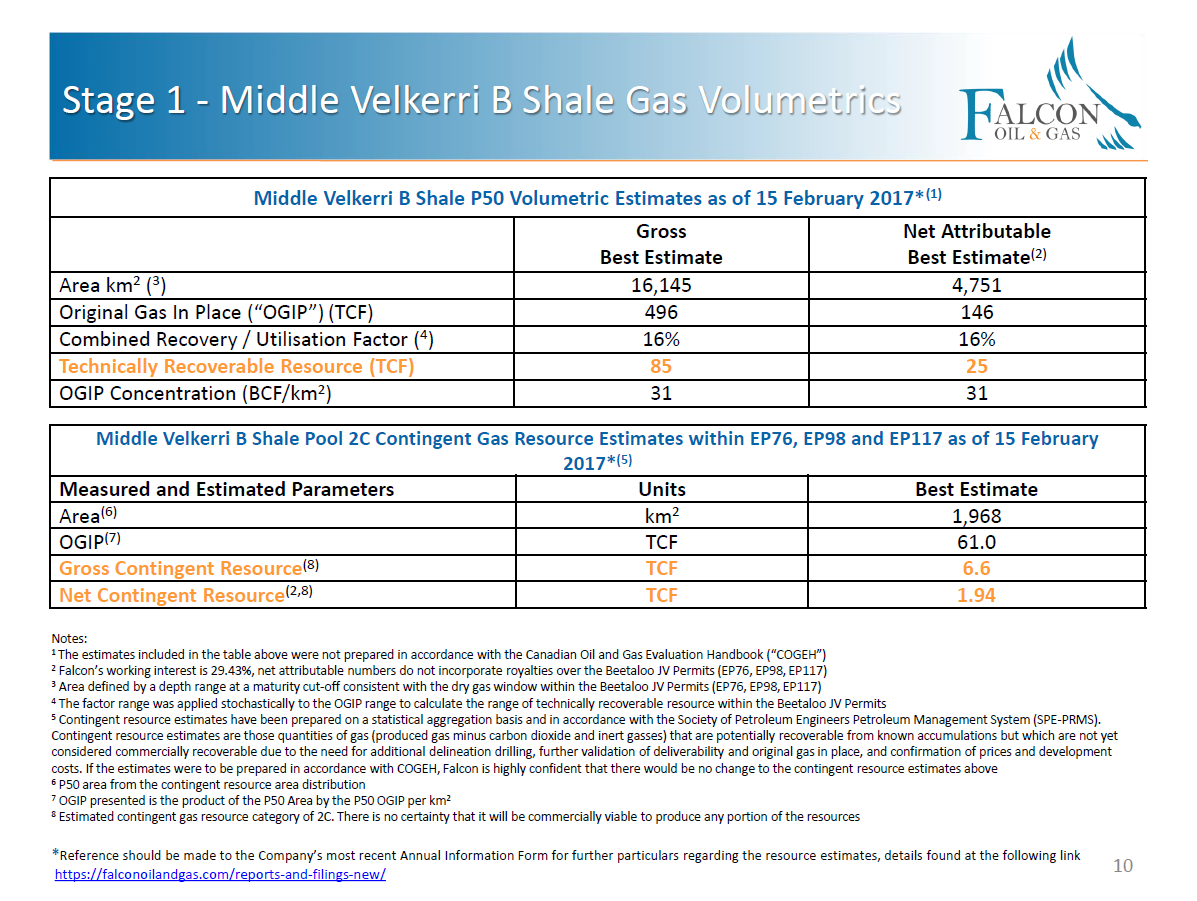

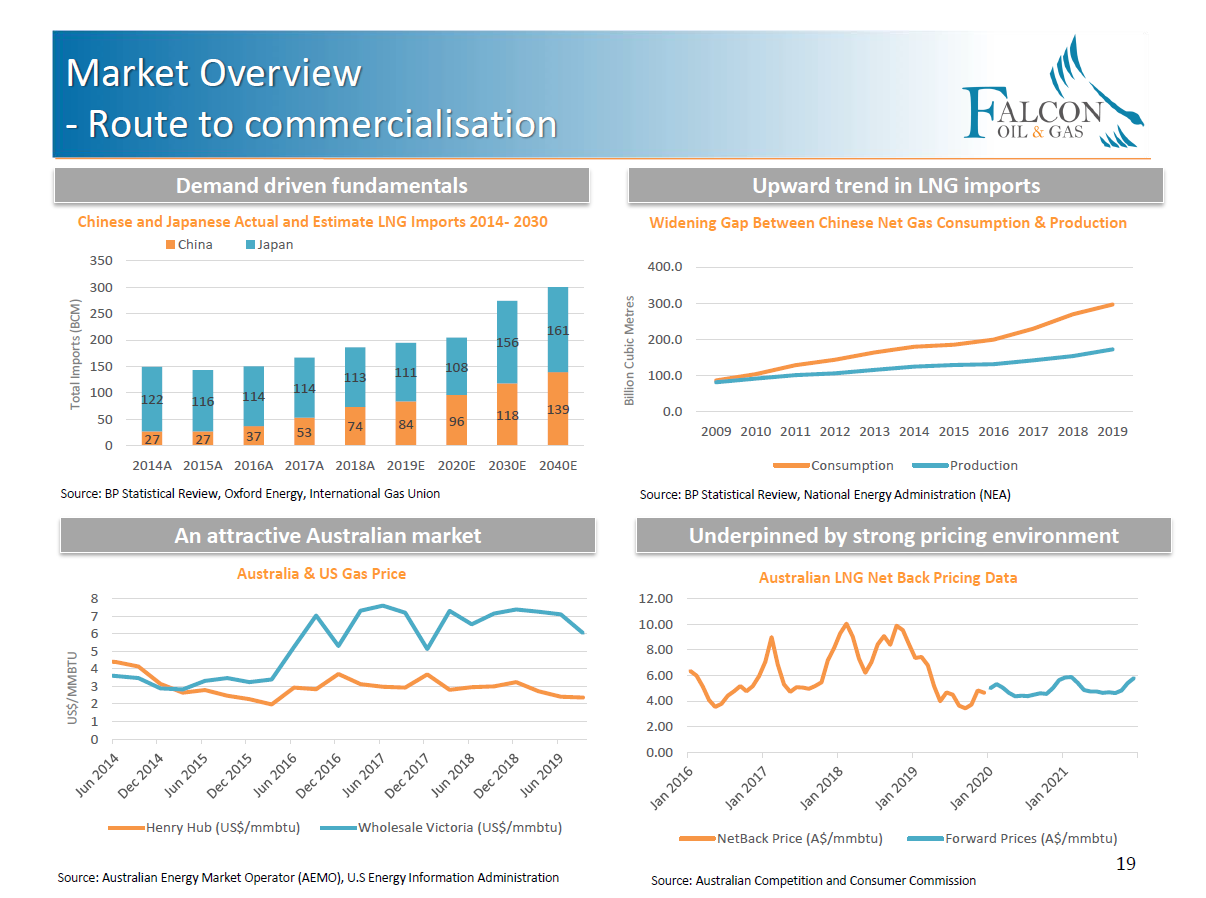

''Falcon and its partner have the largest acreage (4.6 million acres) position centred over the Beetaloo Sub-Basin. The Beetaloo is emerging as a world class shale gas basin with stacked pay potential from several shale intervals. Flow tests from the B Shale of the Amungee Member have confirmed a productive dry gas system in place. Geologic and engineering data from test wells across the Sub- basin have similar properties to some of the highly successful shale gas plays in the United States. The Beetaloo Sub-Basin is still in the exploration and appraisal phase, but with continued good well results, Falcon is well positioned to become a key supplier of low carbon energy to Australia and to the world within a few short years. I am delighted to have this opportunity to acquire a significant interest in Falcon and gain exposure to their net 1 million acres in what may become one of the biggest shale plays in the world.''

Take away: Do not sell under $10.00

2021-11-12 09:18 ET - News Release

Mr. Philip O'Quigley reports

FALCON OIL & GAS LTD. - PRELIMINARY PETROPHYSICS AND MUD GAS COMPOSITION FROM VELKERRI 76 S2-1 WELL

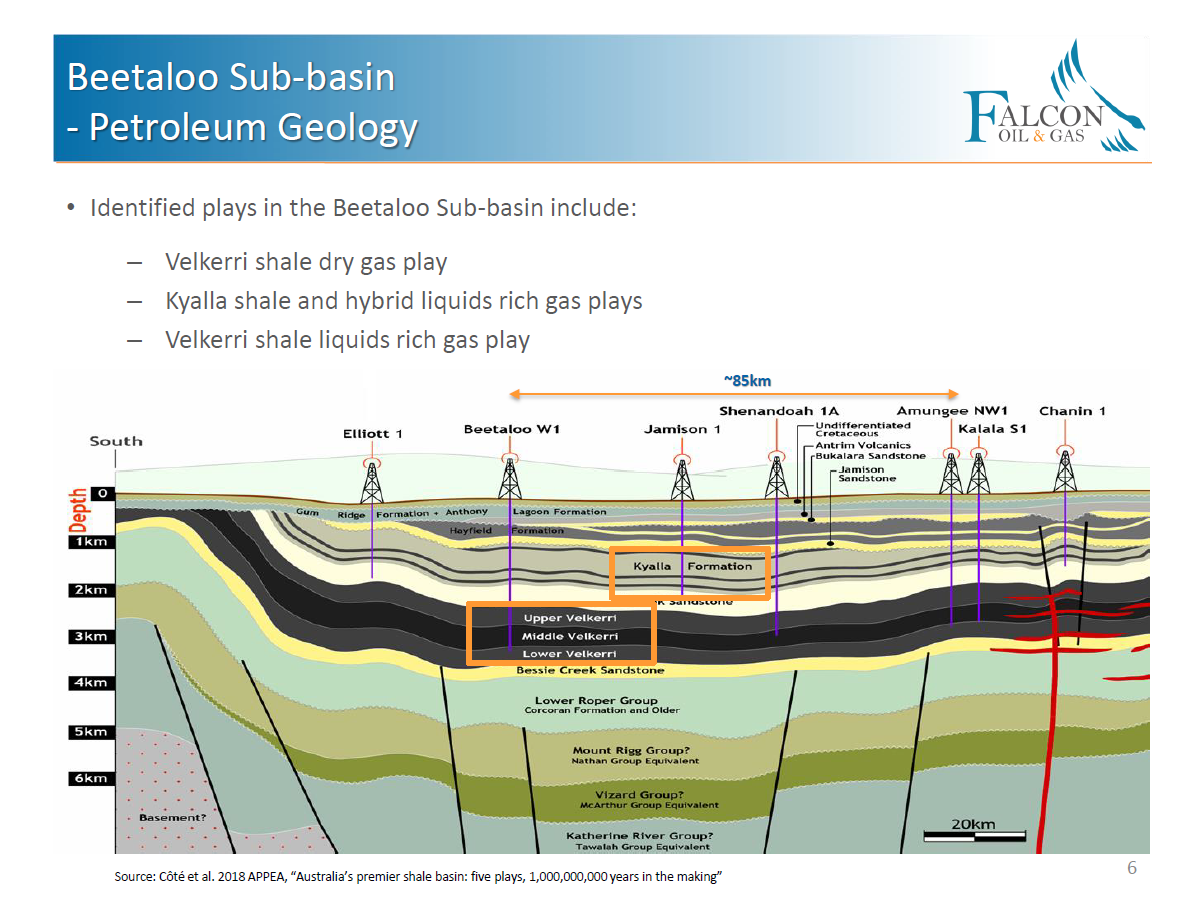

Falcon Oil & Gas Ltd. has provided details on the preliminary petrophysical interpretation and mud gas composition data from the Velkerri 76 S2-1 vertical appraisal well in the Beetaloo subbasin, Northern Territory, Australia, with the company's joint venture partner Origin Energy B2 Pty. Ltd., a wholly owned subsidiary of Origin Energy Ltd.

On Oct. 15, 2021, the company announced that drilling of the Velkerri 76 well had been completed and preliminary evaluation of the results had been very encouraging.

The preliminary petrophysical interpretation of the Velkerri-76 wireline logs has now been carried out, which has confirmed positive indications in particular from the B shale of the Amungee member (formerly known as the Middle Velkerri). Other intervals within the Amungee member also show positive indications and further analysis will now be undertaken to confirm these results.

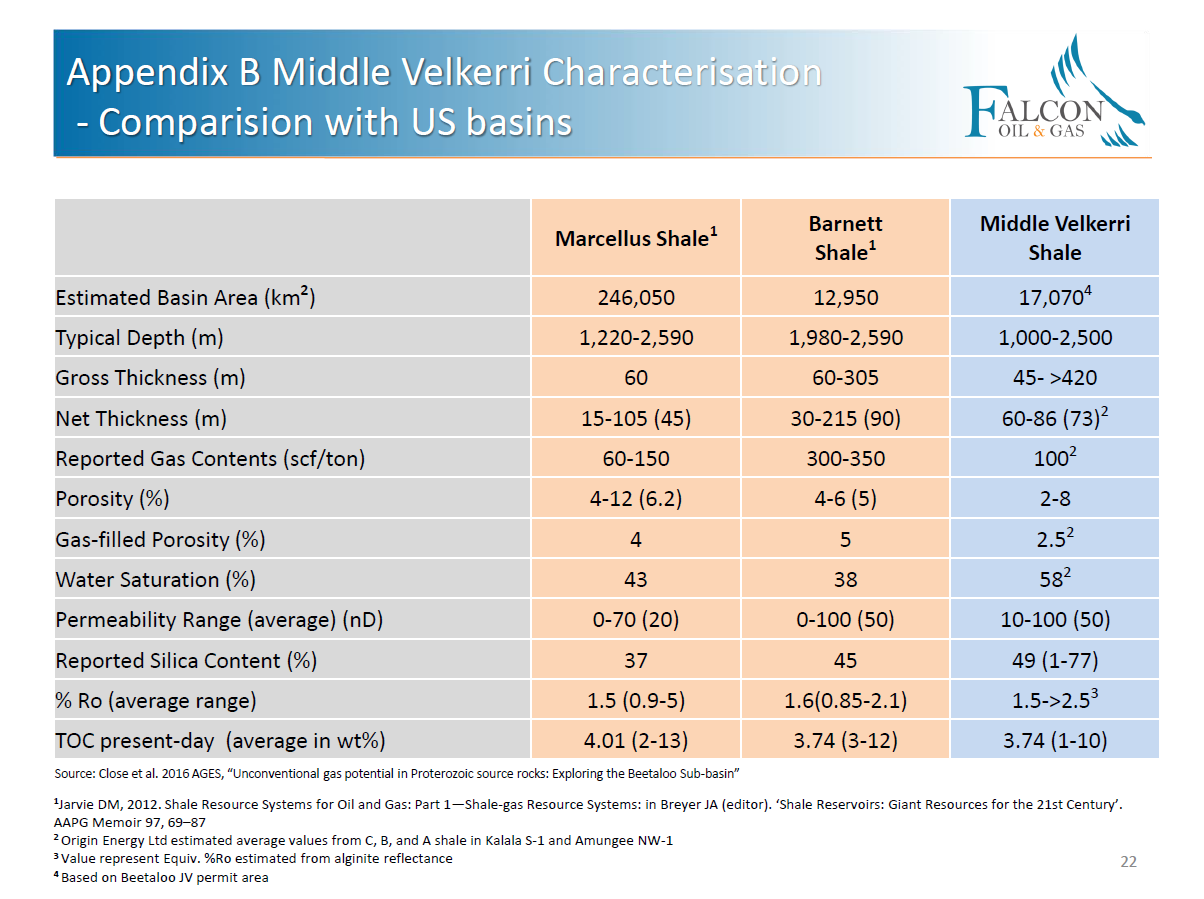

The Amungee member B shale was the principal area of focus with Falcon's operations at Amungee NW-1H and the results obtained to date compare very favourably with some of the most commercially successful shale plays in North America. The Amungee Member B shale is also the focus of activities in the neighbouring Santos and Empire Resources operated blocks.

Mud gas composition data also provides evidence that the Amungee member is within the wet gas maturity window and contains good LPG yields and high heating gas value.

Key information with respect to the preliminary petrophysics and mud gas composition of the Amungee member B shale are included in the attached table.

The results of preliminary petrophysical interpretation confirm:

Additional analysis of the conventional core acquired during the drilling of Velkerri 76 will be required to confirm the preliminary petrophysics interpretation and will take place over the coming months.

Laboratory analysis of gas samples collected during drilling will be carried out to further refine gas composition data within the Amungee member shale intervals.

Philip O'Quigley, chief executive officer of Falcon, commented: "The preliminary petrophysical interpretation of the Velkerri 76 wireline logs is excellent news with the Middle Velkerri B shale comparing favourably to some of the most commercially successful shale plays in North America. These results are further evidence of the increasing significance of the Velkerri play, with results still to come from flow testing of two horizontal wells at the neighbouring Santos-operated blocks also targeting the Velkerri play."

.

I could have predicted in advence the arrival of Boo-birds also known as the Backroomroom Boy's minions. They will try to convince you that the precious stone in your hand is nothing but a piece of black coal.

2021-09-03 06:02 ET - News Release

Mr. Philip O'Quigley reports

FALCON OIL & GAS LTD. - AMUNGEE NW-1H - NORMALISED GAS FLOW RATE EQUIVALENT TO 5 MMSCF/D PER 1,000M HORIZONTAL

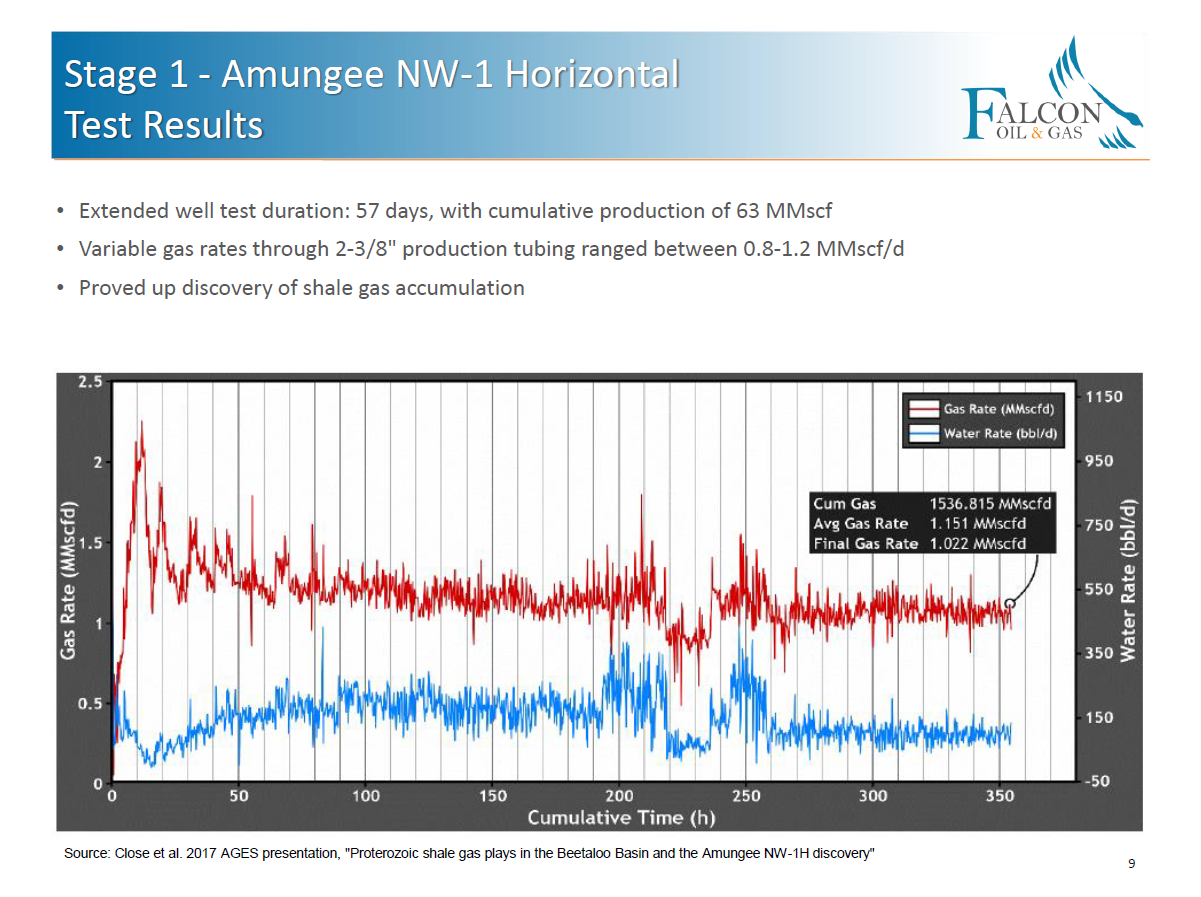

Falcon Oil & Gas Ltd. has provided results of the production log test at the Amungee NW-1H well. The results suggest a normalized gas flow rate equivalent of between 5.2 million to 5.8 million standard cubic feet per day per 1,000 metres of horizontal section.

Amungee is located in the Beetaloo subbasin, Northern Territory, Australia, and the testing conducted is part of the 2021 work program, which is operated by Falcon's joint venture partner, Origin Energy B2 Pty. Ltd., a wholly owned subsidiary of Origin Energy Ltd.

Amungee background:

Details of Amungee testing:

Philip O'Quigley, chief executive officer of Falcon, commented: "With our unique and extensive position in the Beetaloo subbasin, this is really exciting news for Falcon shareholders and this significant development provides line of sight to the commercialization of the Beetaloo, for which we remain carried for further activity.

"A recent report by an industry analyst suggests that gas flows greater than three mmscf/d from a 1,000 m horizontal well are required to demonstrate the commerciality of the Beetaloo. Not only does this test result significantly exceed these parameters and significantly increase our assessment of the Velkerri dry gas play, but it also puts the Beetaloo on a par with other shale gas basins in North America.

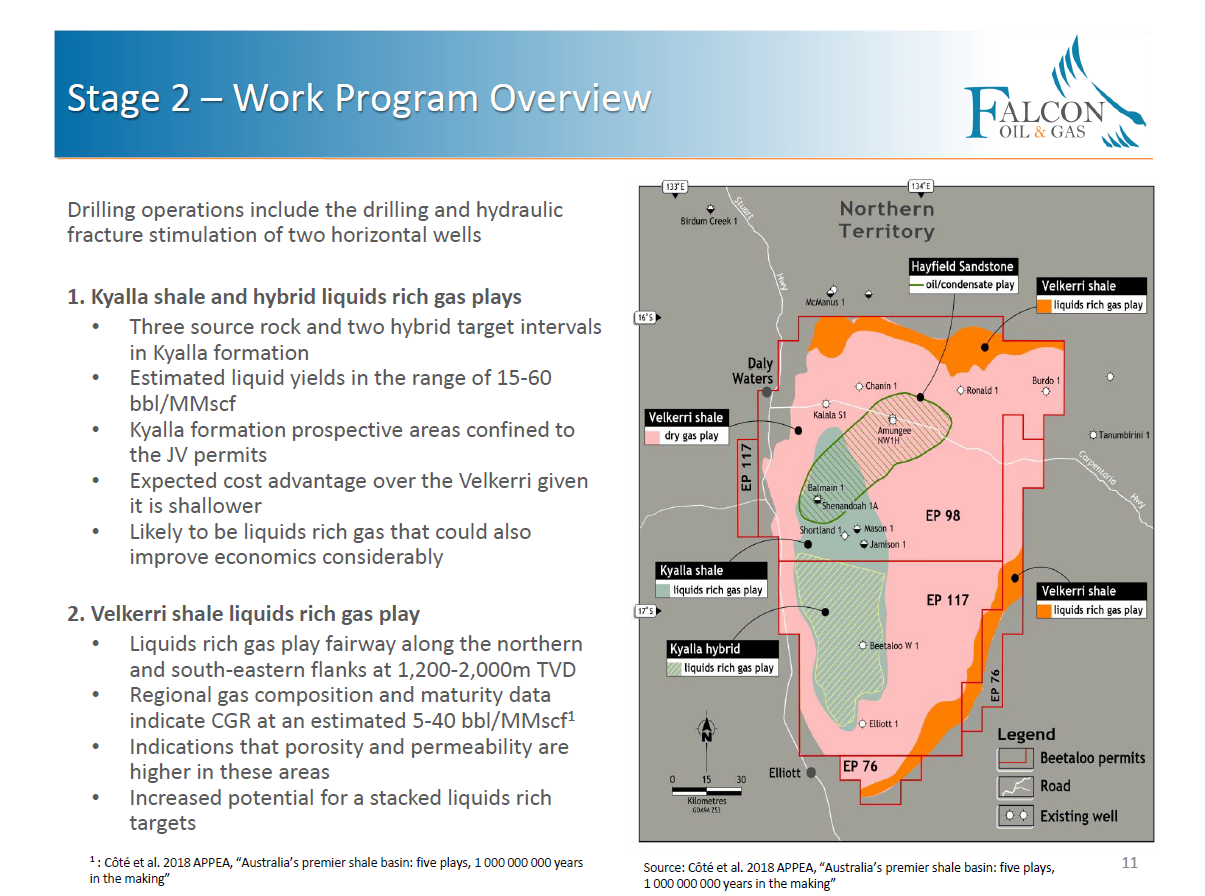

"While we wait for further news from our operations at Kyalla 117 N2-1H ST2 and Velkerri 76 S2-1, we look forward to working with our JV partner, Origin, in establishing the next phase of work on the Middle Velkerri B shale.

"With other drilling activity in neighbouring Santos-operated blocks targeting the Velkerri dry gas play, this is an important moment for the nationally significant Beetaloo subbasin."

Take away:

Do not sell any of your Falcon shares under $10.00

The Beetaloo Strategic Basin Plan released as part of the gas-fired economic recovery

For blind minions…..see link below

https://falconoilandgas.com/company-presentations/#1541158622782-52acf8a2-2f7

Sooo.. If you Boys want our shares you can start paying $10.00

So hold and do not sell any of your shares under $10.00

Apparently the manipulators are back. Many thanks to the BackroomBoys to prove just how badly they yearn to possess your Falcon shares.