All Trades

posted on

Oct 06, 2015 10:59PM

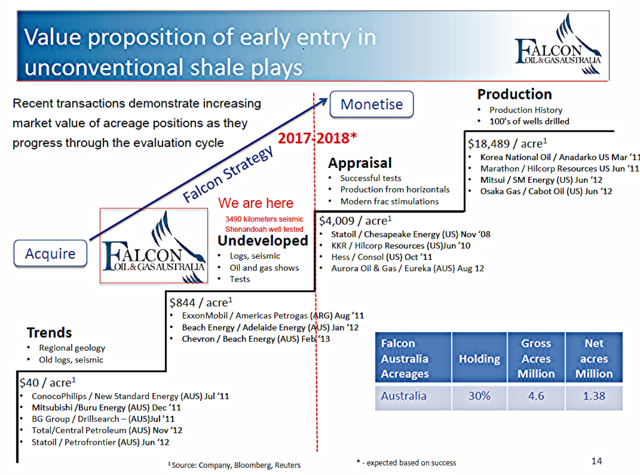

Developing large acreage positions of unconventional and conventional oil and gas resources

The backroom boys don't want you see this.

Falcon loves Asian natural gas prices.

Tools' GIGO activity is up the last two days.

Tuesday's tooth fairy trades...

A sight to behold: toothless 'backroom boys'

|

Trades for C:FO on 20151006 - 12 trades displayed |

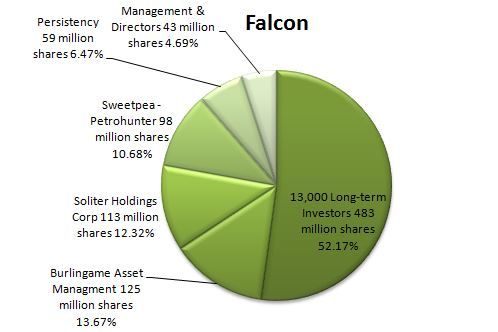

Time ET Ex Price Change Volume Buyer Seller 15:18:40 V 0.135 0.005 1,500 79 CIBC 36 Latimer 13,000 15:18:40 V 0.135 0.005 500 79 CIBC 1 Anonymous chuckles 11:40:04 V 0.135 0.005 14,500 2 RBC 1 Anonymous and 11:40:04 V 0.135 0.005 23,500 2 RBC 7 TD Sec then 11:40:04 V 0.135 0.005 62,000 2 RBC 1 Anonymous some 11:15:15 V 0.13 10,000 7 TD Sec 7 TD Sec 10:46:42 V 0.135 0.005 6,000 2 RBC 1 Anonymous Real 10:46:33 V 0.13 500 7 TD Sec 36 Latimer price 10:46:33 V 0.13 9,500 2 RBC 36 Latimer $2.70 10:26:53 V 0.13 11,500 2 RBC 14 ITG 09:48:05 V 0.13 6,000 2 RBC 19 Desjardins 09:30:00 V 0.135 0.005 7,000 22 Fidelity 1 Anonymous “Shareholders don’t want to wait 20 years for a payback. We’re setting ourselves up to sell. Ultimately, that’s what we want to do. Shareholders want a big return and they want a quick return.” -Philip O’Quigley, chief executive, Falcon Oil & Gas – Just who are these shareholders? Well, all of us, the 13,445 long-term investors. But, Philip O’Quigley really talking about his bosses. You know, the guys who hired him in the first place. Burlingame, Soliter, Persistency, Sweetpea, the folks on left side on this chart. Of course they'll wait for the conclusion of the 9 well program. And so are we, on the right side of the chart. The 13,000 holds the balance of power.