House Positions

posted on

Dec 10, 2014 01:31AM

Developing large acreage positions of unconventional and conventional oil and gas resources

|

House Positions for C:FO from 20141209 to 20141209 |

|

House |

Bought |

$Val |

Ave |

Sold |

$Val |

Ave |

Net |

$Net |

|

254,000 |

25,332 |

0.10 |

21,500 |

2,152 |

0.10 |

232,500 |

-23,180 |

|

|

145,000 |

14,500 |

0.10 |

0 |

|

145,000 |

-14,500 |

||

|

80,000 |

7,850 |

0.098 |

16,300 |

1,758 |

0.108 |

63,700 |

-6,092 |

|

|

41,300 |

4,128 |

0.10 |

10,000 |

1,000 |

0.10 |

31,300 |

-3,128 |

|

|

11,500 |

1,265 |

0.11 |

0 |

|

11,500 |

-1,265 |

||

|

8,500 |

892 |

0.105 |

0 |

|

8,500 |

-892 |

||

|

3,000 |

285 |

0.095 |

0 |

|

3,000 |

-285 |

||

|

3,000 |

300 |

0.10 |

0 |

|

3,000 |

-300 |

||

|

500 |

47 |

0.094 |

0 |

|

500 |

-47 |

||

|

0 |

|

5,000 |

525 |

0.105 |

-5,000 |

525 |

||

|

4,500 |

452 |

0.10 |

27,000 |

2,634 |

0.098 |

-22,500 |

2,182 |

|

|

10,000 |

1,000 |

0.10 |

481,500 |

47,982 |

0.10 |

-471,500 |

46,982 |

|

|

TOTAL |

561,300 |

56,051 |

0.10 |

561,300 |

56,051 |

0.10 |

0 |

0 |

.

This Board exist for the purpose of serving the investors. The following information is factual.

Follow the long-term strategy.

Rule to long-term investing:

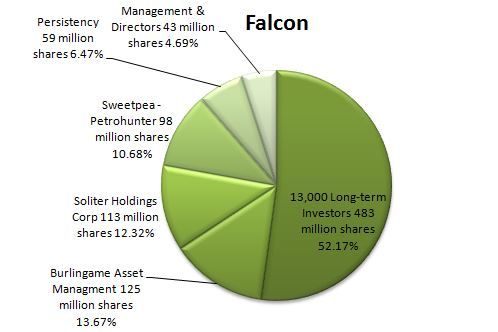

When you find a value stock put it in your portfolio and hold; like Burlingame, like Soliter, like Sweetpea, like Persistency.....

Keeping a keen eye on the one trillion dollars prize.

When big players are set to acquire a big position in a company, they always employ agents to accumulate the shares on the open market, then months later a transaction will occur between the parties for a healthy profit for the agents. On the other hand the buyer saves a lot of money for not buying it on the open markets.

This is how Burlingame acquired 105,835,269 shares in 2008 and 2009.