FALCON OIL & GAS AUSTRALIA FINANCIAL REPORT

posted on

May 30, 2011 12:12AM

Developing large acreage positions of unconventional and conventional oil and gas resources

FALCON OIL & GAS AUSTRALIA

LIMITED

ABN 53 132 857 008

31 DECEMBER 2010

FINANCIAL REPORT

All amounts are in USD unless otherwise stated

FALCON OIL & GAS AUSTRALIA LIMITED

O p e r a t i n g a n d F i n a n c i a l R e v i e w

Acquisition of Beetaloo Permits

On 30 September 2008, Falcon Oil & Gas Ltd (“Falcon”) and Falcon Oil & Gas Australia Limited (the “Company” or "Falcon Australia") consummated the acquisition of an undivided 50% working interest in an aggregate 7,000,000 acres in four exploration permits (the “Permits”) in the Beetaloo Basin, Northern Territory (the “Beetaloo Basin Project”) pursuant to the terms of a Purchase and Sale Agreement, as amended on October 31, 2008, (the “Beetaloo PSA”) with PetroHunter Energy Corporation, PetroHunter Operating Company and Sweetpea Petroleum Pty Ltd. (“Sweetpea”) (collectively, “PetroHunter”), each of which is a non-arm’s length party.

On 11 June 2009, pursuant to a second Purchase and Sale Agreement (the “Second PSA”) with PetroHunter, the Company completed the acquisition of an additional undivided 25% working interest in the Beetaloo Basin Project. Under the terms of the Second PSA, the principal consideration being paid by the Company or this transaction was the exchange of a $5,000,000 note receivable from PetroHunter. In addition, the Company agreed to pay certain vendors who had provided goods or services for the Beetaloo Basin Project, prior to the Company acquiring its 50% interest in September 2008, in exchange for inventory and operator bonds of approximately the same value, and Falcon has relinquished its right to the unexpended testing and completion funds of another project in which it is involved with the PetroHunter group. Upon closing, the Company became operator of the Beetaloo Basin Project.

On 7 December 2009, Falcon and Falcon Australia entered into a Binding Heads of Agreement (the “Agreement”) with PetroHunter and Sweetpea wherein Falcon Australia will issue to Sweetpea common shares of Falcon Australia in consideration for the transfer of Sweetpea’s undivided 25% working interest in the Permits. Under the terms of the Agreement, Falcon has been issued 150 million shares of Falcon Australia for conversion of a portion ($30,000,000) of Falcon Australia’s debt payable to Falcon, which approximates Falcon’s initial acquisition cost previously paid to Sweetpea for the 75% working interest in the Permits held by Falcon Australia as of the date of the Agreement; and Falcon Australia issued 50 million shares of its common stock to Sweetpea (valued at $10,000,000) and settled a joint interest billing receivable from Sweetpea of $1,725,000 for Sweetpea’s remaining 25% working interest in the Permits. On 23 April 2010, Falcon Australia received notice (the “Notice”) from the Department of Resources, Northern Territory Government, that the registration of the transfer of the remaining 25% interest in the Permits was completed, and Falcon Australia now owns 100% of the Permits.

The Permits are subject to a government royalty of 10% and non-government royalties of 13%-14%.

Operational Highlights

In February 2010, the Company commenced well site construction and service tendering exercises for the 2010 work program, with the intentions of commencing drilling and completion activities in July/August 2010. Abnormal rains and flooding throughout the Northern Territory, Queensland and New South Wales had significant impact and caused the service companies to re-evaluate their ability to honor their commitment to perform the required contracted services and provide the equipment required for the 2010 drilling and completion activities. Based on this, the Company requested, and received in June 2010, notice from the Northern Territory Government, Department of Resources, that its 2010 work commitment obligation for EP 98 has been extended to 31 December 2011.

Activity has been limited to geological and geophysical analysis, engineering and analytical evaluations. The Company has submitted applications of approval to the Aboriginal Area Protection Agency and the Northern Land Council for indigenous cultural clearances of future well sites which includes heritage and environmental work that will allow the Company to enter the lands and perform work as required.

Future Operations

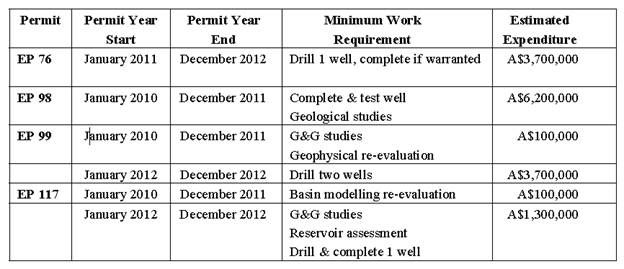

The Company’s revised minimum work program obligations to retain all of the underlying Permits in the Beetaloo Basin will be to expend A$6,400,000 and A$8,700,000 during the years ending December 31, 2011 and 2012, respectively.

FALCON OIL & GAS AUSTRALIA LIMITED

D i r e c t o r s ' R e p o r t

The Directors have pleasure in submitting their report together with the financial report of the Company and the auditor’s report thereon for the year ended 31 December 2010

All amounts referred to in this report and the accompanying Financial Statements are in US dollars, unless stated otherwise.

Directors

The names of directors of the Company holding office at any time during or since the end of the financial period are:

Robert C Macaulay …………………Chairman appointed 31 July 2010

Evan Wasoff ………………………..Director since 21 August 2008

Martin Oring ………………………..Director appointed 31 July 2010

Kym P Livesley …………………….Director appointed 31 July 2010

John W Carroll ……………………..Director appointed 31 July 2010

John Craven ………………………..Director appointed 10 December 2010

Marc Bruner ……………………….Resigned 10 November 2010

Carmen J Lotito ……………………Resigned 31 July 2010

John L. Blue ……………………….Resigned 14 May 2010

Robert Macaulay, PEng- Non-Executive Director, Chairman

Mr. Macaulay has 26 years’ industry experience in petroleum engineering, field development planning and business development and currently provides consulting services in these areas. He is a director of PetroGlobe Inc. (TSX – PGB), serving on the compensation committee and as chairman of the reserves committee. He held the post of V.P. Engineering and Production at Centurion Energy International Inc., a Canadian company active in Egypt which was sold at over 30,000 boepd in 2007. His past experience includes positions of increasing responsibility at Vermilion Resources (petroleum engineering for France properties and business development in Europe), Shell (reservoir engineering in Canada and the Sultanate of Oman) and PanCanadian Petroleum Ltd. He holds a BSc (Hons) in Chemical Engineering from Queen’s University, Ontario and MBA degrees from Queen’s and from Cornell University, New York (with distinction). He is a member of APEGGA and SPE.

Evan Wasoff - Non-Executive Director

Mr. Wasoff has been Chief Financial Officer of Falcon Oil & Gas Ltd. since 1 April 2005. Mr. Wasoff has over 30 years of experience as a Certified Public Accountant. In 1985, he founded Wheeler Wasoff, P.C., a Denver, Colorado CPA firm specializing in companies filing with the U.S. Securities and Exchange Commission between 1985 and 2005. Mr. Wasoff has been a consultant to Chartered Accounting firms in Calgary, Alberta, and Vancouver, British Columbia in securities matters and financial reporting issues in Canada and the United States.

Prior to forming Wheeler Wasoff, P.C., he was a member of the audit staffs of Pannell, Kerr, Forster & Co. and Price Waterhouse. Mr. Wasoff holds an MBA in Finance from the University of Colorado and a BS in Accounting from the State University of New York at Albany. He is a licensed CPA in Colorado and a member of the American Institute of Certified Public Accountants and the Colorado Society of Certified Public Accountants.

Martin B Oring, Non-Executive Director

Mr. Oring has been the Chairman of the Board of Directors of PetroHunter Energy Corporation since April 2009, its President and Chief Executive Officer since May 2009. Mr. Oring is an executive in the financial services and energy industries. Prior to forming his current business in 2001, Wealth Preservation, LLC, he had extensive experience as a member of management in several companies, including Prudential Securities (Managing Director of Executive Services), Chase Manhattan Corporation (Manager of Capital Planning), and Mobil Corporation (Manager, Capital Markets & Investment Banking). He has served as a director of Parallel Petroleum Corporation, located in Midland, Texas, and currently serves as Chairman, CEO and President of Searchlight Minerals Corp., located in Henderson, Nevada. Mr. Oring received a B.S. degree in mechanical engineering from the Carnegie Institute of Technology in 1966 and an M.B.A. degree in production management, finance and marketing from Columbia University in 1968.

Kym Pelham Livesley- Non-Executive Director

Kym Livesley is a corporate lawyer with 32 years experience. Kym has substantial expertise in mergers and acquisitions, capital markets, takeovers and general corporate and commercial advice. Kym maintains an industry focus in the energy and resources sectors, for listed and private corporates in the Asia-Pacific region.

Kym also has experience in capital raising, IPOs, directors' duties, dual listings (AIM, TSX) and corporate governance.

Kym has a Bachelor of Laws from the University of Adelaide. Among other affiliations, Kym is a former National President of the Australian Mining and Petroleum Law Association (AMPLA), member of the Minerals Council NSW and is a fellow of the Australian Institute of Company Directors (AICD).

John Carroll - Non-Executive Director

Mr Carroll is a private consultant specialising in government relations and major project facilitation and has more than 40 years experience in a wide cross-section of public sector positions in Canberra, Queensland and the Northern Territory. Mr Carroll was Chief Executive Officer of the NT Department of Industries and Business from March 2000 until November 2001. Following that he was General Manager, Business and Trade Development, and Deputy Chief Executive and General Manager, Minerals and Energy, NT Department of Business Industries and Resource Development. In May 2005 he was appointed Chief Executive, NT Department of Primary Industry, Fisheries and Mines.

Prior to his time in the Northern Territory, Mr Carroll was Deputy Director-General, Business, Innovation and Trade in Queensland’s Department of State Development. From 1996 he worked in that State’s Department of Economic Development and Trade where he was Director-General until July 1998.

His earlier public sector appointments include managing the Business Regulation Review Unit in Queensland, Administration Manager, Australian National Gallery and a number of years at the Commonwealth Public Service Board, Canberra. Mr Carroll was President of the NT Branch of the Institute of Public Administration from 2001 to 2004 and in 2006/7. In November 2004 the National Council made him a Fellow of the Institute.

John Craven - Non-Executive Director

Mr Craven is the Chief Executive Officer and a director of Cove Energy plc. He is a petroleum geologist with over 35 years experience in senior technical and commercial roles in upstream oil and gas exploration and production companies. Prior to joining Cove he was the founder and Chief Executive of AIM and IEX quoted African and Mediterranean focussed exploration company Petroceltic International plc. Petroceltic grew under his stewardship to a business with a diversified portfolio of exploration and appraisal projects in Italy, Algeria and Tunisia.

Mr Craven has an MSC in Petroleum Geology from the Royal School of Mines in London and an MBA from Queens University Belfast.

Company Secretary

Stephen Peterson – appointed 5 August 2008.

Mr Peterson is currently Chief Financial Officer and Company Secretary. He provides financial and administrative services on a contract basis to a number of companies in the resources industry. He has over 25 years experience in senior financial roles and as company secretary with listed public companies primarily in the resources industry in Australia.

Directors' meetings

The number of directors' meetings held, including meetings held by telephone, and the number of those meetings attended by each of the directors of the Company, while a director, during the financial period are as follows:

Board meetings

…………………………………Number of………….Number of

………………………………..meetings held………meetings attended

Robert C Macaulay …………………4 ………………………4

Evan Wasoff………………………... 4 ……………………...4

Martin Oring ………………………..4 ………………………4

Kym P Livesley ……………………..4……………………… 4

John Carroll …………………………4 ………………………4

Marc Bruner ………………………...2 ………………………2

Carmen J Lotito…………………….. - ……………………….-

John Craven …………………………1 ………………………1

John L Blue ………………………………………- …………………………………-

Principal activities

The principal activity of the Company in the course of the period was exploration for oil and gas in the Beetaloo basin of the Northern Territory.

Financial results

The net loss after income tax attributable to members of the Company for the year ended 31 December 2010 was $3,135,000 (2009: loss of $600,000).

Dividends

There were no dividends paid or declared by the Company during the year ended 31 December 2010, (2009: nil).

State of affairs

On 23 April 2010 the Company completed the acquisition of the final 25% interest in the Beetaloo licence area from Sweetpea Petroleum for the allotment of 50,000,000 ordinary fully paid shares in the Company and the assumption of certain liabilities of Sweetpea Petroleum related to its interest in the Beetaloo licence area.

On 23 April 2010 the Company allotted 149,999,999 fully paid ordinary shares to Falcon Oil & Gas Ltd in exchange for forgiveness of $29,999,999 of the intercompany debt owed by the Company to Falcon Oil & Gas Ltd.

A further aggregate 280,000 fully paid ordinary shares were issued to a corporate advisor and vendor as consideration for services provided.

A capital raising during the year resulted in the issue of 6,113,237 fully paid ordinary shares and 6,113,237 options to private investors raising $6,113,237.

There were no other significant changes in the state of affairs of the Company that occurred during the year under review.

Operating and financial review

The operating and financial review of the Company during the year is detailed on pages 1 to 2 of this report.

Environmental regulation

The Company’s operations are subject to Australian Commonwealth and Northern Territory environmental regulations and legislation. The Board believes the Company has adequate systems in place for the management of its environmental requirements and is not aware of any significant breach of those environmental requirements as they apply to the Company.

Operating and financial review

The operating and financial review of the Company during the year is detailed on pages 1 to 2 of this report.

Environmental regulation

The Company’s operations are subject to Australian Commonwealth and Northern Territory environmental regulations and legislation. The Board believes the Company has adequate systems in place for the management of its environmental requirements and is not aware of any significant breach of those environmental requirements as they apply to the Company.

Events subsequent to balance date

On 28 April 2011, Falcon Australia entered into an Evaluation and Participation Agreement (the “E&P Agreement”) with Hess Australia (Beetaloo) Pty Ltd. (“Hess”). By the terms of the E&P Agreement, Hess will pay $17.5 million to Falcon Australia as a participation fee for the exclusive right to conduct operations for the exploration, drilling, development and production of hydrocarbons from three of the four Permits, and excluding an area comprising 100,000 acres surrounding the Shenandoah-1 well (the “Area of Interest”). In addition, Hess

will pay Falcon $2.5 million as consideration for warrants to acquire 10,000,000 common shares in the capital ofFalcon for a period of 42 months from the date of issuance at an exercise price of CDN$0.19 per share.

Hess shall acquire seismic data, at is sole cost of at least $40.0 million, over the Area of Interest within 18 months of the execution of the E&P Agreement. After acquiring the seismic data, Hess shall have the right to acquire a 62.5% working interest in the Area of Interest. If Hess acquires the working interest, they commit to drill and evaluate five exploration wells at their sole cost, one of which must be a horizontal well. All costs to plug and abandon the five exploration wells will also be borne solely by Hess. The drilling and evaluation of the five exploration wells must meet the minimum work requirements of a work program. Costs to drill wells after the five exploration wells will be borne 62.5% by Hess and 37.5% by Falcon Australia.

By 31 December 2011, Falcon Australia must test and complete the Shenandoah-1 well at their sole cost, in accordance with the Work Program. After testing and completion, Falcon Australia must provide Hess copies of the data obtained from such activities, and Hess must pay Falcon Australia $2.0 million for the data.

The Company will pay a “success fee” to two advisors in the aggregate amount of 5% for services provided in conjunction with the E&P Agreement with Hess. The success fee is based on the cash or cash-equivalent value of any net amount received directly or indirectly by the Company, including the participation fee, cost of seismic data commitment and cost of drilling commitment.

The transaction as a whole is subject to receipt of all governmental and regulatory consents, including the TSX Venture Exchange.

Likely developments

Further information as to likely developments in the operations of the Company and the expected results of those operations in subsequent years has not been included in this report because disclosure of this information would be likely to result in unreasonable prejudice to the Company.

Indemnification of officers and auditors

During or since the end of the financial year, the Company has not indemnified or made a relevant agreement to indemnify an officer or auditor of the Company against a liability incurred by such an officer or auditor.

In addition, the Company has not paid or agreed to pay, a premium in respect of a contract insuring against a liability incurred by an officer or auditor.

Shares

In December 2009 directors issued an Information Memorandum for the purpose of raising up to US$50 million through the issue of 50 million ordinary fully paid shares at US$1.00 per share, with one free attaching option in respect of each share exercisable at US$1.25 per share at any time up to three years from the date of issuance.

The offer closed on 30 September 2010 having raised US$6,113,237 through the issue of 6,113,237 ordinary shares and 6,113,237 options. A further 397,361 options were issued to the broker managing the share issue.

In addition a further 280,000 ordinary fully paid shares were issued as consideration under a contract with a corporate advisor and vendor for services provided.

Options

During the year a total of 6,510,598 options to subscribe for ordinary shares at US$1.25 per share were issued. A total of 5,213,877 options were issued with an expiry date of 4 June 2013. A total of 1,296,721 options were issued with an expiry date of 15 November 2013. The fair value of these options has been estimated at $2,083,292 using the Black Scholes methodology.

Lead Auditor’s Independence Declaration under Section 307C of the Corporations Act 2001

The lead auditor’s independence declaration is set out on page 8 and forms part of the directors’ report for the year ended 31 December 2010.

Signed at Sydney this 6 day of May 2011 in accordance with a resolution of the Board of Directors:

_________________

Robert Macaulay

Director

READ MORE…

http://www.falconoilandgas.com/pdf/FOG%20Financial%20Statements%20Dec%202010%20Final%20exe.pdf