http://portfolio.hu/en/cikkek.tdp?k=2&i=20301

June 11, 2010, 12:20 pm

Hungary’s new centre-right government is "very close" to strike a deal with Surgutneftegaz and buy back the Russian company’s 21.2% stake in national fuels group MOL, local daily Napi Gazdaság reported on Friday. It said the previous Socialist administration also held talks with Surgut about the MOL stake.

Napi said Surgut wanted EUR 1.5 billion for its MOL package it had acquired from Austria’s OMV for EUR 1.4 bn, which was already double the market price in 2009. It added, though that at the latest talks EUR 1.6 bn also came up as the requested purchase price.

The government would finance the buyback by issuing new government bonds, the business daily added. Experts believe Surgut - in exchange for the MOL stake - may also ask Hungary to support the South Stream pipeline or seek permission for Russian companies to buy into local gas storage units or it could also ask partial ownership in MOL’s Dunai refinery.

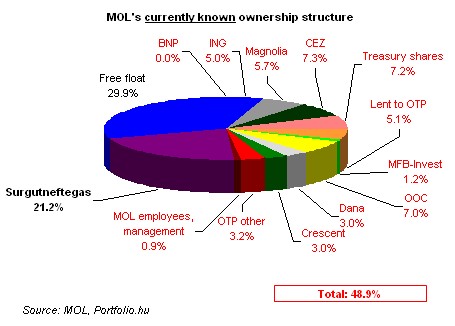

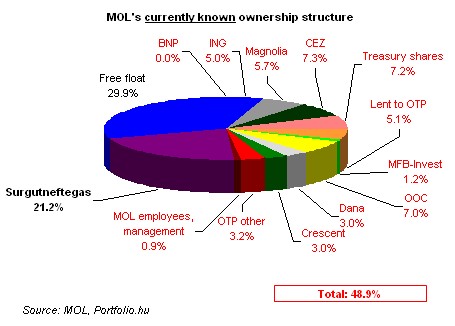

The news is shareholder-neutral, since Surgut has already been unable to attend and vote at MOL’s past two general meetings. On the other hand, the state becoming an owner in MOL may raise mixed feelings. Firstly, because it had sold its last stake in the company way below the market price. And secondly, government presence in MOL greatly reduces possible takeover chances for the company, although based on its current ownership structure chances of that are already slim.

One of the most important issues is the country’s government debt. The HUF 420 bn purchase price would push the gross government debt to GDP ratio higher by 1.6 percentage points to over 80%. In this case, a decline in Hungary’s debt would start a year later and in the current environment that’s something the government may not want. So, the question is: is repurchasing the package from Surgut worth it?

If the government decided to re-nationalise private pension funds, it would reduce - statistically speaking - government debt by up to HUF 1,240 bn, so buying the MOL package would not be a problem. Also, the cabinet would not have to implement the bank tax. The question is what the EU and the IMF would have to say about the transaction.

Two weeks ago there was already speculation on the market that the Hungarian government might buy back the 21% stake in MOL although there was no information how the government wanted to finance the transaction.

By issuing debt, "the government could keep the transaction off-balance sheet and it would not increase the ESA-type budget which is supervised by the IMF. In other words, the transaction would be likely to increase the gross government debt but would leave the budget deficit unchanged," commented Péter Császár, analyst at KBC Securities in Budapest.

He noted, however, that Fidesz’s intention is still unclear why to spend EUR 1.5-1.6 bn in the current fragile economic environment.

"Firstly, there is no urgent need to "save" MOL from Russians thanks to MOL’s existing corporate defence tools. Secondly, we see no reason to buy 21.2% stake as the voting rights are capped at 10%. Thirdly, people in the country are struggling with austerity measures, therefore, public opinion would not really be positive," Császár added.

Thus, he maintains his stance that this is a "bold speculation" and expects no market reaction to the news.

"If, by any chance, the transaction comes to reality, Fidesz needs to change the law to go through with the deal. We also believe the deal, if it happens, would not be cash only," the analyst added.