ANALYST VIEW - BofA/ML reiterate rating, target price for Hungary's MOL on Iraqi

posted on

Nov 24, 2009 08:54AM

Developing large acreage positions of unconventional and conventional oil and gas resources

http://www.portfolio.hu/en/cikkek.tdp?k=1&i=18978

November 24, 2009, 8:39 am

Bank of America/Merrill Lynch have confirmed their 'Buy’ recommendation and HUF 17,000 target price for Hungary’s MOL, after its partner in an Iraqi project indicated further exploration success.

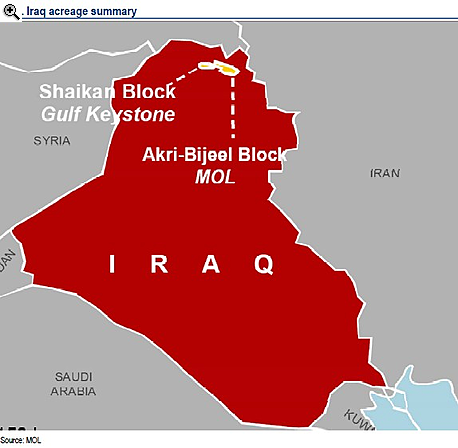

Gulf Keystone, MOL’s partner and operator of the Shaikan block (Gulf Keystone 80%, MOL 20%) in Iraq, morning indicated further exploration success on Monday.

"The Shaikan-1 well reached total depth (TD) at 2,950 metres.Gulf Keystone then conducted its second test in the Triassic (the first Triassic test flowed 2,000 bopd and 2 million scf of gas).This second Triassic test (2,582m to 2,849m) produced 6,000 bopd of 53 to 55 degree API oil and 21 mmscf/day of gas or 10,000 boe per day," Gulf Keystone said in a statement.

"The first Triassic test was severely limited by surface restrictions and down hole tool problems. Internal engineering analysis of the test data indicates that the first Triassic zone could have flowed at rates up to 14,000 boe per day. This gives the Triassic section alone, potential aggregate rates of about 24,000 boe per day."

Overall, the Shaikan-1 well has discovered over 1,000 meters of oil column and over 200 metres of net pay. Thus far Gulf Keystone has tested less than 30% of this net pay. This 30% of net pay demonstrated the capability for 31,000 boe per day of aggregate production (7,000 bopd from the Jurassic and 24,000 boe per day from the Triassic).

"Shaikan-1 has exceeded the most optimistic prognosis held at the start of drilling. Each phase of drilling has resulted in significant discoveries, and any one of the several target layers of the Jurassic or Triassic intervals contain, by any measure, outstanding volumes of oil-in-place. It is our belief that the aggregate volumes suggest an even larger future potential," said Todd Kozel, Executive Chairman of Gulf Keystone Petroleum.

On 21 October, the consortium announced that the Shaikan block could hold between 1 bn and 5.3 bn barrels of gross reserves (worth about HUF 1200/share to MOL).

BofA/ML said the latest news will "likely push the ultimate reserves estimate towards the top end of the range. Looking forward, we believe there is potential for significant value creation from the block, with further testing and drilling set to take place during 2010 (only 30% of the net pay has thus-far been tested)."

Should the positive results be replicated in additional wells across the block, BofA/ML believe "there is potential for reserves to be upgraded in the field."

"The recent positive news flow from the Shaikan block holds strong read across for the adjacent Akri Bijeel block (see chart below) , in which MOL has an 80% stake and is the operator. Importantly, early indications (following the acquisition of 2D seismic data) suggest that the Akri Bijeel block could hold substantially larger hydrocarbon deposits than the Shaikan block," BofA/ML said.

They expect drilling to commence in 2010 and bring significant positive news flow.