ANALYST VIEW - Credit Suisse upgrades Hungary's MOL, sees catalysts in Nabucco,

posted on

Oct 15, 2009 11:39PM

Developing large acreage positions of unconventional and conventional oil and gas resources

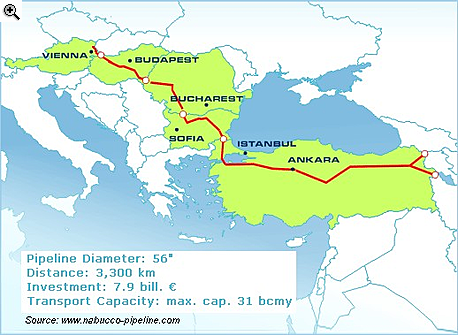

When you are looking at the map, you can see the Nabucco pipe line going through the Mako trough. Perfectly located for exporting gas from the Mako trough.

http://www.portfolio.hu/en/cikkek.tdp?k=1&i=18688

Credit Suisse has upgraded Hungarian fuels group MOL to 'Outperform’ from 'Neutral’ and increased its target price to HUF 18,529 from HUF 12,087 previously, owing to higher earnings estimates, better capital discipline and attractive valuation (a c40% discount to the integrated refiners in Europe).

In a research note on the Eastern European downstream segment, CS has maintained its ratings on Tupras ('Outperform’) and PKN Orlen ('Underperform’).

"MOL and Tupras are downstream companies with differentiated strategies and offer 24% and 29% potential upside to our target prices of HUF 18,529 and TRY 31.70, respectively. PKN Orlen currently has 18% potential downside to our target price of PLN 24.51," Credit Suisse has said.

In CS’s view, the outlook for Eastern European downstream remains negative until the end of 2010.

It believes the fundamental outlook for each of these three companies is quite different, and it prefers companies "with clear and differentiated strategies that can create value in times of weak downstream industry fundamentals."

"We think that MOL will further benefit from the diversified mix of its business portfolio with the E&P and Gas & Power segments offsetting the relative weakness in the Refining and Petrochemicals segments in 2009E and 2010E," said CS analyst Anton Fedotov.

MOL also "looks set to be a significant beneficiary of the completion of the Nabucco gas pipeline from Turkey to Austria and could benefit from Gazprom’s desire to secure greater access to customers in Europe."

Fedotov also believes that the integration of the Croatian oil company, INA, "will add scale and offer earnings-enhancement opportunities, as MOL management applies its operational expertise to improving the efficiency of INA’s assets."

The analyst expects newsflow on further developments in the Nabucco gas pipeline project and an update on Croatian INA restructuring to be the next catalysts for MOL.

"MOL looks attractively valued, trading at 2009E P/E of 11.5x and EV/EBITDA of 4.4x, which offer a significant c40% discount to integrated refiners in Europe," Fedotov added.

Nabucco project timeline: