Hungary MOL looks to extend loan

posted on

Sep 03, 2009 10:15AM

Developing large acreage positions of unconventional and conventional oil and gas resources

Hungary MOL looks to extend loan

Thursday, September 3, 2009 08:44:00 AM

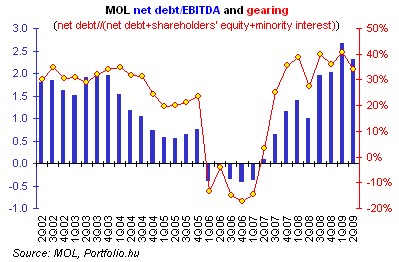

Hungarian oil and gas group MOL intends to extend the maturity of part of its EUR 2.1 billion loan, secured in 2007, by one or two years before its expiration due in October 2010, Reuters reported, citing bankers close to the deal as saying. MOL has already acknowledged it was in talks with banks about pricing.

The extension could be the first forward start loan in Eastern Europe since the onset of the crisis.

Western European borrowers have turned to forward start facilities this year to lock in loans ahead of the maturity in exchange for an increase in margins and fees.

So far this year, borrowers in Europe, the Middle East and Africa have secured forward start loans worth USD 57 bn, with USD 55 bn from western European borrowers, according to Thomson Reuters LPC data.

"MOL is thinking of doing a forward start, which is a suitable mechanism for them. We've not seen anything like this in Central and Eastern Europe," the news agency cited a senior banker as saying.

MOL's relationship banks are expected to submit indicative pricing and maturity proposals imminently, with views to launch syndication in October, according to the first banker.

New share sale possible, but...

MOL CEO György Mosonyi told Bloomberg in an interview published on Wednesday that they were in talks with banks to obtain financing for future investments and may sell new shares.

2009.09.02 09:15

Hungary MOL CEO sees profit rise in 2010 on the back of CEE recovery

Although MOL may consider selling new shares to raise financing this is not the company's most likely option, MOL spokeswoman Dóra Somlyai told Reuters later in the day.

"We don't plan to issue or sell shares but nothing can be ruled out, even if the chance of such an issue is small."

MOL tapped the European syndicated loan market for a EUR 2.1 bn revolving credit facility in 2007. That loan was arranged by mandated arrangers BNP Paribas, Citi, ING, Royal Bank of Scotland, Bank Austria Creditanstalt, Bank of Tokyo-Mitsubishi UFJ and UniCredit.