Hungary's MOL to report gigantic financial gain in Q2 -

posted on

Aug 19, 2009 09:56AM

Developing large acreage positions of unconventional and conventional oil and gas resources

Hungary's MOL to report gigantic financial gain in Q2 - Portfolio.hu POLL

Wednesday, August 19, 2009 10:36:00 AM

Thanks to the firming of the forint, Hungary's MOL recorded a never-before-seen profit in the second quarter of 2009, according to the consensus forecast of analysts in a Portfolio.hu poll. Meanwhile the oil sector environment has deteriorated substantially which weighed down on the fuels group's operating profit that dropped markedly. The future is not overly bright at the moment.

MOL is set to release its Q2 earnings figures on 28 August, next Friday at dawn.

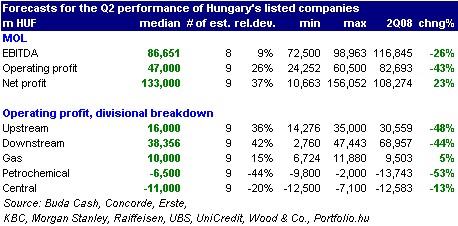

The consensus forecast of analysts in a Portfolio.hu poll shows a massive decline in MOL's operating profit in the April-June period. All divisions but the gas business played a part in the decrease. On the net level, however, the respondents forecast an all-time high profit, a result of foreign currency debt revaluations induced by the forint's strengthening.

The weak operating performance is attributable mainly to the following factors:

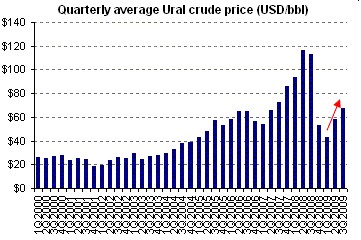

1. Plummeting crude prices: oil prices peaked in the base period and halved by Q2 2009. The HUF's firming versus the USD offset this impact only partly.

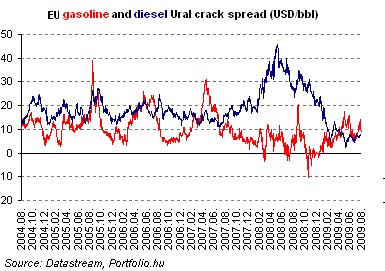

2. Sharply falling diesel crack spreads: owing to diminishing demand diesel crack spreads, the most crucial factor for MOL, dropped substantially and this could not be counterbalanced even by a rise in gasoline crack spreads.

Forint and INA help

Despite the extremely poor operating result MOL is expected to report a never-before-seen net profit, primarily because of the following two factors:

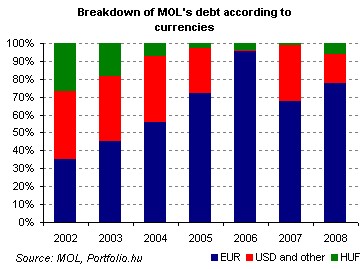

1. Forint firming: the nearly HUF 150 bn financial loss has almost turned around in Q2 thanks to the appreciation of the forint. The reason is MOL's gigantic FX debt. The group's financial profit is seen coming in at around HUF 100 bn.

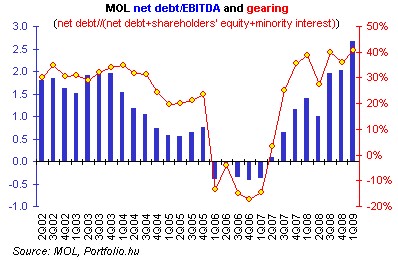

Thanks to HUF strengthening MOL's gearing is projected to show a major decline yr/yr.

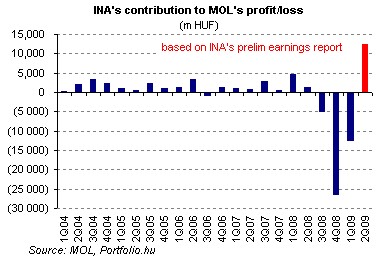

2. INA profit contribution: MOL's Croatian unit INA also contributed greatly to group results, with an estimated HUF 20 bn added to consolidated profit in Q2 following a negligible financial support a year earlier. This is primarily attributable to a one-off item from the sale of its gas business.