Hungary's MOL prepares to give the finger to Russia

posted on

Apr 08, 2009 05:41AM

Developing large acreage positions of unconventional and conventional oil and gas resources

Hungary's MOL prepares to give the finger to Russia

http://www.portfolio.hu/en/cikkek.td...

Wednesday, April 8, 2009 01:03:00 PM

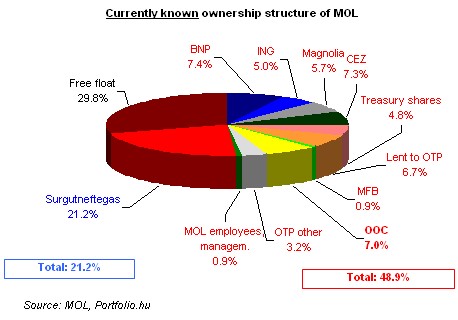

Hungarian oil and gas group MOL has revealed its proposals for the Annual General Meeting to be held on 23 April. The planned measures show that MOL is gearing up against hostile takeover attempts. Some of the changes proposed appear to be directly aimed against Surgutneftegas, a Russian company that recently bought OMV's 21.2% stake in MOL.

The key elements of the proposed changes to the Articles of Association are the following:

1. The “B" series share (one piece at MOL) currently held by the state (MNV Zrt. and State Privatisation Holding ÁPV) will have preferential rights attached to until and only until such share remains in the possession of the state;

2. The shareholder will, at the request of the Board of Directors, immediately identify the ultimate beneficial owner with respect to the shares owned by such shareholder. In case the shareholder fails to comply with the above request or in case there is a reasonable ground to assume that a shareholder made false representation to the board of directors, the shareholder's voting right shall be suspended and shall be prevented from exercising it until full compliance with said requirements.

3. There is a proposal which aims moving the decision on the acceptance of a public purchase offer on treasury share(s) to the authority of the board. MOL considers here that according to the Companies' Act and the Capital Market Act of Hungary, the acceptance of a public offer does not belong to the exclusive competence of the general meeting;

4. The acceptance of a public purchase offer regarding treasury shares would no longer be the exclusive competence of the general meeting (it would be up to the BoD to decide);

5. According to MOL's current Articles of Association, the increase of the share capital and the issuance of convertible bonds shall require the three quarter majority vote of the general meeting. This would be lowered to a simple majority.

6. According to MOL, “the present changes in the shareholder structure compel the Company to operate reasonable mechanisms against a creeping control." As part of this, it is proposed to amend the required (simple) majority of votes to three quarter majority on the dismissal of members of the Board of Directors;

7. For similar reasons it is also proposed to extend the rights attached to “B" series share.

The “yes" vote of the holder of “B" series of share is required to adopt decisions at a general meeting on any proposal not supported by the Board of Directors in the following matters:

- election and dismissal of the members of the Board of Directors,

- election and dismissal of the members of the Supervisory Board,

- election and dismissal of the auditors,

- decision on distribution of profit after taxation,

- amending some Articles int he Articles of Association.

8. Also as a counter measure against “creeping control" MOL proposes that the general meeting may only decide on dismissal of maximum 1 member of the BoD validly with the restrictions that during the three (previously six) months period following the decision on dismissal of the one member of the BoD, no further dismissal of a member of the Board may take place. According to MOL's current Articles of Association, restrictions on the removal of board members are lifted if an owner gets 33% stake in the company through a public bid. Management aims to remove this rule;

9. According to MOL's current Articles of Association, Board of Directors is entitled to increase the share capital until April, 2010 in one or more installments by not more than 15% or HUF 16.2 bn. MOL proposes to prolong this right until April 2014, and lift the limit to HUF 30.0 bn (ca 28.7% of the share capital). While currently the Board is entitled to increase the share capital through private placement of new shares exclusively for the purposes of implementation of its strategic goals, this stipulation would also be scrapped.

Nice defense, but...

“Some points already breach the interest of minority shareholders as it gives nearly unlimited power to the board, which we consider as very dangerous going forward," commented Péter Tordai, analyst at KBC Securities.

Due to a sound political opposition of the Russian ownership in MOL and the fact that MOL management already controls a bit more than 50% of the total votes, he also expects the proposals to be approved.

“This would provide a very effective defense, if the European Commission does not find it against the European law," Tordai said.

He believes the five most important pillars of MOL's defense are

1) the 10% voting cap,

2) voting right limitations if the shareholder fails to identify the ultimate beneficial owner (it might be an especially useful tool against Surgut),

3) private placement of new shares,

4) selling treasury shares to friendly hands and

5) cementing the position of board members.

“In our view the chances of a potential hostile takeover attempt can be reduced to nearly zero if AGM adopts these defense tools, leaving only the friendly way for Surgut. Based on the news, market might start speculating on a harsh reaction from the Kremlin what can give a boost to the share price. In the coming weeks, however, we expect the takeover speculation to erode," Tordai concluded.

Related articles: