The price of OMV's entire MOL package (22,179,488 shares) corresponds to HUF 19,212 per share compared to Friday's closing price of MOL of HUF 9,940 per share.

“[...] it will not be like this forever but we will keep (our MOL shares) this year in any case," OMV CEO Wolfgang Ruttenstorfer told political and economic daily Profil a week ago.

2009.03.23 15:41

Austria´s OMV has no intention to sell its stake in Hungary´s MOL

“Due to restrictions indicated by the European Union as well as the rejection of the MOL board, OMV terminated its respective merger activities in August 2008. Therefore the sale [...] is a logical step and in line with OMV's strategy of acting in the best interest of its shareholders by maximising the value of its investment," OMV said in a statement.

It said it achieved a “good price" in the deal.

The sale of the MOL shares was conducted by investment bank JP Morgan.

Péter Tordai, KBC Securities, Budapest “Surgut is the largest privately owned oil company in Russia, with a market cap of USD 22.7 bn compared to USD 9.6 bn of OMV and USD 4.5 bn of MOL. Surgut has very close ties to the Kremlin, reportedly to Mr Putin himself."

“In the meantime, Surgut is one of the least transparent oil companies in Russia, which even fails to disclose its official ownership. In 2003, Surgutneftegaz management moved 42% of voting shares to an obscure company, and stopped disclosing the ownership of that stake but classes them as treasury shares."

“In late 2007, Stanislav Belkovsky, a famous Russian strategist, told German daily Die Welt that Vldaimir Putin owns 37% of Surgutneftegaz, the biggest element of his wealth."

“However, the key question is, remains the intention of Surgut. Although their long-term goal is likely to gain majority in MOL, it might be difficult without the support of MOL management who effectively controls the company."

“We see little chance for Surgut start buying further MOL shares on the market, they will rather initiate talks with MOL management. MOL should also be careful with Surgut as Putin himself seems behind the company. Thus it seems unlikely for us that MOL will rush qualifying Surgut's move as hostile."

“Moreover, management's control of MOL is pretty unformal and not fully solid. MOL is reliant on the money of banks to finance its treasury shares positions what might push them to the direction to sit together with Surgut and try to find out its intentions."

“Overall, we expect MOL share price rising this morning fuelled by a speculation of a bidding war. However, this can be curbed easily by statements of both MOL or Surgut which might lower this speculation."

On OMV:

“We doubt that it was a straightforward deal, as the price exceeds the market price by ca. 100%. If the intention of Surgut is to purchase minority stake in MOL, it could have done at a much lower price - see Oman Oil's public auction last November."

“While we have a strong suspicion that it was a more complex deal including asset swaps or options, which are more difficult to evaluate, we generally welcome OMV's move to free up a locked asset."

“We expect positive market reaction to the news, however, market is keen to hear further details. If OMV announces shortly that it had purchased upstream assets from Surgut at a price which exceeds the current typical reserve valuation in Russia (ca. US$ 2-3/bbl) market can easily feel that OMV tried to mislead investors with its MOL valuation, and the likely jump in its share price will be partially reversed."

Bram Buring, Wood & Co., Prague “MOL should jump this morning on speculation the company is back in play now that a Russian player now in MOL's shareholders structure, a potential catalyst for consolidation in the sector."

“If Surgutneftegas seeks a full takeover of MOL then it of course faces the same barriers as what MOL used against OMV; however we've generally thought that MOL management might be more flexible when it comes to a combination with a Russian partner, so the first comments from MOL's on the deal and the potential of the new strategic partnership bears close watching."

“OMV should gain this morning on the divestment as well; the EUR 1.4 bn disposal represents 19% of current market cap or 40% of end-08E net debt (EUR 3.43 bn), and should reduce 09E Net Debt to EBITDA to 0.66x."

“OMV paid an average HUF 16,000/share for the stake and may book a one off gain of cc. EUR 230 m on the transaction or cc. 0.78/share (+20% to 09E EPS)."

| Credit Suisse, Deutsche Bank, Citi |

|

James Neale, Credit Suisse, London “The sale comes as something of a surprise, not having been discussed in recent results or roadshow, but should be perceived positively by the market, in that it eases concerns over financing during the low oil price environment."

“OMV's MOL stake was built opportunistically, with an initial c.10% stake being augmented in 2Q07 by a block purchase of 8.6% for an estimated EUR 1.1 bn. The company's subsequent inability to push the stake built to a full business combination - both a function of intransigence on the part of MOL management, and certain objections from the European Commission raised in August 2008 - had left the stake tying-up considerable capital for the company."

“Although the average in-price for OMV on its stake was over HUF 20,000, a sale price of HUF 19,212/share is good, being almost double the MOL closing share price of Ft9,940. A EUR 1.4 bn cash inflow will assist OMV in its quest to live within its cash flows during 2009/10. On our estimates, using a USD 50/bbl oil price in 2009, and USD 60/bbl in 2010, OMV will no longer need recourse to debt financing after this stake sale."

Gergely Várkonyi, Deutsche Bank, Budapest “In a surprising move, OMV sold its 21.2% stake in MOL to Surgut for HUF19,212/share. We believe this should be positive for MOL's stock price.

- Valuation of the this non-controlling stake compares favourably to our valuation of HUF17,500/share.

- Overhang concerns about OMV's stake has been lingering on MOL's stock performance and these concerns should now dissipate.

- The market may start pricing in a voluntary tender offer, although a mandatory offer is not required, given that the stake is below 25%.

- Strategic co-operation is possible, i.e. in upstream or downstream assets in Russia, although Surgut is the most cash-rich of Russian oil majors, so it doesn't really need MOL as a capital partner.

- Although concerns about a potential crude supply disruption via Druzhba are not high right now, should this change, the perception of MOL's risk should be lower with Surgut as a shareholder vis-a-vis regional peers."

“The fact that Surgut is the buyer is a surprise because it is the least internationally exposed among Russian majors and it cannot be ruled out, in our view, that this stake may land in somebody else's hand eventually. Note that both Lukoil and Rosneft supplies more crude to the MOL group today than Surgut: if anything, this may be one of the reasons for Surgut's purchase."

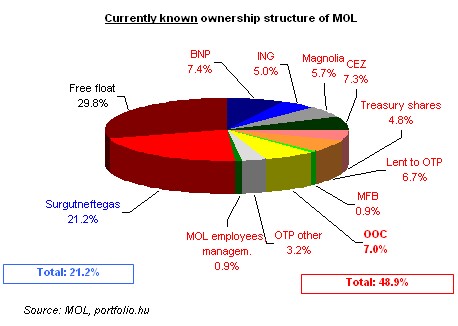

“We couldn't get a comment from MOL just yet but management has not been against a trade sale if it has commercial merits (OMV's proposed deal didn't have much). Note that directly or indirectly, MOL has control over 46% of shares issued so it has the means to prevent a trade sale from happening if it wants to."

“The government may prefer an international major as MOL's controlling shareholder but in our view, if the board endorses a trade sale, the government may not object it."

Alexander Karneev, Citi, Moscow “[...] purchase implies total equity value of MOL of EUR 6.6 bn, or total EV of EUR 9.2 bn. Apparently, the transaction price was set in line with the acquisition price of the stake by OMV. We do not see synergies with Surgutneftegaz."

“MOL's '08 EBITDA stood at USD 2.04 bn and net income at USD 821 m implying purchase multiples of '08 EV/EBITDA of 5.9x and P/E of 10.5x and for '09 of 7x and 14.7x (Bloomberg consensus), respectively, a c50% premium to the European integrateds' multiples."

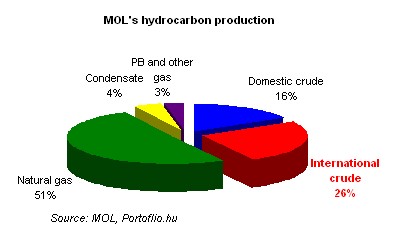

“The group has 351.8 MMboe SPE 2P reserves, nearly half of which comes from Russia, operates a 5,300 km gas trunk pipeline, and has 336kbpd refining capacity with 1,069 gas filling stations in Europe."

“The shareholder structure of MOL is highly dispersed. Even without the core shareholders' stakes, SNGS could potentially consolidate up to 55% (ex 8.4% treasury shares) in the company by further buying out portfolio investors (and has at least a blocking stake in the company)."

“To remind, in summer '08, the European Commission objected to an OMV-MOL merger citing that the merger would remove competition from the markets of Austria, Hungary and Slovakia. Clearly, Surgutneftegaz has no presence in the region and enjoys a cash and financial investments position totalling cUSD 20 bn, according to CIR estimates."