Re: RVX toronto could be a great spec. play, also betting on DDSS long term

posted on

Mar 07, 2010 10:24PM

Crystallex International Corporation is a Canadian-based gold company with a successful record of developing and operating gold mines in Venezuela and elsewhere in South America

I think this could see a good run with announcement of out-licensing recently FDA approved OLEPTRO to a distribution partner suprise with the extent of the 'sell the new' brought in the 1.50 to 1.60 range after talking with IR, recent finanacing and FDA approval along with other drugs in the pipeline could be a good play, good luck to us both

here is a blog after approval

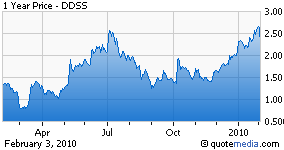

LaboPharm, Inc. (DDSS) announced on Wednesday that the US FDA has approved OLEPTRO, the company's treatment for major depressive disorder [MDD] in adults. OLEPTRO is a once-daily formulation of trazodone and utilizes the LaboPharm's controlled release technology, CONTRAMID.

According to the Wednesday morning press release, the company expects to have OLEPTRO available for prescription in the United States later this year. After spiking to nearly $3 on the market open, shares of DDSS traded down roughly to the $2.70 mark as the morning progressed, although volume was extremely heavy; the first hour of trading saw more than ten times the average daily volume change hands.

After spiking to nearly $3 on the market open, shares of DDSS traded down roughly to the $2.70 mark as the morning progressed, although volume was extremely heavy; the first hour of trading saw more than ten times the average daily volume change hands.

The modest bump in price did not meet the expectations of many investors, although it's my opinion that the February 3rd approval may have caught some off-guard since February 11th was expected to be the decision-day; and the FDA has been running behind schedule at that.

The booming volume would indicate that there are big players taking positions in the stock, and although OLEPTRO won't make it to market until later this year, the potential for a short term bump in price still exists since Wednesday's PR mentioned that the company "currently expects to finalize the commercialization plan for OLEPTRO[TM] in the near term."

That means partnership news can come at any time.

With an approved product in a very large market, DDSS should be considered a nice long term growth play, one that also could become a nice short to mid term story if the stock starts trading to its potential.

These days in the biotech sector it looks more and more like large investors like to see revenue before running the stock, but the small investor needs to have the patience to wait for the run.

Remember, the big boys will play their games and eat their cake, we're just trying to pick up a few crumbs along the way.

DDSS just became a great growth stock, in my opinion, especially since the share price hasn't changed on what should be considered big news.

Also worth mentioning is the possibility of dilution, although a partnership deal could bring enough of an upfront payment to LaboPharm to negate the need for raising a large sum of cash through stock sales.

UPDATE (after market close):

An early day price spike to nearly three dollars preceded the downturn that saw DDSS trade for as low as $2.17, before closing the day at $2.21. Volume remained very strong throughout the day, as expected after such news.

These days, it's not unusual to see such a drop in price after positive FDA approval news (see: BDSI, NRIFF.PK, etc); and although it's a bit nerve-shattering for longs of the stock to watch, it's actually nothing to complain about because it gives small investors the chance to buy shares of a company with an approved drug for the same price - or less - that just days before would have bought a more speculative company with an uncertain FDA decision looming.

Even when the stock trades down after positive news, it's still a better buy today than it was yesterday because of the increased certainty that the company will be able to generate revenue over the mid to long term.

However, it's because of scenarios like this one that demonstrate the need of the small investor to base investment decision on his or her own DD - and not the message boards, blogs or unexpected price swings; in the confusion it's a whole lot easier to sell into the uncertainty and move on, but an investor who is confident in the DD will have the fortitude to stick it out, maybe add some shares on the dip, and look towards the future.

The small investor cannot influence the stock price, the stock price will do what the big boys want it to do; it's up to the small investor to be on top of his or her game and to take advantage of the volatility and manipulation (if in fact manipulation is at play) . In this case it's a buying opportunity that has been presented, in my opinion.

When discussing possible manipulation, you can't ignore the fact that when the big boys want a stock to drop, they get their minions - that I like to call riff-raff - to swarm the message boards with multiple user IDs whose orders are to create a mood of confusion, panic, fear and uncertainty. Many small investors cannot handle the desperation that comes with all of those emotions and will therefore sell their shares (either for a loss or not as much profit as they could have banked by selling earlier) and play right into the hands of the riff-raff.

Once the stock has dropped and the riff-raff are somewhat satisfied with the amount of shares that they've shaken loose, they disappear off the message boards just as quickly as they showed up. Many will deny that such manipulation takes place, but after seeing the same game quite a few times, you'll feel a lot more comfortable holding through the storm, and possibly even adding a few shares.

Don't get me wrong, if something changes with the company that you're investing in that fits your 'exit strategy' protocol, then it may be wise to completely bail out. But if it's a secondary variable that is impacting the share price of your stock, and not actually events related to the company, then rely on your DD and stick to your entry/exit strategies.

It always comes back to DD and patience - and to not being afraid to take some profit off the table when the opportunity arises.

In the case of DDSS - as is usually the case immediately after FDA approvals- the time between approval and commercial launch is usually months, and that is why - in my opinion - there is time for these games to be played; because even after a commercial launch, it'll still be months before the investor has a good idea of how much revenue is coming in.

That's why these days the small investor can't count on banking some profits immediately after approval - we need to have a longer term outlook to realize the expected gains; however, with that said, there is usually plenty of volatility leading up to the FDA approval that allows investors to do a bit of trading in order to end up on house money by the time D-day comes.

If you were positive on DDSS before the FDA decision, then there's no reason to change your position now - just keep patient and look for news regarding a partnership announcement, commercial launch and ultimately, the revenue generation for OLEPTRO could be significant.

All just my opinion, each investor should do his or her own DD.