Bullish Trading on .......................

posted on

Apr 25, 2017 11:49PM

We may not make much money, but we sure have a lot of fun!

Share

Share

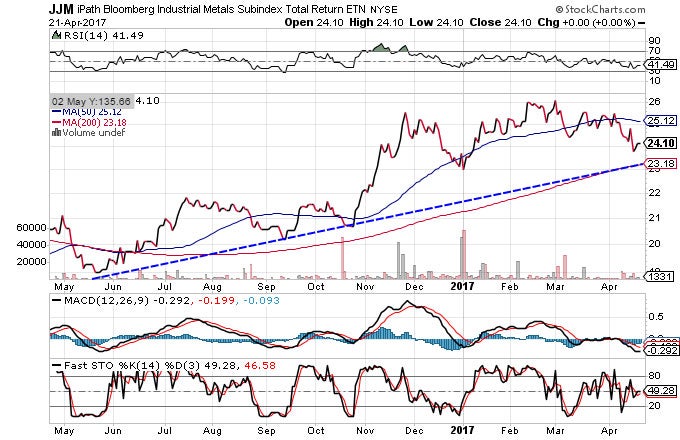

When it comes to trading commodities, many products are trading within clearly defined downtrends for a variety of reasons ranging from oversupply to poor weather. One group of commodities that has been able to move counter to the rest is industrial metals. While continued discussion about increased spending on American infrastructure has acted as a strong catalyst to price moves, it seems that nearby support levels could be the next item to propel prices higher. In the article below we’ll take a look at the charts and try to determine the best plan for trading the strength in industrial metals. (For more, see: Can Industrial Metals Make a Comeback?)

Investors looking to gain exposure to metals such as copper, zinc, and aluminum have traditionally had to rely on the futures market. However, given the rapid rise in popularity of exchange-traded notes, retail investors can now purchase assets such as the iPath Bloomberg Industrial Metals Subindex Total Return ETN (JJM

Of the industrial metals, the one that looks poised for the strongest rally is copper. Taking a look at the chart of the iPath Bloomberg Copper Subindex Total Return ETN (JJC

One of the most overlooked commodities can be aluminum, but the chart of the iPath Bloomberg Aluminum Subindex Total Return ETN (JJU

In recent days industrial metals such as aluminum, copper, and zinc along with the associated miners have renewed the interest of many active traders. More specifically, the pronounced shift in the trend combined with nearby support is creating some of the best risk/reward setups anywhere in commodities. (For more, see: These Commodities Are Trading Near Major Levels of Support).

At the time of writing, Casey Murphy did not own a position in any of the assets mentioned.

subscribe.energyandcapital.com

The Lithium-Ion Battery Will Replace Oil Within the Next Decade. The Time to Invest is Now

The Rise of Electric Vehicles Will be the End of Gas-Invest in its Replacement, Here's How

Oil is set to flow in 2017. Here's how you can profit. Free report.

Want to learn how to invest?

Delivered twice a week, straight to your inbox.

Read more: Active Traders Are Turning Bullish on Industrial Metals (JJM, JJC) | Investopedia http://www.investopedia.com/news/active-traders-are-turning-bullish-industrial-metals-jjm-jjc/#ixzz4fK8zEx5Q

Follow us: Investopedia on Facebook