STOCKS to Follow:

posted on

Mar 10, 2015 12:29AM

We may not make much money, but we sure have a lot of fun!

Stocks to Follow

Analysis by

Keith Howlett

Analyst

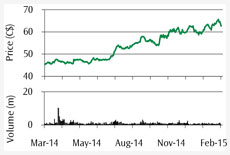

Loblaw is the largest grocery retailer and the largest drug retailer in Canada, with forecast revenue of C$46b and EBITDA of C$3.6b in 2015

The company is positioned for 3–4 years of good earnings growth as improving industry conditions coincide with harvesting of the benefits of internal operating improvements

The company pays a quarterly dividend of C$0.245, with a yield of 1.6%

| Rating | Buy-Average Risk | |

| Target | C$72.00 | |

| Symbol | L | |

| Exchange | TSX | |

| Recent price | C$61.93 | |

| Total potential return | 16% | |

| 52-week range | C$45.07–66.88 | |

| Shares outstanding | 412.5m | |

| Market capitalization | C$25,546m | |

| Year-end | Dec-31 | |

| EBITDA | 2014 2015E 2016E |

C$3.2b C$3.6b C$3.8b |

| EPS | 2014 2015E 2016E |

C$3.10 C$3.55 C$3.95 |

| Dividend per share | C$0.98 | |

| Dividend yield | 1.6% |

With more than 1,000 grocery stores across its portfolio of banners, Loblaw has the leading market share in most trade areas across Canada. The company is known for its prominent in-house brands and excellent locations. It also operates more than 1,200 Shoppers Drug Mart and Pharmaprix locations, as well as more than 500 pharmacies inside its grocery stores.

Both Loblaw’s and Shoppers’ businesses are highly cash flow–generative. Over the next two years, Loblaw is expected to benefit from two internal sources of EBITDA growth—realization of an additional C$200m in synergies from the Shoppers’ acquisition and C$100m in savings from the completion of the SAP IT implementation in late 2015. The external environment has also improved. Growth in competitive square footage has moderated. Moderate food inflation, as being experienced currently, is generally positive for industry profitability.

Loblaw should have much improved decision-making capability by 2017, once its employees are fully familiar with the new information systems platform and have a solid base of accurate historical information. The primary benefits, in our view, are likely to be improved retail pricing decisions and better productivity from promotions on a store-by-store basis.

As debt from the acquisition of Shoppers is paid down in 18–24 months, free cash flow will likely support share buybacks and further growth in the dividend. The recurring level of capital spending is expected to fall below C$900m by 2017. Free cash flow is estimated to approach C$2b.

Our target price of C$72 reflects the sum of the value of the retail business at 10x EV/EBITDA and the value of the interest held in Choice Properties REIT (using our real estate team’s 12-month target price of C$11.50).

Our rating remains Buy–Average Risk.

Analysis by

Maher Yaghi

CPA, CMA, CFA, Analyst

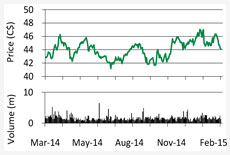

Significant mobile user base and the most levered to trends in mobile data consumption

Transition out of restructuring period is expected to lead to improving operational results over the next year

Attractive valuation relative to peers, with dividend yield of ~4.4%

| Rating | Buy-Average Risk | |

| Target | C$48.50 | |

| Symbols | RCI.B, TSX RCI, NYSE |

|

| Sector | Telecom, Media & Tech | |

| Recent prices | C$43.66, US$34.98 | |

| Total potential return | 15% | |

| 52-week range | C$40.80–47.50 | |

| Market capitalization | C$22,625m | |

| Enterprise value (EV) | C$36,689m | |

| Year-end | Dec-31 | |

| EBITDA | 2014 2015E |

C$5.0b C$5.1b |

| EV/EBITDA | 2014 2015E |

7.3x 7.2x |

| EPS | 2014 2015E |

C$2.96 C$3.04 |

| P/E | 2014 2015E |

14.8x 14.4x |

| Dividend per share | C$1.92 | |

| Dividend yield | 4.4% |

Rogers is a diversified communications and media company offering wireless, broadband, television and telephony services. With more than 9 million wireless voice and data subscribers, it is Canada’s largest wireless carrier. The company’s exposure to wireless—which makes up about 60% of its revenue base—serves as a growth driver given consumers’ increasingly large appetite for mobile data.

We believe Rogers is the most advanced among cable companies in Canada in its development of next-generation IP-based cable systems. The move to IP from the current standard cable platform should allow the company to compete more effectively against Bell’s FibeTV platform, as having an IP delivery model makes it much easier to create a streamlined and tailored customer experience. Rogers is facing increased competition, with both TELUS and Bell aggressively seeking market share in the lucrative mobile space, but the company is responding well and maintaining pricing rationality.

In the past year, the company has reorganized its structure and made strategic investments into new product offerings that leverage its media assets. However, the transition has resulted in lower-than-expected financial and operational metrics. We believe that results from past investments will become more tangible over the next year and help drive future revenue growth.

Rogers provides an attractive 4.4% dividend yield supported by healthy cash flows, which should resonate well with yield-seeking investors—however, a rising interest rate environment would negatively impact high-yielding names.

Our valuation for Rogers is based on the average of two techniques (discounted cash flow and net asset value) to generate our target price of C$48.50. Rogers’ shares are trading at a more attractive level than the peer group; the company currently trades at 7.0x EV/EBITDA relative to incumbent peers at 7.9x EV/EBITDA. We believe this trading spread to be excessive, given the strength of Rogers’ asset base and the opportunity to improve its results following its transitional investment period.

We upgraded our rating to Buy from Hold in January.

| Algonquin Power & Utilities Corp. | AQN | 10.29 | 2,450 | Top Pick-AR | 11.25 | 4.0% | 13% | Power & Utilities |

| Canadian Pacific Railway Limited | CP | 234.64 | 38,829 | Buy-AR | 262.00 | 0.6% | 12% | Transportation & Aerospace |

| Sun Life Financial Inc. | SLF | 38.38 | 23,532 | Buy-AAR | 46.00 | 3.8% | 24% | Life Insurance |

| Canadian Tire Corporation, Limited | CTC.A | 130.68 | 10,492 | Buy-AR | 143.00 | 1.6% | 11% | Consumer Products & Merchandising |

| CI Financial Corp. | CIX | 35.23 | 9,986 | Buy-AAR | 40.00 | 3.6% | 17% | Diversified Financials |

| Gildan Activewear Inc. | GIL | 75.04 | 9,077 | Buy-AR | 79.00 | 0.9% | 6% | Special Situations |

| Agnico Eagle Mines Limited | AEM | 39.52 | 8,498 | Buy-AR | 47.00 | 1% | 20% | Precious Metals |

| Labrador Iron Ore Royalty Corporation | LIF | 17.55 | 1,123 | Buy-AR | 28.00 | 8.0% | 68% | Metals & Mining |

| Uni-Select Inc. | UNS | 41.09 | 872 | Buy-AR | 47.00 | 1.5% | 16% | Consumer Discretionary |

| Dream Industrial REIT | DIR.UN | 9.33 | 514 | Buy-AR | 10.00 | 7.5% | 15% | Real Estate |