EQUEDIA WEEKLY

posted on

Aug 04, 2013 09:01PM

We may not make much money, but we sure have a lot of fun!

August 4, 2013

This Could Kill the Stock Market: What You Should Be Watching

Dear Readers,

A couple of years ago, I wrote that the S&P 500 would surpass the 1500 mark. This was during a time when investors were worried, the market appeared to be headed lower, and volume was non-existent.

Many doom and gloom experts called me a sucker. Some said I was crazy for thinking the market had the gusto to even move through 1400. They told me the fundamentals simply weren't there.

And they were right.

The fundamentals for growth weren't there - and they still aren't.

Corporate earnings continue to beat analyst estimates but have seen so many downward revisions that beating market expectations doesn't exactly mean there's growth.

Housing starts and construction data are showing positive signs, yet mortgage applications continue to fall. I mentioned this a month ago, whereby mortgage applications dropped by 29% over an 8-week period - the biggest plunge in 30 months.

It dropped another 3% last week. Mortgage refinancing applications are down nearly 60% from a year ago.

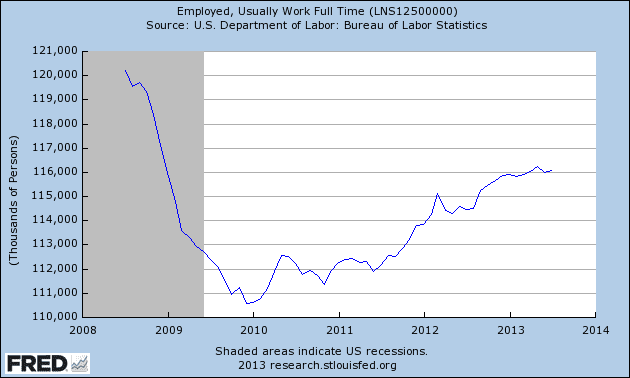

Unemployment remains lackluster and despite all of the good news you hear about more jobs being created, it's not as rosy as it appears. I mentioned this many times before, but to sum it up:

Of the 953K jobs that have been created so far this year, 731k of them were part-time jobs. That means only 23% of the newly created jobs, were full-time.

Take a look at these charts:

But hey, at least jobs are being created.

So the "experts" were right: from a fundamental growth perspective, the market should not have gone passed 1500.

So why then did I argue that the market was going higher?

Herein lies the simplest answer to a very hard question.

Artificially Inflated Assets

Print money. Put that money into the system. Inflate prices.

Bernanke and his crew can use whatever term they desire: QE, operation twist, and low interest rates - it doesn't matter. It's all the same. Create money and cheap credit and put it into the market.

It took some time for that money to enter the system, but now that it's going in, the stock market has only one way to go, and that's up.

But what happens when the money stops?

Tapering Disaster?

We're now hearing all of this talk about the Fed scaling back on its record $85 billion per month in bond purchases. We're hearing the Fed will completely stop the purchases at the end of 2014.

Yet, the market takes it in and keeps on chugging - knowing that as long as money is entering the system at a faster pace than it's moving out, the market will climb.

After years of working its way up, the stock market climbed to yet another all time high this week, surpassing the 1700-mark.

But here's where it starts to get really interesting - and dangerous.

The Real Indicator You Should Be Watching

Something happened last week that few retail investors noticed.

And it should wake up misinformed bulls.

Take a look at the following chart of the benchmark 10-Year Treasury bond:

In the last few months, the 10-year bond price has continued to fall. Now take a look at this:

The yield on the benchmark 10-year Treasury bond has now shot passed 2.7% - a dramatic rise of 1% in less than 3 months.

If this trend continues, it could be the tipping point that pops the stock market bubble.

Let me explain.

The 10-Year US Treasury bond yield is the benchmark indicator - not just for the U.S., but also for the rest of the world.

The higher the yield on the 10-year, the higher the interest rates worldwide.

And in the last few months, this number has soared more than 60% - its greatest percentage move since 1962.

Higher interest rates makes housing less affordable and among other things, will slow GDP growth. Given that the housing sector is already being affected, as noted by the continued decline of mortgage applications, the 10-year yield continues to prove itself as a consistent indicator.

The decline in mortgage applications clearly indicates the effect of the 10-year yield. Mortgage rates in the U.S. have already jumped from 3.4% in early May to 4.4% today. When the 10-year yield goes up, so do mortgage rates.

And the drastic decline in mortgage applications follows.

Not only do rising rates cause a major slowdown to economic growth - especially during a time when growth is needed - they can have an adverse effect on the financial markets.

An Extremely Leveraged Market

As I wrote before, margin debt levels continue to climb:

"Margin debt amounted to $379.5 billion in the month of March. The highest margin debt amount previously was $381.4 billion back in July 2007. That means the amount of money people are borrowing to buy stocks are now back at pre-2008 levels."

If interest rates rise further, investors will likely bail out of stocks. Given that margin debt levels are already near all-time highs, a stock market collapse is more likely to happen.

Margin debt allows speculators to borrow money to buy stock. These "loans" are collateralized by stock holdings, and much like a short, must be covered when the market goes south. That means if a bet goes the other way, these speculators have to find more money, or sell out of their "collateralized" stock holdings to cover the margin.

The low interest rate environment has made the cost of borrowing so low that speculators have been piling up on margin debt, big time.

The Trillion Dollar Gamble

According to Bloomberg, the nation's (US) largest hedge funds borrowed more than $1 trillion as of the fourth quarter, yet only had net assets of $1.47 trillion:

"The nation's largest hedge funds had $1.47 trillion in net assets and more than $1 trillion in borrowings as of the fourth quarter, according to the first report compiled on confidential data they provided to the U.S. Securities and Exchange Commission.

...The funds reported having $1.47 trillion in net assets and $1.06 trillion in aggregate debt during the fourth quarter. Debt includes secured and unsecured borrowings for each fund and excludes "other significant methods of incurring leverage," such as derivatives, according to the report.

...The report also provided details on the liquidity of the assets held by the funds.

Twenty-seven percent of their $1.47 trillion in net assets could be divested within a day, according to the SEC. Fifty-three percent of the net assets could be liquidated in a week or less, the large managers said, and 71 percent would take no more than a month to sell. Fifteen percent of assets would take more than six months to liquidate.

The agency also detailed how quickly the managers allowed their investors to cash out. About 7 percent of the $1.47 trillion could be withdrawn by investors in a day, and 24 percent could be taken out within a month. Investors could redeem about 59 percent of the total capital within 180 days, the report said. About 26 percent of capital would take more than a year to get back."

Not only are hedge funds highly leveraged, but their leverage is now likely much higher than the Q4 reports. If that is the case, then hedge funds are borrowing over $1 trillion.

But what happens if interest rates continue to climb causing the stock market to fall?

Fund Redemptions

We'll likely see a massive exit of money from the stock market as investors scramble to salvage what is left.

In other words, hedge funds are so highly leveraged that a small crash in the market could lead to a major stock market collapse.

How do you feel about the amount of leverage used by hedge funds?

Remember, the value of American subprime mortgages was estimated at $1.3 trillion as of March 2007. That was more than enough to send the stock market into a free fall. Hedge fund debt has now topped $1 trillion - that doesn't include the smaller funds.

The recent rise in rates has already caused emerging markets and asset prices around the world to crash.

In less than a month, Brazil's stock market has already lost 20% of its value.

While we still have room for the stock market to climb, as a 2.7% yield on a 10-year is still very low - especially from a historical perspective - but if it continues to rise, it will put a screeching halt to stocks.

Oh, and there is now more than 440 trillion dollars worth of interest rate derivatives in the world financial system. What will happen to those derivatives if interest rates spike?

Scary thought.