For each company, we'll focus on market cap, valuation ratios, and EPS projections. We've also included interactive charts on each company's forward P/E ratios.

1. Cubic Corporation (CUB): Scientific & Technical Instruments Industry. Market Cap of $1.02B. P/E ratio of 17.42, Forward P/E ratio of 15.63, and PEG of 2.11. Insiders, who currently own 41.04% of the company, have increased holdings by 0.09% over the last 3 months, while institutional investors, who currently own 46.78% of the company, increased holdings by 1.3%. Wall Street analysts expect the company's EPS to grow by 3.4% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading at the bottom of its 3-year range.

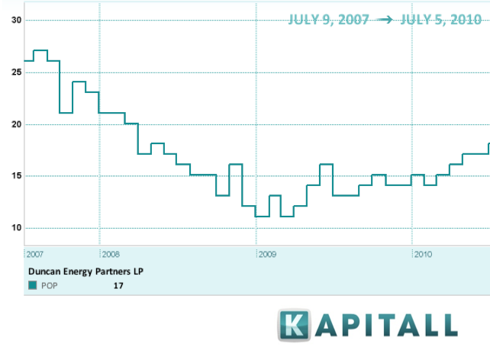

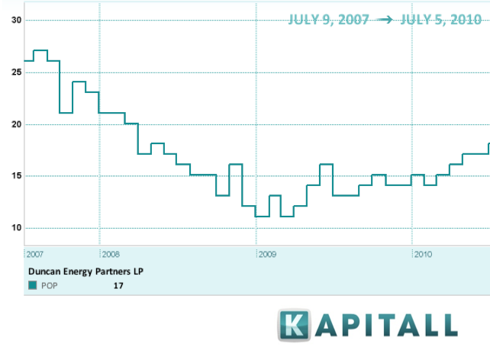

2. Duncan Energy Partners LP (DEP): Oil & Gas Pipelines Industry. Market Cap of $1.57B. P/E ratio of 17.17, Forward P/E ratio of 17.73, and PEG of 4.64. Insiders, who currently own 59.55% of the company, have increased holdings by 0.17% over the last 3 months, while institutional investors, who currently own 13.24% of the company, increased holdings by 17.18%. Wall Street analysts expect the company's EPS to grow by 0.65% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading in the middle of its 3-year range.

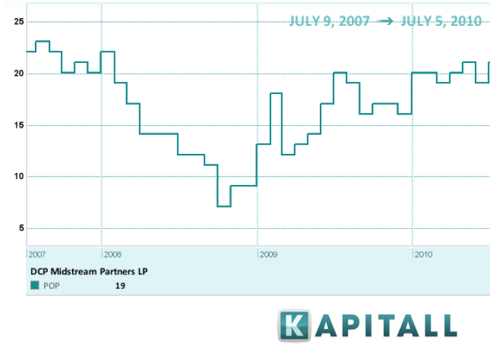

3. DCP Midstream Partners LP (DPM):

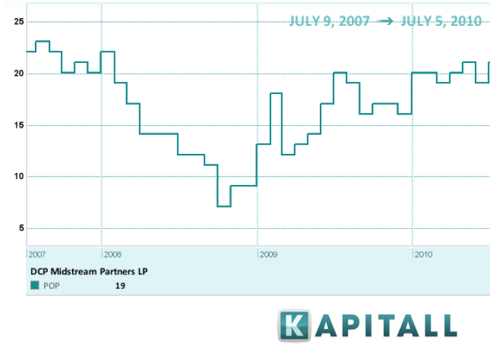

3. DCP Midstream Partners LP (DPM): Oil & Gas Pipelines Industry. Market Cap of $1.14B. Forward P/E ratio of 19.17. Insiders, who currently own 34.66% of the company, have increased holdings by 0.07% over the last 3 months, while institutional investors, who currently own 32.7% of the company, increased holdings by 5.4%. Wall Street analysts expect the company's EPS to grow by 10.26% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading at the upper end of its 3-year range.

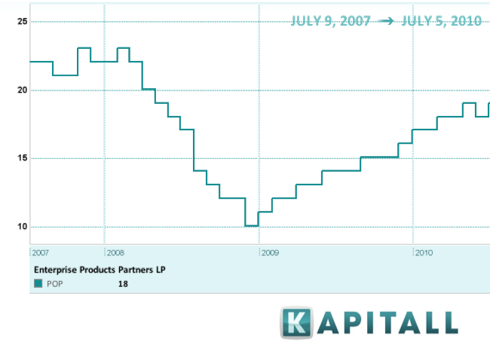

4. Enterprise Products Partners LP (EPD):

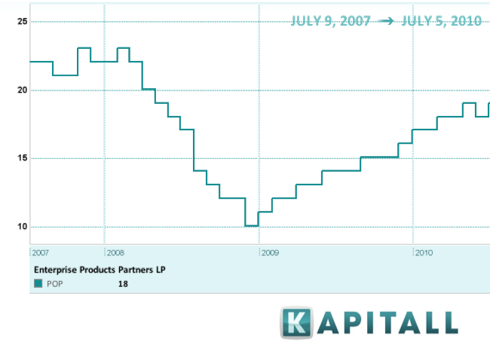

4. Enterprise Products Partners LP (EPD): Independent Oil & Gas Industry. Market Cap of $2.31B. P/E ratio of 18.05, Forward P/E ratio of 17.78, and PEG of 3. Insiders, who currently own 28.7% of the company, have increased holdings by 0.24% over the last 3 months, while institutional investors, who currently own 19.42% of the company, increased holdings by 3.31%. Wall Street analysts expect the company's EPS to grow by 6.84% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading in the middle of its 3-year range.

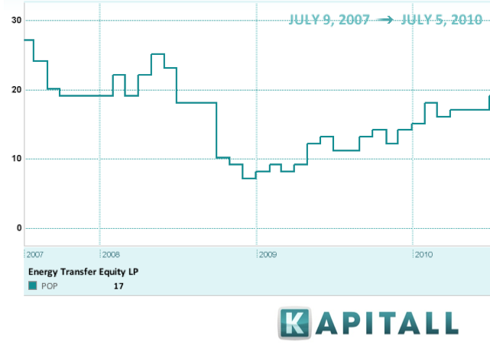

5. Energy Transfer Equity, L.P. (ETE):

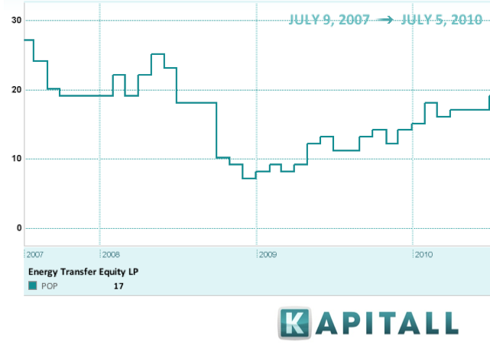

5. Energy Transfer Equity, L.P. (ETE): Oil & Gas Pipelines Industry. Market Cap of $7.64B. P/E ratio of 19.03, Forward P/E ratio of 17.04, and PEG of 2.54. Insiders, who currently own 41.54% of the company, didn't change their holdings over the last 3 months, while institutional investors, who currently own 22.8% of the company, increased holdings by 6.63%. Wall Street analysts expect the company's EPS to grow by 6.91% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading in the middle of its 3-year range.

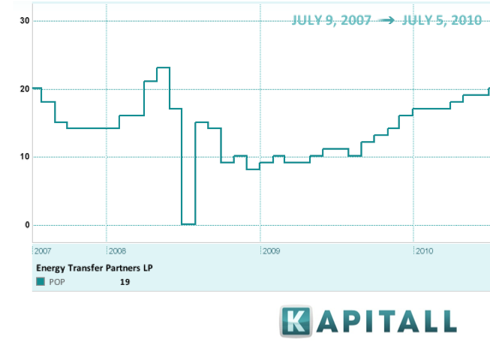

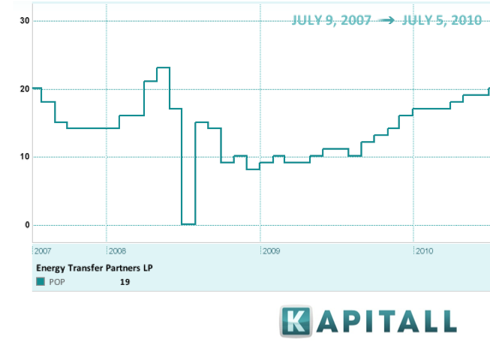

6. Energy Transfer Partners L.P. (ETP):

6. Energy Transfer Partners L.P. (ETP): Oil & Gas Pipelines Industry. Market Cap of $9.18B. P/E ratio of 24.87, Forward P/E ratio of 17.84, and PEG of 4.97. Insiders, who currently own 32.99% of the company, have increased holdings by 0.02% over the last 3 months, while institutional investors, who currently own 19.23% of the company, increased holdings by 6.98%. Wall Street analysts expect the company's EPS to grow by 26.29% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading at the top of its 3-year range.

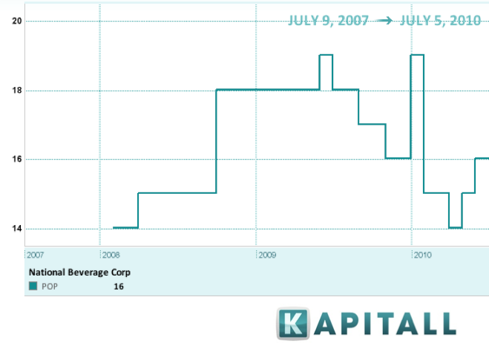

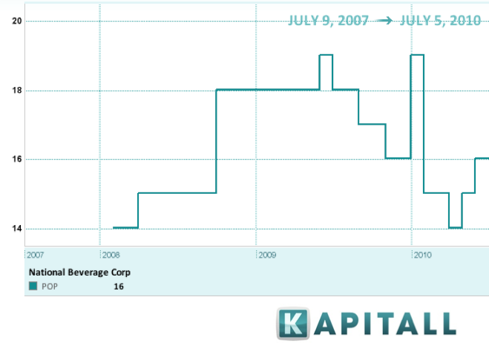

7. National Beverage Corp. (FIZZ):

7. National Beverage Corp. (FIZZ): Soft Drinks Industry. Market Cap of $580.71M. P/E ratio of 23.63, Forward P/E ratio of 21.63, and PEG of 3.94. Insiders, who currently own 77.81% of the company, have increased holdings by 0.03% over the last 3 months, while institutional investors, who currently own 20.02% of the company, increased holdings by 11.37%. Wall Street analysts expect the company's EPS to grow by 13.46% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading in the middle of its 3-year range.

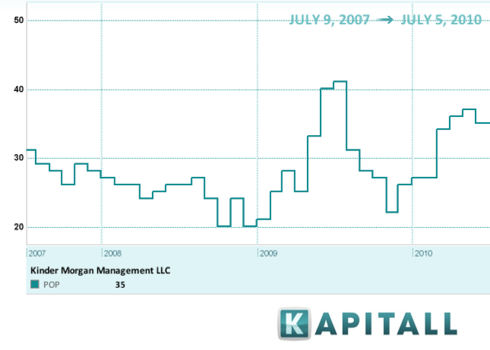

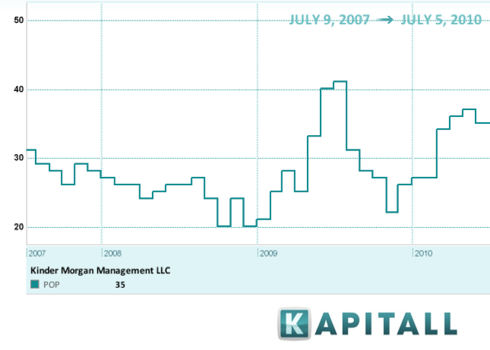

8. Kinder Morgan Management LLC (KMR):

8. Kinder Morgan Management LLC (KMR): Oil & Gas Pipelines Industry. Market Cap of $5.04B. Forward P/E ratio of 27.68, and PEG of 18.57. Insiders, who currently own 14.28% of the company, have increased holdings by 0.4% over the last 3 months, while institutional investors, who currently own 53.02% of the company, increased holdings by 1.58%. Wall Street analysts expect the company's EPS to grow by 20.11% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading in the top of its 3-year range.

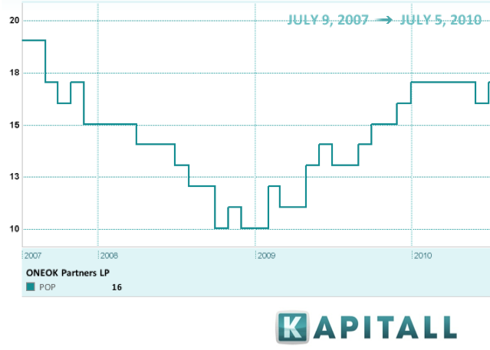

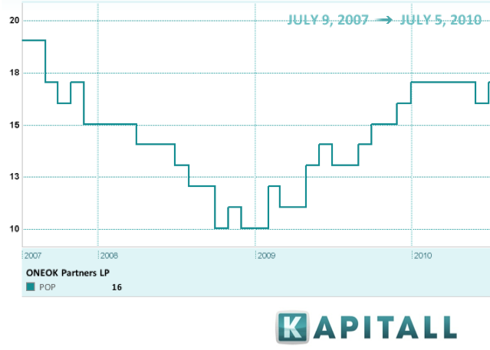

9. ONEOK Partners, L.P. (OKS):

9. ONEOK Partners, L.P. (OKS): Oil & Gas Pipelines Industry. Market Cap of $6.68B. P/E ratio of 19.45, Forward P/E ratio of 17.3, and PEG of 4.86. Insiders, who currently own 41.65% of the company, have increased holdings by 0.02% over the last 3 months, while institutional investors, who currently own 15.55% of the company, increased holdings by 16.81%. Wall Street analysts expect the company's EPS to grow by 13.13% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading at the top of its 3-year range.

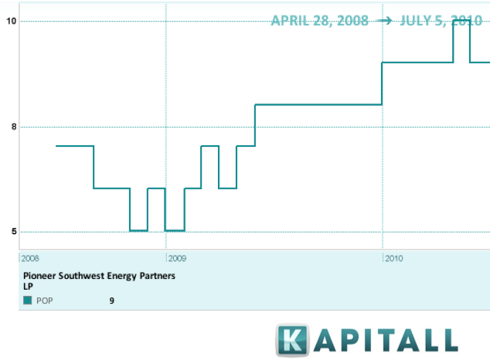

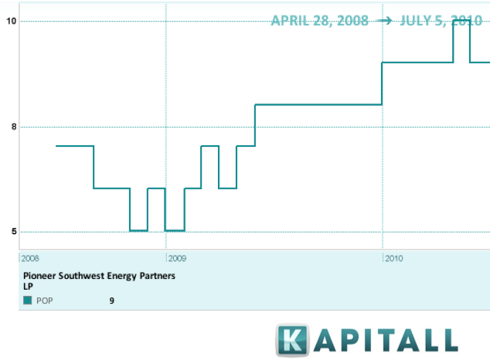

10. Pioneer Southwest Energy Partners L.P. (PSE):

10. Pioneer Southwest Energy Partners L.P. (PSE): Oil & Gas Drilling & Exploration Industry. Market Cap of $836.03M. P/E ratio of 14.6, Forward P/E ratio of 8.2, and PEG of 7.3. Insiders, who currently own 62.29% of the company, have increased holdings by 0.05% over the last 3 months, while institutional investors, who currently own 14.21% of the company, increased holdings by 1.29%. Wall Street analysts expect the company's EPS to grow by 8.45% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading at the top of its 3-year range.

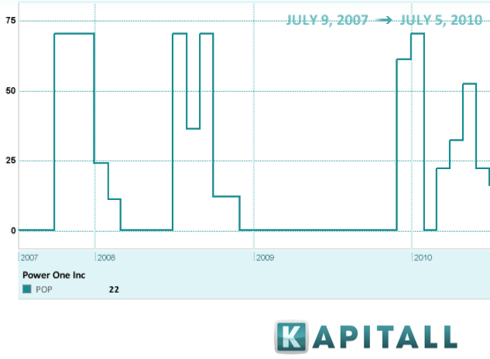

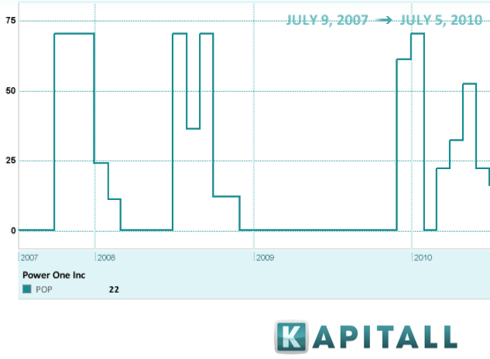

11. Power-One Inc. (PWER):

11. Power-One Inc. (PWER): Diversified Electronics Industry. Market Cap of $707.2M. P/E ratio of , Forward P/E ratio of 15.69, and PEG of ***. Insiders, who currently own 10.51% of the company, have increased holdings by 0.17% over the last 3 months, while institutional investors, who currently own 77.55% of the company, increased holdings by 6.58%. Wall Street analysts expect the company's EPS to grow by 45.71% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading near the bottom of its 3-year range.

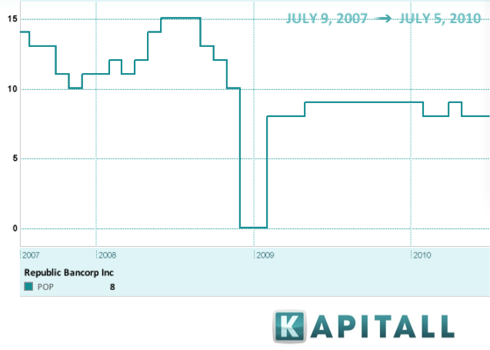

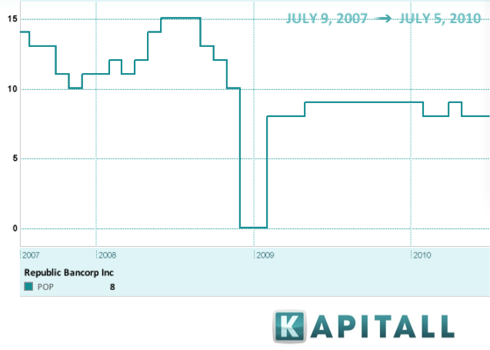

12. Republic Bancorp Inc. (RBCAA):

12. Republic Bancorp Inc. (RBCAA): Regional Bank (South East). Market Cap of $488.65M. P/E ratio of 8.04, Forward P/E ratio of 7.85, and PEG of 0.8. Insiders, who currently own 53.06% of the company, have increased holdings by 0.02% over the last 3 months, while institutional investors, who currently own 23.35% of the company, increased holdings by 0.83%. Wall Street analysts expect the company's EPS to grow by 4.55% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading in the middle of its 3-year range.

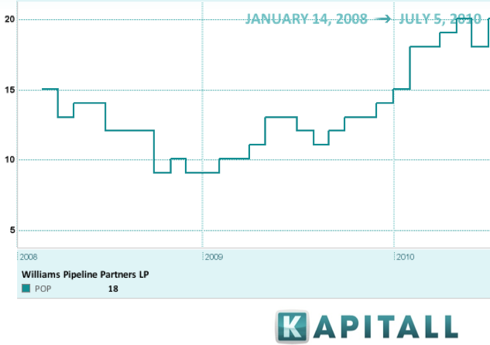

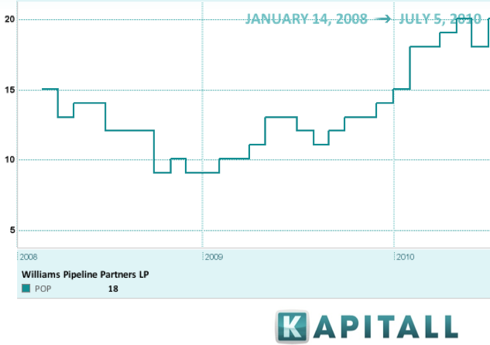

13. Williams Pipeline Partners L.P. (WMZ):

13. Williams Pipeline Partners L.P. (WMZ): Major Integrated Oil & Gas Industry. Market Cap of $1.1B. P/E ratio of 22.62, Forward P/E ratio of 20.27, and PEG of 4.52. Insiders, who currently own 46.92% of the company, have increased holdings by 0.07% over the last 3 months, while institutional investors, who currently own 29.27% of the company, increased holdings by 5.93%. Wall Street analysts expect the company's EPS to grow by 7.89% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading at the top of its 3-year range.

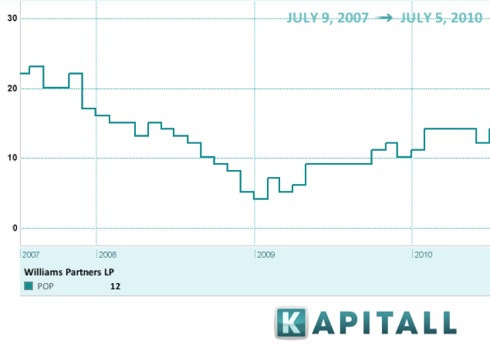

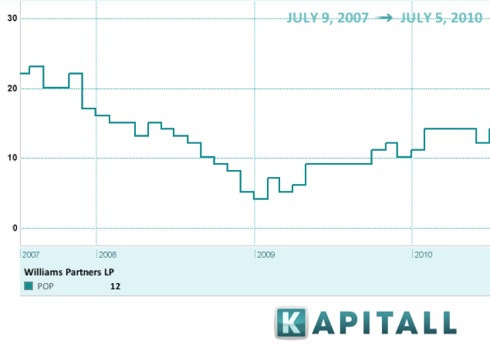

14. Williams Partners L.P. (WPZ):

14. Williams Partners L.P. (WPZ): Specialty Chemicals Industry. Market Cap of $1.13B. P/E ratio of 14.15, Forward P/E ratio of 14.11, and PEG of 8.68. Insiders, who currently own 83.97% of the company, haven't changed their holdings over the last 3 months, while institutional investors, who currently own 39.43% of the company, increased holdings by 2.68%. Wall Street analysts expect the company's EPS to grow by 2.96% over the next year. As the following chart shows, the company's forward P/E ratio is currently trading in the middle of its 3-year range.

15. Crosstex Energy LP (XTEX):

15. Crosstex Energy LP (XTEX): Independent Oil & Gas Industry. Market Cap of $515.91M. Insiders, who currently own 34.57% of the company, have increased holdings by 6.17% over the last 3 months, while institutional investors, who currently own 30.38% of the company, increased holdings by 9.73%. Wall Street analysts expect the company's EPS to grow by 97.1% over the next year.

16. Opko Health, Inc. (OPK): Drug Manufacturer. Market Cap of $589.58M. Insiders, who currently own 60.48% of the company, have increased holdings by 0.33% over the last 3 months, while institutional investors, who currently own 6.46% of the company, increased holdings by 62.64%.

Disclosure: No positions