PHEVs and EVs: Plugging into a Lump of Coal / Petersen

posted on

Aug 30, 2009 10:46AM

We may not make much money, but we sure have a lot of fun!

http://seekingalpha.com/article/159020-phevs-and-evs-plugging-into-a-lump-of-coal?source=email

(nice comment by Jack Lifton of Great Western Minerals)

PHEVs and EVs: Plugging into a Lump of Coal 9 comments

Since I've stirred up a hornet's nest over the last two weeks first by debunking the mythology that PHEVs and EVs will save their owners money and then by showing how PHEVs and EVs will sabotage America's drive for energy independence, I figured I might as well go for the triple-crown of harsh realities by showing readers that in the U.S., where 70% of electricity comes from burning hydrocarbons, PHEVs and EVs won't make a dent in CO2 emissions. They'll just take distributed CO2 emissions off the roads and centralize them in coal and gas fired power plants.

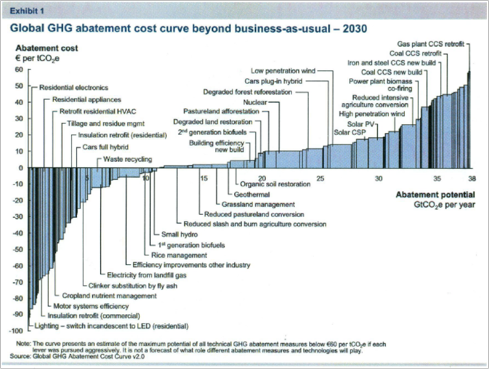

I started to seriously question the policy arguments in favor of PHEVs and EVs when McKinsey Quarterly published an article titled "Profiting from the low-carbon economy" in early August. The article included a "Global carbon abatement cost curve" that shocked me because it showed that HEVs offered a substantial cash benefit from carbon abatement while PHEVs imposed a significant carbon abatement cost. A few days ago I got permission to reprint the original graph from a recent McKinsey & Company report entitled "Pathways to a Low-Carbon Economy. Version 2 of the Global Greenhouse Gas Abatement Cost Curve," 2009."

While the graph is fairly complex because it shows both the benefits and costs of various carbon abatement options and the potential amount of CO2 that each option could eliminate, the key issue is the relative positions that HEVs and PHEVs occupy on the curve. HEVs are shown on the left hand side of the graph between residential insulation retrofit and electricity from landfill gas; which means that HEVs save €30 ($43) per metric ton of carbon abatement. PHEVs are shown on the right hand side of the graph between nuclear power plants and low penetration wind farms; which means that PHEVs cost €12 ($17) per metric ton of carbon abatement. Since the McKinsey graph analyzed abatement costs at a 'global' level, I felt compelled to dig a little deeper and analyze their impact in the U.S.

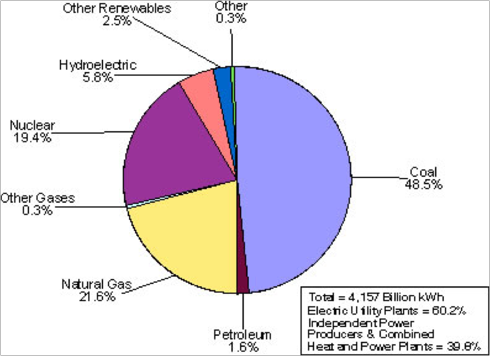

In its latest report on greenhouse gas emissions in the U.S., the Energy Information Administration said that CO2 emissions from electricity generation were 2,433.4 million metric tons in 2007. In its 2007 annual summary of electric power in the U.S., the EIA reported that net generation of electric power during 2007 was 4,157 billion kilowatt-hours from the sources identified in the following graph.

When you divide the total CO2 emissions from electricity generation by the total amount of electricity generated, it works out to 585.4 grams of CO2 per kWh. While the figures vary among manufacturers, the average electric-only range of the PHEVs and EVs planned by General Motors, Nissan (NSANY), Mitsubishi (MMTOF.PK), BYD (BYDDF.PK), Tesla Motors, Fisker Automotive, Th!nk Global and a legion of others is roughly 4 miles per kWh of useful battery capacity. So in the U.S., a PHEV or EV will ultimately be responsible for about 146 grams of CO2 emissions per mile unless the owner has the foresight and dedication to buy solar panels or wind turbines to generate the electricity his PHEV or EV will use.

To review the math, a gallon of gasoline releases 20.35 pounds of CO2 (9,231 grams) when it is burned in an internal combustion engine. So a normal car that meets current CAFE standards of 27.5 mpg is responsible for roughly 336 grams of CO2 emissions per mile. In contrast, an HEV like the Prius, which slashes fuel consumption by roughly 40% through a combination of recuperative braking, idle elimination and electric launch will be responsible for roughly 201 grams of CO2 emissions per mile.

The following table compares typical vehicle costs (without tax subsidies) and CO2 emissions per mile for each class of vehicle. It then goes two steps further and (a) calculates an average carbon abatement cost for HEVs, PHEVs and EVs, and (b) calculates an incremental carbon abatement cost for PHEVs and EVs. Both carbon abatement costs are expressed in dollars of capital spending per gram/mile of CO2 emissions.

| ICE Vehicle | $20,000 | 336 | ||

| Prius class HEV |

$26,500 | 201 | $48.15 | |

| Volt class PHEV |

$40,000 | 146 | $105.26 | $245.45 |

| Leaf class EV |

$40,000 | 146 | $105.26 | $245.45 |

Is it any wonder that Vinod Khosla keeps telling interviewers that in the U.S., China and India, PHEVs and EVs will be plugging into a lump of coal for years to come?

News stories, speeches and press releases can only maintain the electric drive illusion for so long. Sooner or later the public is going to realize that it's all hype, blue smoke and mirrors, and that PHEVs and EVs have little of substance to offer customers in the U.S. market. When the public comes to the realization that electric drive vehicles:

The backlash against lithium-ion battery developers like Ener1 (HEV) and Valence Technologies (VLNC) that have attained nosebleed level market capitalizations based on electric drive hype may be vicious. The big winners should be developers of cheap and efficient high-performance lead-carbon batteries like Exide Technologies (XIDE) in cooperation with Axion Power International (AXPW.OB); C&D Technologies (CHP) in cooperation with Firefly Energy; and East Penn Manufacturing in cooperation with Japan's Furukawa Battery Co. (FBB.DE).

It would be wrong for readers to assume that I dislike lithium-ion battery technology, because I believe it will be an increasingly important part of the coming cleantech revolution. I also believe that companies like Advanced Battery Technologies (ABAT), Altair Nanotechnologies (ALTI), Johnson Controls (JCI) and A123 Systems (IPO pending) that are taking a diversified approach by focusing on products for a wide variety of consumer, industrial, utility and military applications will grow and prosper. But the companies, reporters, financial analysts and politicians that have built a mountain of unreasonable expectations from an electric drive molehill may be in for a tough time.

DISCLOSURE: Author is a former director and executive officer of Axion Power International and holds a large long position in its stock. He also holds a small long position in Exide.

Related Articles

|

Alternative Energy

Get essential analysis of |

Have a great trip Jack. I hope you come back with something interesting you can share on the rare earth metals front.

Have a great trip Jack. I hope you come back with something interesting you can share on the rare earth metals front.

Dave, while I suspect your personal grand energy plan would take a fair bit of time to implement and face a number of daunting emotional and technical hurdles, I did some searching about and found the following NERL report on the relative cost and energy efficiency of producing hydrogen through electrolysis.

Dave, while I suspect your personal grand energy plan would take a fair bit of time to implement and face a number of daunting emotional and technical hurdles, I did some searching about and found the following NERL report on the relative cost and energy efficiency of producing hydrogen through electrolysis. Manya05, the most interesting part of this article for me is the carbon abatement cost curve from McKinsey. It really deserves a lot more attention than I could ever give it in a blog. If people who are concerned about CO2 would take the time to study the curve and see where they can make a difference with efficient lighting, insulation, efficient appliances etc., we could make a big dent in the problem while saving money.

Manya05, the most interesting part of this article for me is the carbon abatement cost curve from McKinsey. It really deserves a lot more attention than I could ever give it in a blog. If people who are concerned about CO2 would take the time to study the curve and see where they can make a difference with efficient lighting, insulation, efficient appliances etc., we could make a big dent in the problem while saving money.