The disconnect between the "physical" and "paper" prices

posted on

Oct 31, 2008 06:01AM

We may not make much money, but we sure have a lot of fun!

http://seekingalpha.com/article/1030...

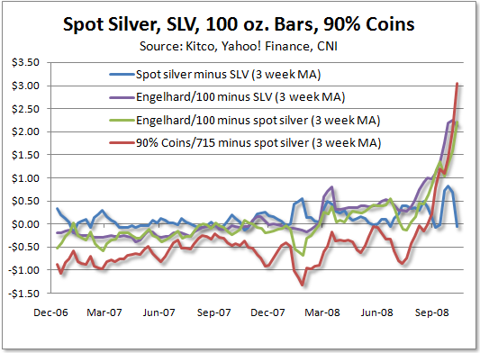

Look what's happened to the premium for 90 percent silver coins at one coin dealer - from about a dollar under spot to three dollars over spot in just the last few months (click on chart to enlarge). And these are their buy prices - their sell prices are a dollar or two an ounce higher.

And these are their buy prices - their sell prices are a dollar or two an ounce higher.

[Note: Sell prices would be used in the chart above except for the fact that it's hard to make a nice graphic when you go to look up a price and, more often than not, you see "Out of Stock" instead of a dollar amount.]

This is all part of the rapidly growing disconnect between the "physical" and "paper" prices for precious metals - the "paper" price being set on futures markets and the "physical" price being set at coin shops.

Normally, there is a fairly steady relationship between the two but, over the last year (a period which has been anything but normal) that has all changed as coin dealers have recently begun raising prices relative to spot amid short supply of precious metals and heavy demand.

The chart above contains data from just one coin shop, California Numismatic Investments, and, while it doesn't necessarily reflect the pricing at other coin shops, CNI is one of the country's largest precious metals dealers and its prices certainly are representative of bullion prices in Southern California. For many years now, I've owned both gold and silver bullion in various forms and have long encouraged others to do the same for a number of reasons.

For many years now, I've owned both gold and silver bullion in various forms and have long encouraged others to do the same for a number of reasons.

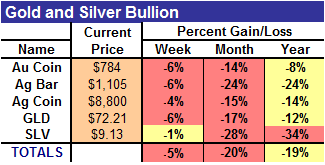

Having looked at prices for each form of bullion on a weekly basis for many years now, it wasn't hard to see how the premiums for both silver bars and silver coins had risen sharply in recent months as shown to the right as of last Friday.

A few weeks ago, it was noted that spreads between spot silver, the iShares Silver Trust ETF (SLV), and 100 ounce silver bars at CNI had changed dramatically this year. The chart you see at the top of this post just adds 90 percent silver coins to the list, the star silver performer so far in 2008 - down just 14 percent versus 34 percent for the silver ETF.

Of course, even higher bullion prices can be seen at eBay and Bullion Seek.

They say that this is just a temporary supply disruption amid recently "unprecedented" demand from the public (which actually isn't unprecedented at all) during uncertain times where more and more individuals feel the need to add a little hard currency to their investment portfolio.

We will see where these growing spreads between "paper" and "physical" go from here - at some point they are sure to converge. Exactly where they converge is the interesting part.

Full Disclosure: Long gold and silver in various forms

Related Articles

Related Stocks: |

|